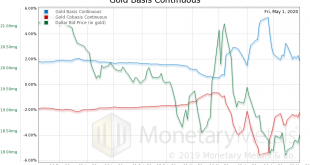

The price of gold dropped $29 and the price of silver dropped $0.27. We’ll get back to where we think the prices are likely to go in a bit. In recent Reports, we’ve looked at the elevated bid-ask spread in gold (though not nearly as elevated as some goldbugs would have you believe) and the elevated gold basis. As an aside, we continue to see articles that get the high gold basis exactly backwards, the way John Maynard Keynes got commodity markets backwards. A high...

Read More »Hard talk with Václav Klaus: “The people should say NO to all of it.”

As we get deeper into this crisis and we get used to our “new normal”, it’s easy to focus on the daily corona-horror stories in the media or the latest shocking unemployment numbers, and lose track of the bigger picture and of what is really, fundamentally important. Even as the lockdown measures begin to get phased out, the scale of the economic damage is unimaginable and the idea of returning to “business as usual” is no longer tenable. The last couple of months...

Read More »Beim Reselling auf Waren sitzen bleiben ??

Ich möchte euch heute erklären, was ich mache, wenn ich Waren nicht verkaufen kann und diese im Lager hängen bleiben. Wie du da vorgehen kannst, um dieses Risiko vermeidest, zeige ich euch in diesem Beitrag. Reselling Risiko – Auf Waren sitzen bleiben Wenn Waren sitzen bleiben, steckt Kapital fest, das eigentlich Gewinne machen könnte. Das ist ja das große Problem im Reselling. Das Ganze ist auch etwas von der Nische abhängig, denn gerade im Elektronikbereich hat...

Read More »FX Daily, May 4: Monday Blues

Swiss Franc The Euro has fallen by 0.11% to 1.054 EUR/CHF and USD/CHF, May 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The constructive mood among investors in April has given way to new concerns as May gets underway. Japan and China are still on holiday, but most of the other markets in Asia fell, led by 4.5%-5.5% declines in Hong Kong and India, and more than 2% in most other local markets. Australia...

Read More »United States regulator approves Roche’s Covid-19 antibody test

Through a blood sample, the test can detect antibodies to the new coronavirus, which could signal a person may have already been infected. (Copyright 2020 The Associated Press. All Rights Reserved.) The US Food and Drug Administration (FDA) has given emergency approval for use of the serological test developed by Swiss pharmaceutical giant Roche, the company announced on Sunday. The test is designed to determine whether a person has been exposed to the new...

Read More »Why Assets Will Crash

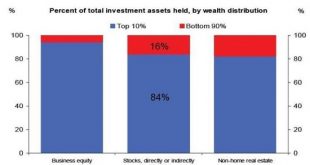

This is how it happens that boats that were once worth tens of thousands of dollars are set adrift by owners who can no longer afford to pay slip fees. The increasing concentration of the ownership of wealth/assets in the top 10% has an under-appreciated consequence: when only the top 10% can afford to buy assets, that unleashes an almost karmic payback for the narrowing of ownership, a.k.a. soaring wealth and income inequality: assets crash. Most of you are aware...

Read More »Decades of Productivity Gains Have Made Our Debt Bomb Manageable (For Now)

Listen to the Audio Mises Wire version of this article. Listening to the news, you might have the impression that its Christmas and the government is Santa Claus. Under legislation recently introduced in Congress, Americans over the age of sixteen would receive $2,000 per month for at least six months. This follows the government’s $1200 giveaway in progress. Milton Friedman, the creator of the term “helicopter money,” warned that the helicopter was unlikely to fly...

Read More »Finance minister Ueli Maurer eyes central bank surplus to reduce expected debts

Maurer (left) has publicly voiced concern over the costs caused the economic lockdown due to the Covid-19 pandemic. (Keystone/Peter Klaunzer) Swiss Finance Minister Ueli Maurer wants the country’s central bank to contribute to the reduction of the debt caused by the coronavirus pandemic. “I suggest the Swiss National Bank spends the money from an annual surplus to reduce coronavirus-related debts,” he told the Neue Zürcher Zeitung newspaper on Wednesday. The central...

Read More »Coronavirus: relatively few medical staff infected in Switzerland

© Damir Senčar | Dreamstime.com In Switzerland, around 3% of medical staff have been infected with Covid-19, based on data covering the period up until Easter, according to Switzerland’s Federal Office of Public Health. The highest rates of infection were among staff in French- and Italian-speaking Switzerland, regions with Switzerland’s highest infection rates. The low rate suggests the Swiss health system has the required material and equipment to protect staff,...

Read More »Dollar Remains Under Pressure as Europe Unveils Some Plans to Reopen

Global equity markets continue to trend higher; the dollar remains under pressure The two-day FOMC meeting ends today; the first look at Q1 US GDP comes out France and Spain laid out plans to reopen; the UK will rely on a contact tracing plan to limit the viral spread Ahead of the ECB meeting Thursday, European policymakers are showing a similar willingness to act as needed Fitch cut Italy by a notch to BBB- with stable outlook; Germany reports April CPI Reports...

Read More » SNB & CHF

SNB & CHF