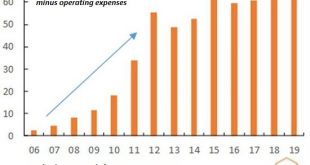

Ours is a Wile E. Coyote economy, and now we’re hanging in mid-air, realizing there is nothing solid beneath our feet. The story we’re told about how our “capitalist” economy works is outdated. The story goes like this: companies produce goods and services for a competitive marketplace and earn a profit from this production. These profits are income streams for investors, who buy companies’ stocks based on these profits. As profits rise, so do stock valuations. It’s...

Read More »The War On Cash – COVID Edition Part II

The digital “toll” It doesn’t require too dark an imagination to realize the gravity of the concerns over the digital yuan. China is a true pioneer when it comes surveillance, censorship and political oppression and the digital age has given an incredibly efficient and effective arsenal to the state. Adding money to that toolkit was a move that was planned for many years and it is abundantly clear how useful a tool it can be for any totalitarian regime. The ability...

Read More »Coronavirus: the rising number of mild cases with symptoms lasting months

© Piyapong Thongcharoen | Dreamstime.com Those with mild Covid-19 symptoms are supposed to recover after two weeks. However, a rising number of relatively young people with mild cases report symptoms months later. Johns Hopkins Medicine says that those with mild cases of COVID-19 appear to recover within one to two weeks. For severe cases, recovery may take six weeks or more. But more and more people who have had mild cases are reporting symptoms several months after...

Read More »The Smallness of the Most Gigantic

These numbers do seem epic, don’t they? It’s hard to ignore when you have the greatest percentage increase in the history of a major economic account. Just writing that sentence it’s difficult to deny the power of those words. Which is precisely the point: we already know ahead of time how the biggest economic holes in history are going to produce the biggest positives coming out of them. Whether that constitutes an actual recovery as opposed to the simplistic and...

Read More »Why the European Recovery Plan Will Likely Fail

The €750 billion stimulus plan announced by the European Commission has been greeted by many macroeconomic analysts and investment banks with euphoria. However, we must be cautious. Why? Many would argue that a swift and decisive response to the crisis with an injection of liquidity that avoids a financial collapse and a strong fiscal impulse that cements the recovery are overwhelmingly positive measures. But history and experience tell us that the risk of...

Read More »June 19, 2020

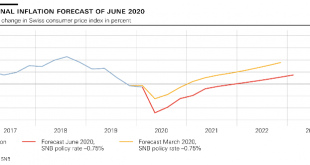

SNB Monetary Policy Assessment June 2020 and Videos

Swiss National Bank maintains expansionary monetary policy The coronavirus pandemic and the measures implemented to contain it have led to a severe downturn in economic activity and a decline in inflation both in Switzerland and abroad. The SNB’s expansionary monetary policy remains necessary to ensure appropriate monetary conditions in Switzerland. The SNB is keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75%, and in light of the highly...

Read More »Weekly View – Reality check

[embedded content] The short-term pull-back in stock prices last week on the back of persistent virus concerns in the US and elsewhere shows the market remains jittery despite the massive run-up in prices since late March. May data from China showed a relatively fast rebound on the supply side of the economy, but a much slower take-off in consumption, suggesting a ‘reverse square root’ kind of recovery for economies rather than the ‘v’-shaped one markets have been...

Read More »Coronavirus: national lockdown not part of Switzerland’s second wave response plan

© Michael Müller | Dreamstime.com Switzerland’s federal government is against imposing nationwide restrictions to slow the spread of a second wave on infections, according to the NZZ am Sonntag newspaper. The federal government plan, which is under development, is more regional than the response to the first wave of infections and focuses decision making power at the cantonal level, reported the newspaper. Cantons would have the power to independently confine and...

Read More »Monthly Macro Monitor – June 2020

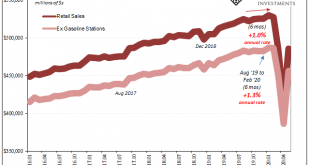

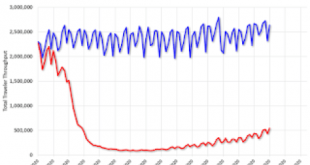

The stock market has recovered most of its losses from the March COVID-19 induced sell-off and the enthusiasm with which stocks are being bought – and sold but mostly bought – could lead one to believe that the crisis is over, that the economy has completely or nearly completely recovered. Unfortunately, other markets do not support that notion nor does the available economic data. Of course, markets look forward and there is the possibility that stock market...

Read More » SNB & CHF

SNB & CHF