At a young age, circus artist Meret Ryhiner migrated to the United States to study circus arts in New York. She became a professional circus artist and eventually moved to New Orleans. This is the story of how a road accident and hurricane Katrina changed her life, as well as the lives of the people in her community. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on...

Read More »Keith Weiner interview – The first gold bond for 87 years with 13 percent

Invest in physical metals and earn interest on them? This is a little known business model of the US company "Monetary Metals". Precious metals are lent out and generate about 3% per year. But 13% in gold is also possible through financing for mining and non-mining companies. So far there have been no defaults on these investments, but there are risks, of course. Digital currencies are being promoted to displace paper money and prevent a bank run. Rather desperate attempts at a...

Read More »FX Daily, February 9: Players are Not Buying Everything Today

Swiss Franc The Euro has fallen by 0.18% to 1.0807 EUR/CHF and USD/CHF, February 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The rally of US benchmarks to new record highs helped lift most Asia Pacific markets today, but the bulls are pausing in Europe, and there has been little follow-through buying of US shares. Australia, South Korea, and Indonesia did not participate in today’s regional advance led by...

Read More »Stillbirths on the Rise

The coronavirus has dominated all of our lives in recent months. Radical paths were taken by politicians in the form of lockdowns to contain the pandemic. But we should recognize that even if the coronavirus is a (major) challenge for us, we always have to keep a holistic view of world events. Just as there are epidemiological factors to consider in this crisis, there are also economic, social, cultural, political and other health factors at play. It is...

Read More »Permanent Jobs And Permanent Job Losses

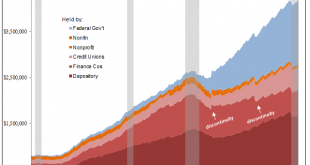

Even the feds haven’t been able to keep up. Without the government having taken over student loans in the wake of 2008-09’s Great “Recession”, there’d have been almost no additional consumer credit extended during the decade since. It’s one more facet to the recovery-less recovery; like Japan, a dominant even overbearing government influence that doesn’t stimulate anything but its own proportionally larger footprint. Given all that, the “need” for maintaining its...

Read More »The Insatiable Appetite to Tax Social Security Benefits

First, it was 10%, then 20%, and today more than 50% of U.S. retirees pay taxes on their Social Security benefits, and the number is expected to go even higher. The cause seems to be that one government hand doesn’t know, or care, what the other government hand is doing. The rub comes because income tax brackets are adjusted for inflation each year. But income thresholds determine if you pay taxes on Social Security, and how much, haven’t been adjusted for inflation...

Read More »Politics and Ideas

In the Age of Enlightenment, in the years in which the North Americans founded their independence, and a few years later, when the Spanish and Portuguese colonies were transformed into independent nations, the prevailing mood in Western civilization was optimistic. At that time all philosophers and statesmen were fully convinced that we were living at the beginning of a new age of prosperity, progress, and freedom. In those days people expected that the new political...

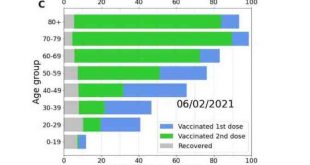

Read More »Covid: Israel’s vaccine experiment looks promising

Israel leads the world in the race to vaccinate against the SARS-CoV-2 virus, in what some are calling the world’s leading Covid-19 vaccine experiment. 64 doses of vaccine per 100 people have been administered there, far more than in any other nation. Israel’s strategy has focused on protecting the most vulnerable first. By 6 February 2021, 80% of the population over 60 had been vaccinated, compared to less than half that percentage among those under 60 – see chart...

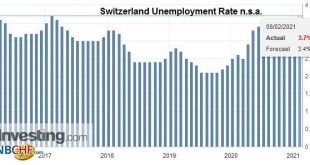

Read More »Switzerland Unemployment in January 2021: risen to 3.7percent, seasonally adjusted remained at 3.5percent

Unemployment Rate (not seasonally adjusted) Registered unemployment in January 2021 – According to surveys by the State Secretariat for Economic Affairs (SECO), 169,753 unemployed people were registered with the regional employment centers (RAV) at the end of January 2021, 6,208 more than in the previous month. The unemployment rate rose from 3.5% in December 2020 to 3.7% in the reporting month. Compared to the same month last year, unemployment increased by 48,735...

Read More »FX Daily, February 8: Limited Follow-Through Dollar Selling to Start the Week

Swiss Franc The Euro has risen by 0.05% to 1.0832 EUR/CHF and USD/CHF, February 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar has drifted higher against the major currencies and most of the freely accessible emerging market currencies, paring the losses seen before the weekend in response to the disappointing employment report. Easing pressure from the pandemic as the surge in cases after the...

Read More » SNB & CHF

SNB & CHF