The US Congress has returned from recess with a lot on its plate. Priority must be given to passing an omnibus spending bill that prevents a government shutdown after December 11. The next round of fiscal stimulus has taken on greater urgency and may be attached to the wider spending bill. RECENT DEVELOPMENTS The Senate returned from recess Monday and the House returns today. Much of the work ahead will be done behind the scenes as lawmakers negotiate passage of an omnibus spending bill by December 11 in order to avert a government shutdown. While we expect a deal to be struck, it is possible that Congress will be forced to pass another continuing resolution that would keep the government temporarily funded as negotiations continue. We are in this current

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro

This could be interesting, too:

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Charles Hugh Smith writes Is Social Media Actually “Media,” Or Is It Something Else?

Charles Hugh Smith writes Welcome to the Circular Firing Squad

Charles Hugh Smith writes Can We Rein In the Excesses of Financialization Without Crashing the Economy?

The US Congress has returned from recess with a lot on its plate. Priority must be given to passing an omnibus spending bill that prevents a government shutdown after December 11. The next round of fiscal stimulus has taken on greater urgency and may be attached to the wider spending bill.

The US Congress has returned from recess with a lot on its plate. Priority must be given to passing an omnibus spending bill that prevents a government shutdown after December 11. The next round of fiscal stimulus has taken on greater urgency and may be attached to the wider spending bill.

RECENT DEVELOPMENTS

The Senate returned from recess Monday and the House returns today. Much of the work ahead will be done behind the scenes as lawmakers negotiate passage of an omnibus spending bill by December 11 in order to avert a government shutdown. While we expect a deal to be struck, it is possible that Congress will be forced to pass another continuing resolution that would keep the government temporarily funded as negotiations continue.

We are in this current predicament after Congress was unable to pass all twelve regular appropriations bills this fall. As a result, a continuing resolution was passed at the end of September that lasts until December 11. If this expires with no other appropriations bills or continuing resolution to replace them, then a shutdown will be triggered. In the event of a shutdown, government agencies are required to furlough non-essential personnel and either stop or severely limit their activities.

Before the Thanksgiving recess, the Republican-led Senate Appropriations released a $1.4 trln spending plan. While it was meant to be a placeholder and serve as a starting point for negotiations, the plan was reportedly not well-received by House Democrats. Sticking points include (but are in no way limited to) the lack of pandemic relief as well as $2 bln of funding for the border wall.

There are plenty of hot button issues for President Trump in the spending bills and so there is a risk that he vetoes. For instance, Trump has threatened to veto the bill covering Defense spending if it includes renaming military bases that are named for Confederate leaders. That said, Trump has been uncharacteristically quiet since his election loss with regards to the budget and stimulus packages. It may be that he has simply checked out and allow Congress to take the lead. No one but Trump knows but we may learn more as December 11 approaches.

There are new efforts to pass another round of stimulus sooner rather than later. Details remain in flux but we believe any proposal is likely to get attached to the government’s spending bill due by December 11. Unsurprisingly, the size of the stimulus remains in dispute but it does appear that both sides may be willing to compromise. Reports emerged that a bipartisan group of rank-and-file Senators are putting together a $908 bln package. It contains an extension of employment benefits at $300 per week as well as $160 bln in aid for state and local governments. This compares to $500 bln proposed by the Senate Republican leadership and $2.4 trln proposed by the House Democratic leadership. Reports suggest House Speaker Pelosi submitted an updated offer to the Republicans, but no details have been revealed.

We warn against getting too optimistic here. Why? Reports suggest Senate Majority Leader McConnell has already rejected this compromise and begun circulating a new version of his plan to fellow Republicans that doesn’t go much above the original $500 bln. Some believe the compromise offer moved the goalposts in favor of McConnell and a smaller deal, since the gap is now effectively between $500 bln and $908 bln. On the other hand, some goodwill by the Republicans could be seen due to nervousness over the pending Georgia Senate races, and the need for a change of narrative away from the Presidential race. Bottom line: while we may eventually see some sort of compromise, it will be of a much smaller scale than what we think is needed.

ECONOMIC OUTLOOK

While we do not expect one, the last thing the US needs right now is another disruptive event like a shutdown. Coming in the middle of a pandemic, a shutdown would clearly have second order effects in terms of public health. That is why we believe all parties involved will work to avoid a shutdown now. We will do a deeper dive on the US outlook after this Friday’s jobs report.

There is no rule of thumb with regards to when a shutdown starts to really impact the economy. Clearly, ones that last less than a week (see A Brief History Lesson below) would have close to zero economic impact. When the length starts getting up to two weeks or longer, then it starts to get more serious as paychecks start to be missed. The Congressional Budget Office (CBO) estimated that the 2018-2019 shutdown (again, see A Brief History Lesson below) reduced the level of Q4 2018 GDP by 0.1% and Q1 2019 by 0.2%, or around $11 bln in total. It noted that the “The effect on the annualized quarterly growth rate in those quarters will be larger” and added that “Although most of the real GDP lost during the fourth quarter of 2018 and the first quarter of 2019 will eventually be recovered, CBO estimates that about $3 bln will not be.”

INVESTMENT OUTLOOK

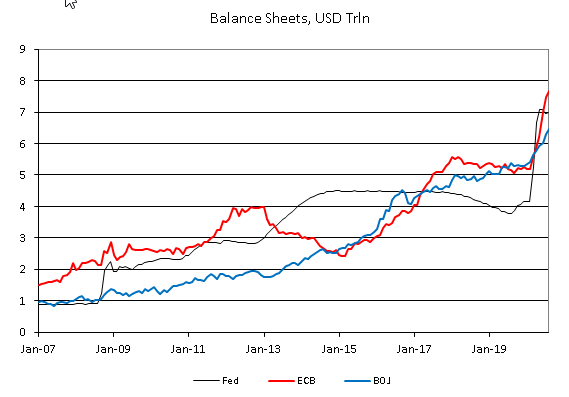

US equities continue to rise. This is due to a variety of factors, including growing optimism of vaccine rollouts globally, potential fiscal stimulus by the lame duck Congress, and an ultra-dovish Fed. Markets are forward-looking and so appear to be looking past the very dark fall and winter in the US to a better 2021. We can’t argue with this and note that accommodative central banks around the world will continue to push liquidity into risker assets like equities and EM.

We doubt a stimulus package of the size being discussed will have a big impact on the Fed’s thinking, but the outcome is highly path dependent. The 10-year yield has risen over 10 bp to 0.96% today, the highest since November 12 and nearing the year’s high near 0.97%. Likewise, the 30-year yield is up nearly 15 bp to 1.71%, the highest since November 16 and nearing the year’s high near 1.77%. Given our more pessimistic outlook on the stimulus package, we would fade this move higher in yields. Until we see a significantly larger stimulus package and/or higher inflation pressures, that 1.0% level for the 10-year will be tough to crack.

With the short end anchored, the 3-month to 10-year US curve at 87 bp is the steepest since the year’s high near 89 bp on November 11. Regardless of the economic impact of the stimulus package (if any), we believe that the steepening of the curve implies a greater chance of some sort of Fed action to contain longer dated yields. That said, we don’t think it will materially change market’s expectation for the timing of when it will remove accommodation.

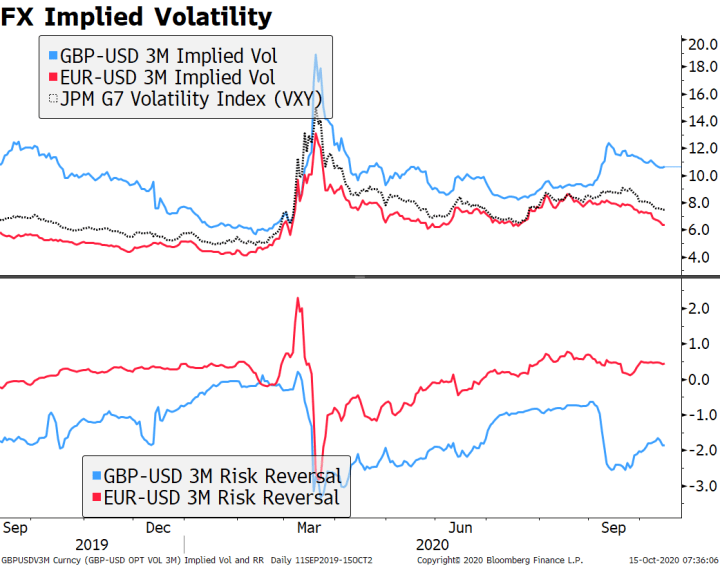

The dollar continues to weaken. Given our bearish US outlook for Q4 and early Q1, weakness should persist and so we are maintaining our bearish dollar call. After trading at the lowest level since April 2018 near 91.104 earlier today, DXY is finding some limited traction. Weakness should persist and so we are sticking with our medium-term target of the February 2018 low near 88.253. The euro finally broke above the September 1 high near $1.2010 and traded at a new cycle high near $1.2110 today. We maintain our medium-term target of $1.2555. Sterling is underperforming a bit on renewed Brexit angst. While it was unable to maintain its foothold above $1.34, a successful Brexit deal should see cable break above the September high near $1.3480 and perhaps make some good headway towards the April 2018 high near $1.4375. USD/JPY remains stuck in its recent 104-105 trading range but we look for an eventual break below 104 that would set up a test of the November low near 103.20 and quite likely the March low near 101.20.

For now, we will refrain from making any longer-term calls for the demise of the dollar. We note that weakening to those 2018 lows would still keep the dollar within broad trading ranges seen since 2015. That is, it should not be seen as some historic dollar decline. We still think this is cyclical dollar weakness, not structural, and believe that President-elect Biden’s efforts to rein in the virus will eventually be key to improving the dollar’s medium-term outlook. We saw this dynamic during the financial crisis, when aggressive Fed QE led to initial dollar losses before it turned around as the US economy recovered. We see that happening again this time around but we need to get the virus under control or that recovery won’t happen. We think the dollar can bottom in Q1 if (and that’s a mighty big if) we control the virus and get more fiscal stimulus.

A BRIEF HISTORY LESSON

The US government is typically funded by 12 separate appropriations bills. Each fiscal year, twelve regular appropriations bills must be passed by October 1 to keep the government fully funded and running smoothly for the fiscal year that’s just starting. These bill are broken down by departments: 1) Agriculture; 2) Commerce, Justice, Science; 3) Defense; 4) Energy and Water Development; 5) Financial Services and General Government; 6) Homeland Security; 7) Interior, Environment; 8) Labor, Health and Human Services, Education; 9) Legislative Branch; 10) Military, Construction, Veterans Affairs; 11) State, Foreign Operations; and 12) Transportation, Housing and Urban Development.

If a regular appropriations bill is not passed by the deadline, Congress can pass a so-called continuing resolution. This is what happened this year and generally continues the already existing appropriations at the same levels as the previous fiscal year for a set amount of time. This temporary funding measure must eventually be replaced by the regular spending bills. The Pew Research Center noted that in nearly 50 years under this system, Congress has been able to pass all the required appropriation bills on time only 4 times, for the fiscal years 1977, 1989, 1995,and 1997.

A shutdown occurs when an appropriations bill or a continuing resolution cannot be passed. This failure could be due to Congressional inability to either pass legislation or to override a veto of said legislation by the President of the United States. This leads to what is called a funding gap, which means that the federal government must shut down.

Since the current budget process was enacted In 1976, there have been 21 shutdowns of varying length. One came during Gerald Ford’s administration, lasting 10 days. Five came during Jimmy Carter’s administration, ranging from 8-18 days. Eight came during Ronald Reagan’s administration, ranging from 1-3 days. One came during George H.W. Bush’s administration, lasting 3 days. Two came under Bill Clinton’s administration, lasting 5 and 21 days. One came during Barack Obama’s administration, lasting 16 days. Lastly, three have come during Donald Trump’s administration ranging from 1-34 days. The last one that started in December 2018 lasted 35 days, the longest ever. Let’s hope we can avoid a fourth one this month.

Tags: