Far more people ordered goods by parcel during the pandemic. © Keystone / Peter Klaunzer The Covid-19 pandemic cost the state-owned Swiss postal service CHF139 million ($150 million) last year, which was largely responsible for driving down profits by 30%. Swiss Post delivered a record 182.7 million parcels in 2020, up nearly a quarter in volume from the previous year. But the number of letters being posted declined by 5.6%. The pandemic also negatively impacted the...

Read More »More rare earth metals detected at Swiss wastewater plants

The team carried out investigations into the presence of rare earth metals in sewage at 63 treatment plants across Switzerland. © Keystone / Christian Beutler Rare earth metals like cerium and gadolinium, which are used in industry and hospitals, are increasingly being detected at Swiss wastewater plants, new research shows. For the first time scientists from the Swiss Federal Institute of Aquatic Science and Technology (Eawag) carried out investigations into the...

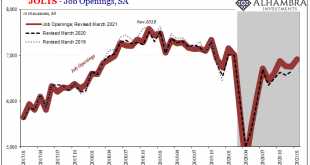

Read More »JOLTS Revisions: Much Better Reopening, But Why Didn’t It Last?

According to newly revised BLS benchmarks, the labor market might have been a little bit worse than previously thought during the worst of last year’s contraction. Coming out of it, the initial rebound, at least, seems to have been substantially better – either due to government checks or, more likely, American businesses in the initial reopening phase eager to get back up and running on a paying basis again. The JOLTS labor series annual revisions took about...

Read More »In Some Countries, Lockdowns May Be the “New Normal”

Like many mainstream economists who make predictions that inform and shape government policy, medical experts make predictions which can determine how a government addresses a perceived problem. A good example here is Professor Neil Ferguson, who led the flawed Imperial College covid-19 study which played a major role in the lockdowns implemented throughout Europe, and even in the US and Canada. The model used by Imperial offered many predications, including the...

Read More »Fed Coin Is Coming – Keith Weiner #5084

The Fedcoin has bipartisan support. Jay Powell, appointed as Federal Reserve Chairman by President Trump, said in October that the Federal Reserve is conducting research into issuing a digital currency, on its own and also in partnership with other central banks and the Bank for International Settlements. Janet Yellen, appointed as Fed Chair by President Obama, said last week, “It makes sense for central banks to be looking at issuing sovereign digital currencies.” They...

Read More »FX Daily, March 11: Risk Extends Gains Ahead of the ECB

Swiss Franc The Euro has fallen by 0.18% to 1.1065 EUR/CHF and USD/CHF, March 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Even though the NASDAQ closed lower yesterday and the reception of the 10-year Treasury auction did not excite, market participants are growing more confident. Led by China, the major markets in the Asia Pacific region rallied. The Shanghai Composite’s 2.35% gain not only snaps a...

Read More »Swiss government expects fast economic recovery in 2021

The Swiss government has started to cautiously lift several Covid restrictions put in place in mid-January to reduce infection levels. Shops, museums and sports facilities re-opened from March 1 but restaurants and bars remain closed. Keystone / Jean-christophe Bott After a weak start to the year, Switzerland’s economy should recover rapidly from a heavy coronavirus-driven slump to grow by 3% in 2021, the government said on Thursday. Gross domestic product will fall...

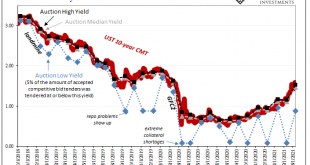

Read More »What Gold Says About UST Auctions

The “too many” Treasury argument which ignited early in 2018 never made a whole lot of sense. It first showed up, believe it or not, in 2016. The idea in both cases was fiscal debt; Uncle Sam’s deficit monster displayed a voracious appetite never in danger of slowing down even though – Economists and central bankers claimed – it would’ve been wise to heed looming inflationary pressures to cut back first. Combined, fiscal and monetary policy was, they said,...

Read More »Free Meng Wanzhou

Reminder: Our online conference “The National Security State and the Kennedy Assassination” continues today, Wednesday, March 10, at 7 pm Eastern time. We now have 650 registrations. This week’s speaker is Michael Swanson, author of the book The War State: The Cold War Origins Of The Military-Industrial Complex And The Power Elite, 1945-1963 and his newly released book Why the Vietnam War? When it comes to Chinese business executive Meng Wanzhou, President Biden...

Read More »Per Bylund and Mark Packard: Radically Reshaping Business Thinking via Subjective Value

In a recently published paper titled “Subjective Value In Entrepreneurship,” Professors Bylund and Packard apply the principle of subjective value to generate significant new avenues of thinking for entrepreneurial businesses to pursue. Watch the “Value Generation Business Model” video at Mises.org/E4B_108_Video. value-generation-business-model:7?r=69GquufdquhHCfynHaaJizQfhSz8R87h [embedded content] Key Takeaways and Actionable Insights Re-think value....

Read More » SNB & CHF

SNB & CHF