Swiss Franc The Euro has fallen by 0.33% to 1.1024 EUR/CHF and USD/CHF, March 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Yesterday’s new record highs in the S&P 500 and Dow Jones Industrial helped set the tone for today’s advance in the Asia Pacific region and Europe. The MSCI Asia Pacific Index snapped a two-day decline, with other major markets rising today. The Dow Jones Stoxx 600 had edged to new...

Read More »Art Basel and UBS Global Art Market Report: Online sales reached record highs in 2020, doubling in value

Zurich, 16 March 2021 – Art Basel and UBS announced today the publication of the fifth Art Basel and UBS Global Art Market Report, authored by renowned cultural economist Dr Clare McAndrew. The report integrates insight from a recent survey of 2,569 high-net-worth (HNW) collectors, conducted by Arts Economics and UBS Investor Watch, across ten markets: the United States, United Kingdom, France, Germany, Italy, Hong Kong, Taiwan, Singapore, Mexico, and for the first...

Read More »In Some Countries, Lockdowns May Be the “New Normal”

While some countries in Europe are showing signs of lifting all restrictions soon, Ireland’s so-called leaders are telling citizens it cannot be guaranteed that they’ll even be able to holiday in their own country this summer. Original Article: Like many mainstream economists who make predictions that inform and shape government policy, medical experts make predictions which can determine how a government addresses a perceived problem. A good example here is...

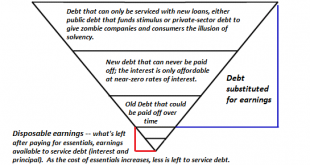

Read More »Stimulus Addiction Disorder: The Debt-Disposable Earnings Pyramid

One glance at this chart explains why the status quo is locked on “run to fail” and will implode in a spectacular collapse of the unsustainable debt super-nova.. For those who suspect the status quo is unsustainable but aren’t quite sure why, I’ve prepared a simple chart that explains the financial precariousness many sense. The chart depicts the two core elements of a debt-based, consumerist economy: disposable earnings, defined as the earnings left after paying...

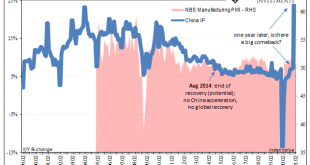

Read More »Looking Past Gigantic Base Effects To China’s (Really) Struggling Economy

The Chinese were first to go down because they had been first to shut down, therefore one year further on they’ll be the first to skew all their economic results when being compared to it. These obvious base effects will, without further scrutiny, make analysis slightly more difficult. What we want to know is how the current data fits with the overall idea of recovery: is it on track, perhaps going better than thought, or falling short. Another set of huge positives...

Read More »Marc Chandler looks at ECB policy Catherine Austin Fitts on tech future Clip

Hack on US security-camera company sparks Swiss police raid

The hackers said they wanted to raise awareness about mass surveillance © Keystone / Christian Beutler Swiss authorities on Monday confirmed a police raid at the home of a Swiss hacker who took credit for helping to break into a US security-camera company’s online networks, part of what the hacker cited as an effort to raise awareness about the dangers of mass surveillance. The Federal Office of Justice said regional police in central Lucerne, acting on a legal...

Read More »FX Daily, March 15: Big Week Begins Quietly

Swiss Franc The Euro has fallen by 0.24% to 1.1077 EUR/CHF and USD/CHF, March 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets are beginning a new and busy week in a non-committal fashion. Equities are mixed. Except for Japan, Hong Kong, and Australia, most markets in the Asia Pacific region were lower, led Chinese and Indian shares. Europe’s Dow Jones Stoxx 600 ended a four-day advance...

Read More »Das staatliche Geldmonopol und der „Große Reset“

Das ungedeckte Papiergeldgeldsystem – man kann es auch als Fiat-Geldsystem bezeichnen – ist wirtschaftlich und sozial äußerst problematisch. Es verursacht Schäden, die vermutlich weit über die Vorstellungen der meisten Menschen hinausgehen. Beispielsweise ist das Fiat-Geld inflationär; es begünstigt einige wenige auf Kosten vieler; es verursacht Konjunkturzyklen („Boom-und-Bust“); es korrumpiert das Moral- und Wertesystem...

Read More »Flu deaths surprisingly rare in Switzerland

© Udra11 | Dreamstime.com Sometimes comparisons are drawn between the seasonal flu and Covid-19. But how many die from the seasonal flu in a typical year? According to Switzerland’s Federal Statistical Office, surprisingly few. Over the ten years from 2009 to 2018, an annual average of 1181 people died from the flu in Switzerland, according to death certificate data collated by the Federal Statistical Office, a rate of around 14 per million. From 2009 to 2018, the...

Read More » SNB & CHF

SNB & CHF