If you are interested in personal finance, you probably have come across the concept of emergency funds. An emergency fund is simply some money available directly that you can use for emergencies. Most people will advise you to get such an account. And they will insist heavily on this subject. It is an interesting subject since not everybody agrees on the importance of the emergency fund. Some people have an emergency fund that can cover one year of expenses. And...

Read More »Der Wohlfahrtsverlust durch Besteuerung

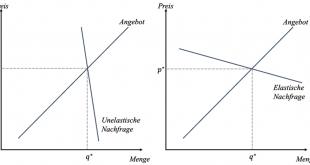

Alle Studenten der Wirtschaftswissenschaften werden früher oder später mit der neoklassischen Standardanalyse des Wohlfahrtsverlusts durch Besteuerung konfrontiert. Dabei geht es nicht um die Klärung der Frage, wozu man die Steuereinnahmen des Staates verwenden sollte, sondern vielmehr darum, wie und wo der Staat besteuern sollte, damit es zu möglichst geringen Verzerrungen im Marktgefüge kommt – gewissermaßen so, dass es am wenigsten wehtut. Idealerweise sollte die...

Read More »Weekly Market Pulse – Real Rates Finally Make A Move

Last week was only four days due to the President’s day holiday but it was eventful. The big news of the week was the spike in interest rates, which according to the press reports I read, “came out of nowhere”. In other words, the writers couldn’t find an obvious cause for a 14 basis point rise in the 10 year Treasury note yield so they just chalked it up to mystery. Of course, anyone who’s been paying attention knows that rates have been rising for almost a year –...

Read More »Some Swiss cantons call for earlier restaurant re-openings

A restaurant that has been shut in Geneva Keystone / Martial Trezzini Several cantons have called for restaurants to be re-opened a month earlier than the official nationwide plan presented by the government earlier this week. Canton Graubünden wants restaurants to open their terraces from March 1. The canton has done a lot to fight the pandemic with its mass testing pilot programme, its officials argue. “In the end the government will have to give some...

Read More »Switzerland’s record breaking deficit in 2020

© Marekusz | Dreamstime.com Switzerland’s federal accounts ended 2020 with a record-breaking deficit of CHF 15.8 billion. The deficit was caused by the pandemic. An unexpected CHF 3.6 billion fall in revenue combined with net CHF 12.5 billion in largely unplanned expenses combined to take the overall result CHF 16.1 billion below the expected positive net result of CHF 0.3 billion to deliver a loss of CHF 15.8 billion for the year. Pandemic-related expenditure...

Read More »Eurodollar University’s Making Sense; Episode 46; Part 3: Bill’s Reading On Reflation, And Other Charted Potpourri

46.3 On the Economic Road to NothingGoodVilleRecent, low consumer price inflation readings combined with falling US Treasury Bill yields are cautionary sign posts that say this reflationary path may not be the road to recovery but a deflationary cul-de-sac. [Emil’s Summary] Having studied monetary policy for several years it was only natural that your podcaster spent considerable time contemplating the essential elements of fiction. Some experts say there are five...

Read More »New Opportunities 2021: Covid-19 and the future of shipping and aviation

The Covid-19 pandemic has disrupted transportation worldwide, sending shockwaves across supply chains, lowering demand and reducing revenue. Shipping and aviation especially experienced a steep financial decline. Companies have had to operate at limited capacity and growth prospects have dropped sharply. According to the World Trade Organization, global maritime trade volumes declined by approximately 10 percent in 2020. The International Civil Aviation...

Read More »49.2 Do Not Rule Out a Market Panic Next Month

A Financial Times column warns of a US Treasury Bill air pocket in March. Learn the little-known history of a mid-market, 1970s German bank that compelled regulators to move towards capital and supplementary leverage ratios. The very ratios that may now trigger a panic. ----------SPONSOR---------- But first, this from Eurodollar Enterprises! The motion picture event of the summer: (Con)Tango & Cash. When an international smuggling ring uses the local commodity exchange to send gold...

Read More »Alpine skiing industry faces uphill battle after reopening U-turn

Carving its own way: ski resorts in Switzerland have remained open this winter. Keystone / Marcel Bieri As a fresh covering of snow brought ideal skiing conditions to the Alpine resort of Piani di Bobbio last weekend, facilities manager Massimo Fossati eagerly anticipated the arrival of the first visitors in nearly a year. Italy’s government had given the go-ahead for the skiing industry to reopen on February 15, raising hopes of a return to normality after 11 months...

Read More »Der Liberalismus hat immer das Wohl des Ganzen im Auge

19. Februar 2021 – von Ludwig von Mises Ludwig von Mises (1881 – 1973) Weit verbreitet ist die Meinung, der Liberalismus unterscheide sich von anderen politischen Richtungen dadurch, daß er die Interessen eines Teiles der Gesellschaft – der Besitzenden, der Kapitalisten, der Unternehmer – über die Interessen der anderen Schichten stelle und vertrete. Diese Behauptung ist ganz und gar verkehrt. Der Liberalismus hat immer das Wohl des Ganzen, nie das irgendwelcher...

Read More » SNB & CHF

SNB & CHF