In baseball, there is a situation where a base runner is sprinting to home plate and can’t see what is happening behind him. Totally focused on scoring, he doesn’t know if the outfielder is throwing a ball that will reach home plate first. That’s where we get the phrase “out of left field.” (If the ball were coming from right field, the runner could actually see it.)

COVID-19 was the ultimate ball out of left field. Yes, we knew viruses spread and pandemics were possible. Most of us have lived through them before. We didn’t foresee this particular one appearing when and where it did. But it quickly changed the course of history.

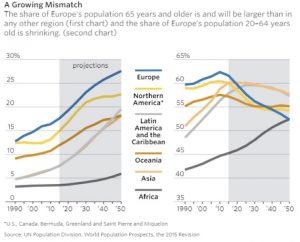

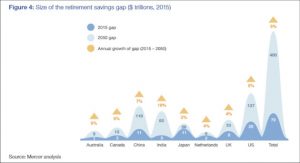

Or did it? In the grand scheme of things, maybe not. World-changing trends were already in motion and are continuing. The pandemic may

Read More »