Read More »

Covid: responding to coronavirus denial

This week, the Swiss National COVID-19 Science Task Force published a guide on responding to coronavirus denial. During second wave, trust in the decisions of the Swiss authorities dropped below where it was in spring, and the social consensus on how to respond to the pandemic eroded over the summer, said the authors. Conspiracy theories and misinformation have contributed to this trend and reduced the adoption of measures to control the spread of the virus, said the...

Read More »Can Novartis really make its medicines available to everyone?

Novartis launched a new strategy in sub-Saharan Africa in 2019. Sales people will no longer be incentivised by sales targets but rather by patients reached. Reuters / Baz Ratner Novartis has said it wants everyone in the world to be able to access its products, even multi-million-dollar gene therapies. Can its experiment work? Five years ago, Swiss pharma firm Novartis did something no one else in the industry had ever done. It set out to rigorously evaluate whether...

Read More »FX Daily, February 4: Negative Rates and the Bank of England: Having Your Cake and Eating it Too

Swiss Franc The Euro has risen by 0.01% to 1.0817 EUR/CHF and USD/CHF, February 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The euro has been sold through $1.20 for the first time since December 1 and has now given back roughly half of the gains scored from the US election (~$1.16) to the early January high (~$.1.2350). More broadly, the greenback is bid against most of the major currencies, with the...

Read More »Your Marginal Tax Rate and all you need to know about it

Your marginal tax rate is an important metric. But it is also a complex and misunderstood concept. Many beliefs about the marginal tax rates are wrong. So, in this article, I want to clear out as much as possible regarding the subject. By the end, you will know how to estimate your marginal tax rate and what it means. Marginal Tax Rate Let’s start at the beginning: what is a marginal tax rate? Your marginal tax rate is the rate at which new income is taxed. It is...

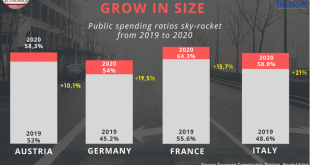

Read More »Governments Grow in Size

The coronavirus has dominated all of our lives in recent months. Radical paths were taken by politicians in the form of lockdowns to contain the pandemic. But we should recognize that even if the coronavirus is a (major) challenge for us, we always have to keep a holistic view of world events. Just as there are epidemiological factors to consider in this crisis, there are also economic, social, cultural, political and other health factors at play. It is...

Read More »There’s Nothing Wrong with Short Selling

The recent GameStop short-squeeze drama has riveted financial markets. Given the historic unpopularity of short sellers (e.g., Holman Jenkins has written that “short-selling is…widely unpopular with everyone who has a stake in seeing stock prices go up”), the resulting heightened invective against them is not a surprise. Unfortunately, an intensification of this rhetoric could lead to unwarranted broader restrictions on short selling, indicated by the politicians...

Read More »Reddit Residue on Silver, 3 February

The price of silver is going up and down like a yo-yo. On Sunday and into the first part of Monday, the price skyrocketed on news that Reddit was touting the metal. But as the data clearly showed, the price was not driven up by retail buying of physical metal. To be sure, there was retail buying. But even if they depleted the finite inventories of Eagles and Maples, they were not the buyers that pushed the price up to $30. That would be the futures speculators....

Read More »Travelling to Switzerland post-Brexit

--- If you're a Brit planning to visit Switzerland, you might want to think twice about bringing your pets with you! Things have changed since Brexit. UK nationals are no longer covered by the EU’s free movement of persons agreement. When the present Covid-19 related travel ban is lifted, they will still be able to visit Switzerland for short periods using just their passports. But from 2022, short visits will require a visa waiver. UK citizens now have had to go through a...

Read More »Charles Hugh Smith-The Upcoming Revolt of the Middle Class

Charles Hugh Smith explains the reasons for two separate Americas and what impact this division will have on our economy and the middle class in general.

Read More » SNB & CHF

SNB & CHF