There are new efforts to pass another round of stimulus sooner rather than later; we warn against getting too optimistic; US bond yields rose in anticipation of stimulus; Fed Chair Powell and Treasury Secretary Mnuchin gave somewhat conflicting outlooks for the US The Fed releases its Beige Book report for the December FOMC meeting; ADP releases its private sector jobs estimate, with consensus at 430k; Brazil outperformed yesterday on positive fiscal comments from President Bolsonaro The UK became the first country to approve a Covid-19 vaccine; on the Brexit front, headlines have been mixed but that’s nothing unusual Reports suggest the EU is likely to delay previously agreed funding to Poland and Hungary as punishment for their veto threats; Germany reported

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- There are new efforts to pass another round of stimulus sooner rather than later; we warn against getting too optimistic; US bond yields rose in anticipation of stimulus; Fed Chair Powell and Treasury Secretary Mnuchin gave somewhat conflicting outlooks for the US

- The Fed releases its Beige Book report for the December FOMC meeting; ADP releases its private sector jobs estimate, with consensus at 430k; Brazil outperformed yesterday on positive fiscal comments from President Bolsonaro

- The UK became the first country to approve a Covid-19 vaccine; on the Brexit front, headlines have been mixed but that’s nothing unusual

- Reports suggest the EU is likely to delay previously agreed funding to Poland and Hungary as punishment for their veto threats; Germany reported strong retail sales; Poland is expected to keep rates steady at 0.10%

- Australia reported firm Q3 GDP; President-elect Biden will maintain the status quo with China

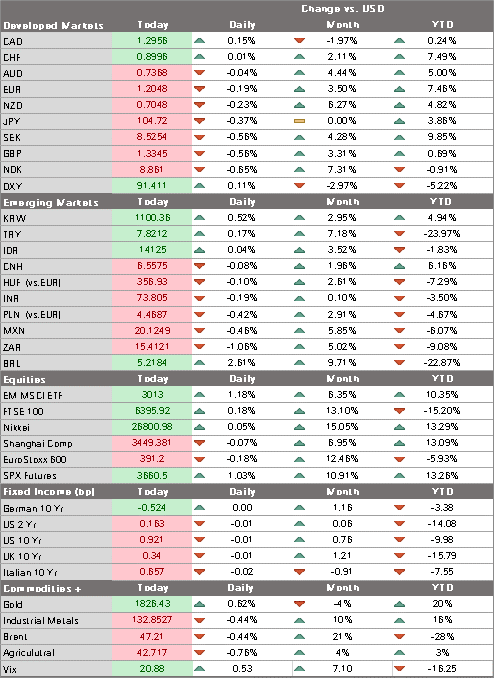

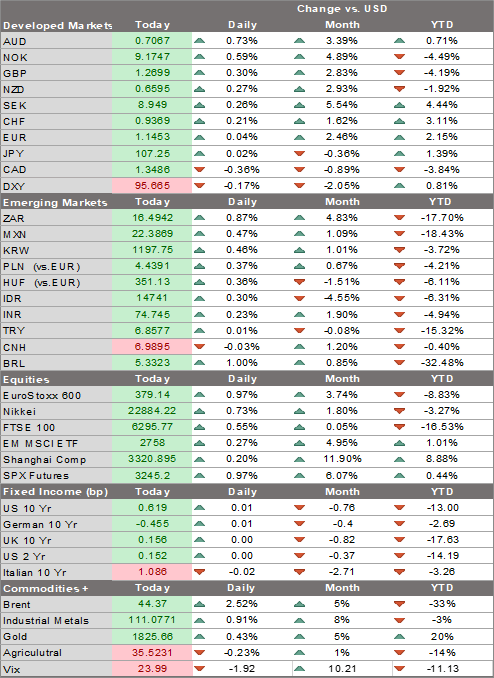

The dollar has stabilized but weakness is likely to resume. After trading at the lowest level since April 2018 near 91.109 earlier today, DXY has finding some limited traction. Weakness should persist and so we are left looking for the February 2018 low near 88.253. The euro finally broke above the September 1 high near $1.2010 and traded at a new cycle high near $1.2090 today before edging lower. We maintain our medium-term target of $1.2555. Sterling is underperforming today on renewed Brexit angst. While it was unable to maintain its foothold above $1.34, we still look for a near-term, test of the $1.3480 high from September. USD/JPY remains stuck in its recent 104-105 trading range but we look for an eventual break below 104 that would set up a test of the November low near 103.20.

AMERICAS

There are new efforts to pass another round of stimulus sooner rather than later. Details remain in flux but we believe any proposal is likely to get attached to the government’s spending bill due by December 11. Unsurprisingly, the size of the stimulus remains in dispute but it does appear that both sides may be willing to compromise. Reports emerged that a bipartisan group of rank-and-file Senators are putting together a $908 bln package. It contains an extension of employment benefits at $300 per week as well as $160 bln in aid for state and local governments. This compares to $500 bln proposed by the Senate Republican leadership and $2.4 trln proposed by the House Democratic leadership. Reports suggest House Speaker Pelosi submitted an updated offer to the Republicans, but no details have been revealed.

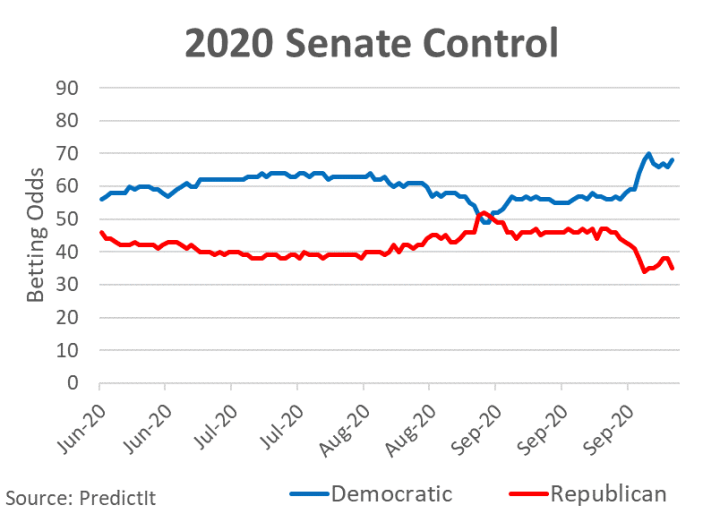

We warn against getting too optimistic here. Why? Reports suggest Senate Majority Leader McConnell has already rejected this compromise and begun circulating a new version of his plan to fellow Republicans that doesn’t go much above the original $500 bln. Did the bipartisan effort at compromise backfire? Some believe it moved the goalposts in favor of McConnell and a smaller deal, since the gap is now effectively between $500 bln and $908 bln. On the other hand, some goodwill by the Republicans could be seen due to nervousness over the pending Georgia Senate races, and the need for a change of narrative away from the Presidential race. Although the odds of Democrats taking both seats (and controlling the Senate) are small, Trump’s refusal to concede and combative rhetoric could put off swing or even Republican voters. Bottom line: while we may eventually see some sort of compromise, it will be of a much smaller scale than what we think is needed.

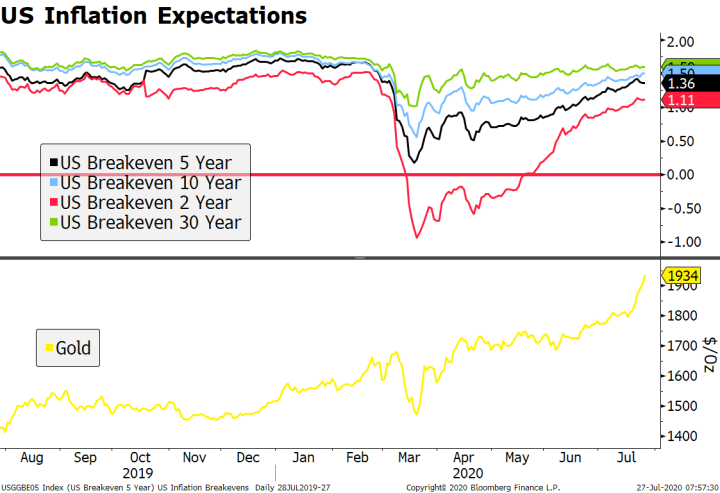

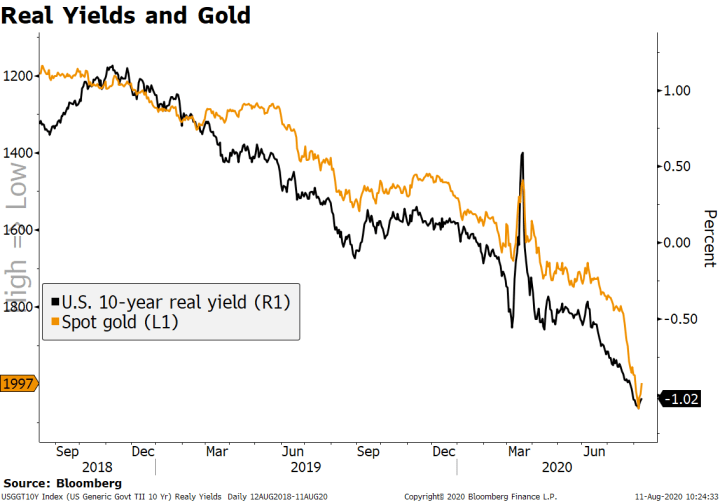

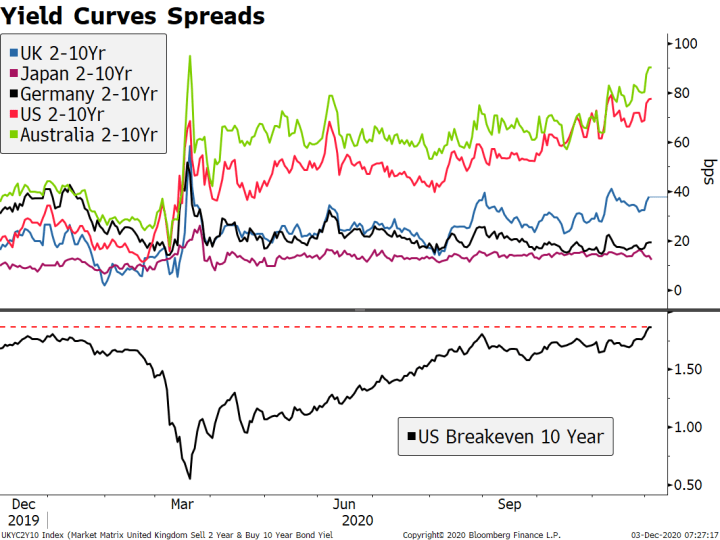

US bond yields rose in anticipation of fiscal stimulus. The 10-year yield has risen nearly 10 bp to 0.92%, the highest since November 12 and nearing the year’s high near 0.97%. Likewise, the 30-year yield is up nearly 10 bp to 1.66%, the highest since November 16 and nearing the year’s high near 1.77%. With the short end anchored, the 3-month to 10-year curve at 84 bp is the steepest since the year’s high near 89 bp on November 11. Given our more pessimistic outlook on the stimulus package, we would fade this move higher in yields. Until we see a significantly larger stimulus package and/or higher inflation pressures, that 1.0% level for the 10-year will be tough to crack.

Fed Chair Powell and Treasury Secretary Mnuchin gave somewhat conflicting outlooks for the US. They appeared yesterday before the Senate Banking Committee as part of the oversight mechanism required by the CARES Act from March. Powell was much more cautious about the outlook amidst the risks from rising virus numbers, while Mnuchin was more upbeat and said state and local lockdowns were the main threat to growth. This should come as no surprise given the recent spat between the two, with Mnuchin ending five of the Fed’s emergency programs because he thought they were no longer necessary. This dichotomy was on full view with regards to fiscal stimulus. While both called for more fiscal stimulus, Powell wanted more wide-ranging aid while Mnuchin wanted a more targeted (read smaller) approach. Yet in many ways, these differences will become moot in a little over a month when Janet Yellen takes over as Treasury Secretary. Powell and Mnuchin will both appear before the House Financial Services Committee today, while the Fed’s Williams speaks.

The Fed releases its Beige Book report for the December FOMC meeting. Since the last FOMC meeting November 4-5, the US outlook has clearly darkened. Most Fed regions are likely to be seeing deteriorating conditions as rising virus numbers weigh on activity and force more shutdowns. We expect a very sobering tone in this report as well as from Fed speakers this week.

| ADP releases its private sector jobs estimate, with consensus at 430k. This will be one of the final clues, the last one being the employment component for ISM services PMI tomorrow. Yesterday, headline manufacturing PMI fell to 57.5 from 59.3 while the employment component fell to 48.4 from 53.2 in October, back below 50 after spending one month above it. The drop in the employment component is the first time since April and at 48.4 is the lowest since August. The recent rise in weekly jobless claims supports our view that the labor market is deteriorating again. To us, the clues so far suggest a soft jobs number this Friday, where consensus is currently 486k.

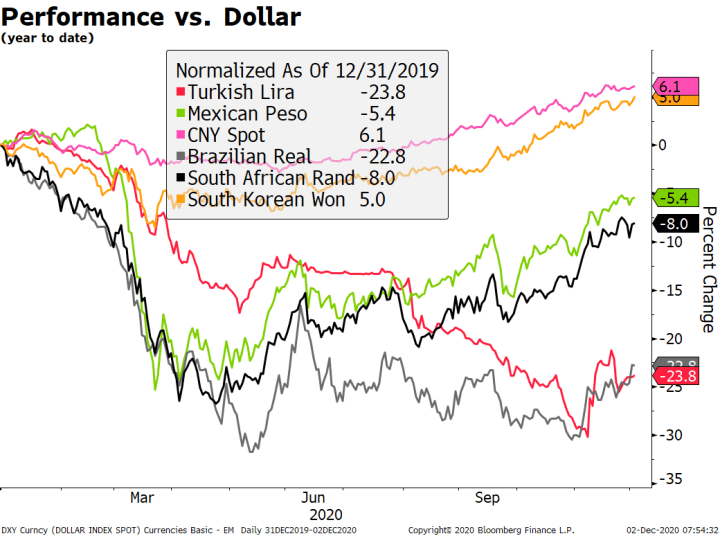

Brazil outperformed yesterday on positive fiscal comments from President Bolsonaro. He said the country can’t afford to extend the emergency fiscal transfers. It now looks like the government will return to the previous assistance program (Bolsa Familia) instead of using the pandemic to establish a larger and semi-permanent fiscal expenditure. The Brazilian real has been outperforming other major EM currencies over the last few week, but it still has a long way to catch up. Year to date, the real is down over 20% against the dollar, compared to a decline of just 5% for the Mexican peso and single digit appreciation for several EM Asian currencies. Markets are expecting a protracted tightening cycle to begin in January, which would likely increase the real’s allure. |

Performance vs. Dollar, 2020 |

| EUROPE/MIDDLE EAST/AFRICA

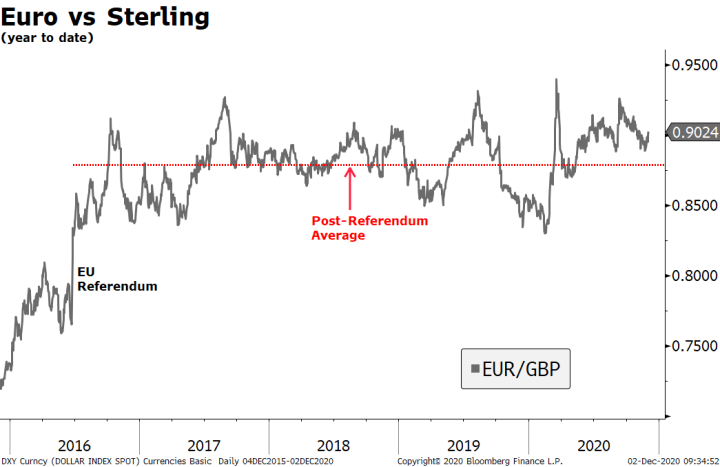

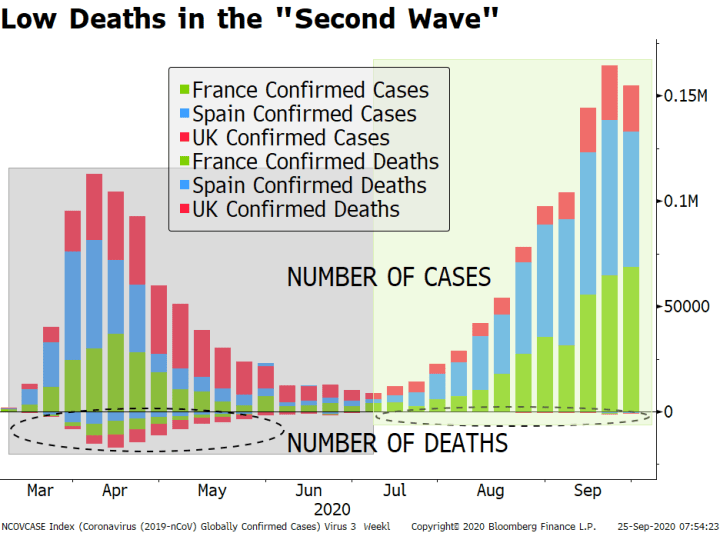

The UK became the first country to approve BioNTech/Pfizer’s Covid-19 vaccine. The government says it could become available next week. Separately, Prime Minister Johnson is facing yet another Tory rebellion over the government’s handling of the new “tiered” semi-lockdown system which comes into force today. The measure was approved by 291 to 78, but 54 Tory MPs voted against the new rules and 16 abstained. On the Brexit front, headlines have been mixed but that’s nothing unusual. The most notable one came early in the London morning when EU negotiator Barnier told EU envoys that three main issues still unresolved, and that the “deal still hangs in the balance.” This followed news that the French are hardening their position on fisheries with the view that the EU is being too generous with the UK. We think markets are largely positioned for some sort of skinny deal (which is also our base case). As such, the risks for sterling are likely asymmetric with greater likelihood of a big downside move from no deal than a big upside move from a skinny deal. Of note, the Tuesday “deadline” has come and passed, with reports now suggesting a deal is needed by this weekend so as not to interfere with preparations for the EU summit that begins December 10. |

Euro vs Sterling, 2016-2020 |

| Reports suggest the EU is likely to delay previously agreed funding to Poland and Hungary as punishment for their veto threats. While the EU cannot renege on those agreements, the lack of a budget allows it to “prioritize” its spending if it has to go into partial shutdown. These two countries happen to be amongst the largest recipients of EU aid and so stand to lose the most as well if tensions continue to ratchet up. We continue to look for a compromise but commend the EU for starting to play hardball with these two.

Germany reported strong retail sales. Sales rose 2.6% m/m, more than double the expected 1.2% and fully offsetting the revised -1.9% (was -2.2%) in September. Eurozone retail sales will be reported tomorrow, which are expected to rise 0.7% m/m vs. -2.0% in September. Last week, France reported a stronger than expected 3.7% m/m gain in consumer spending, as did Spain and its retail sales. As such, we see some upside risks for the eurozone reading. National Bank of Poland is expected to keep rates steady at 0.10%. Minutes will be released Friday. November CPI was just reported and rose the consensus 3.0% y/y vs. 3.1% in October, which keeps inflation in the upper half of the 1.5-3.5% target range. The bank has signaled steady rates for the time being as the pandemic continues to unfold. However, Polish policymakers now have another potential headwind to worry about if EU funding dries up. Risks are clearly tilted to the downside and so there should be no hint of hawkishness from the NBP today. ASIA Australia reported firm Q3 GDP. It grew 3.3% q/q vs. 2.5% expected and -7.0% in Q2, while the y/y rate improved to -3.8% y/y from a revised -6.4% (was -6.3%) in Q2. RBA Governor Lowe told a parliamentary panel that the growth will be “solidly positive” in Q3 and Q4 but warned that the recovery will be “uneven and bumpy.” He sees unemployment remaining above 6% at the end of 2022, which he said should keep a lid on wage and price pressures. For now, we think the RBA is in wait and see mode. October trade will be reported Thursday, with both exports and imports expected to grow 4% m/m. October retail sales will be reported Friday and are expected to rise 0.5% m/m vs. -1.1% in September. President-elect Biden will maintain the status quo with China. In an interview, he said he would not immediately remove Trump’s tariffs on China or change the Phase 1 agreement. This means that the 25% tariffs on about half of China’s exports will continue and its commitment to buy some $200 bln in US imports remains in place. Biden said in the NYT interview that he would review the existing agreement first and then consult with the traditional allies. This supports our view that the US-China relationship has irrevocably changed, and that China should not expect any let-up in the hardline stance from the US. Indeed, China should be even more nervous as Biden appears likely to use a multilateral approach to containing China as opposed to Trump’s unilateral one. |

Tags: Articles,Daily News,Featured,newsletter