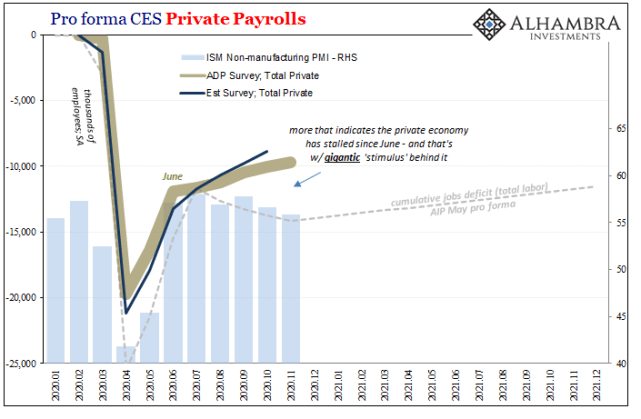

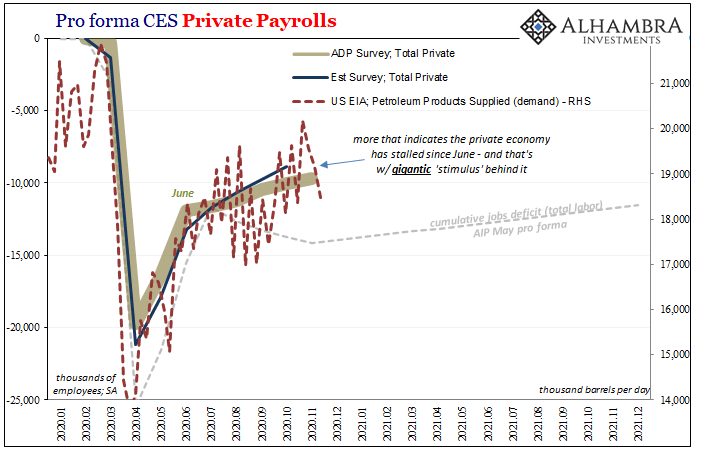

The ISM’s Non-manufacturing PMI continued to decelerate from its high registered all the way back in July 2020. In that month, the headline index reached 58.1, the best since early 2019, and for many signaling that everything was coming up “V.” Since, however, it’s been a slow downward trend that, when realizing early 2019 wasn’t exactly robust, only reconfigures the very nature of this rebound. When comparing comebacks from outsized economic contractions, the best level in 2020 was entirely too equal to the best from 2010-11 – which, as we unlike Economists know, didn’t equate to recovery then, either. Pro forma CES Private Payrolls, 2020-2021 - Click to enlarge Sure, the economy is still moving positively but barely. Given now this summer slowdown has

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, currencies, economy, employment, Featured, Federal Reserve/Monetary Policy, Initial Jobless Claims, ism non manufacturing index, jobless claims, Labor market, Markets, newsletter, unemployment insurance

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

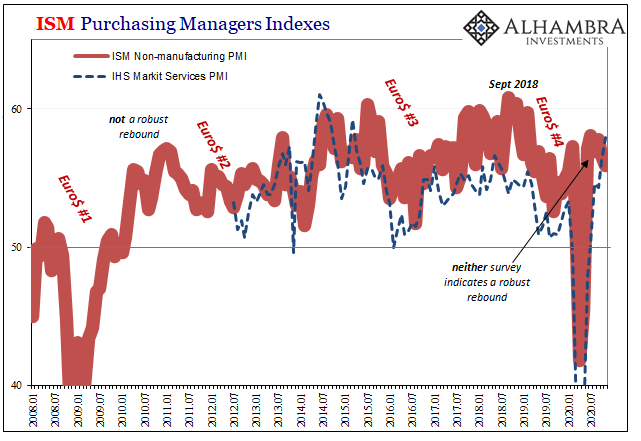

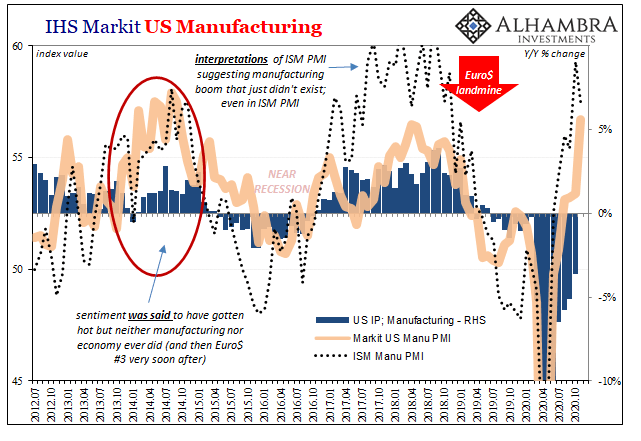

| The ISM’s Non-manufacturing PMI continued to decelerate from its high registered all the way back in July 2020. In that month, the headline index reached 58.1, the best since early 2019, and for many signaling that everything was coming up “V.” Since, however, it’s been a slow downward trend that, when realizing early 2019 wasn’t exactly robust, only reconfigures the very nature of this rebound.

When comparing comebacks from outsized economic contractions, the best level in 2020 was entirely too equal to the best from 2010-11 – which, as we unlike Economists know, didn’t equate to recovery then, either. |

Pro forma CES Private Payrolls, 2020-2021 |

| Sure, the economy is still moving positively but barely. Given now this summer slowdown has extended into its fourth or fifth month (depending which data point), the “V” is surely dead. Add this ISM number on top of the multitude of others already nailed into its coffin.

Further, to reinforce the point that even the non-manufacturing 58.1 wasn’t indicative of recovery rather than rebound, the underlying employment index has remained stuck – at best – around neutral. There just was never enough momentum or even raw activity (or functional dollar liquidity) which would have persuaded businesses to robustly rehire let alone hire a lot more workers. |

ISM Purchasing Managers Indexes, 2008-2020 |

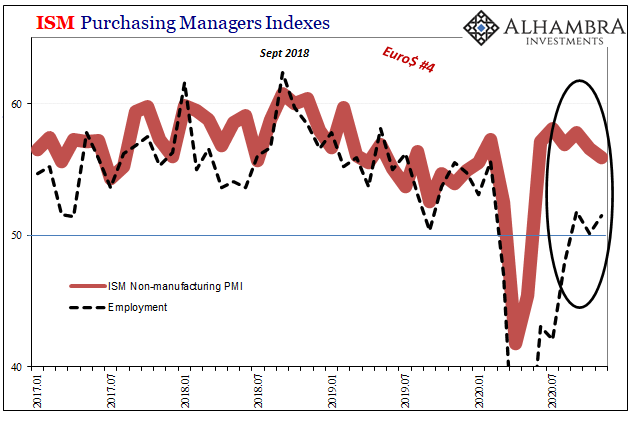

ISM Purchasing Managers Indexes, 2017-2020 |

|

| At least in the ISM’s employment components, both manufacturing and non-manufacturing, they quite easily fit with the troubling picture of a labor market likewise experiencing a summer slowdown way, way short of sufficient. Weakness is far more apparent in levels, too, not just these lacking rates.

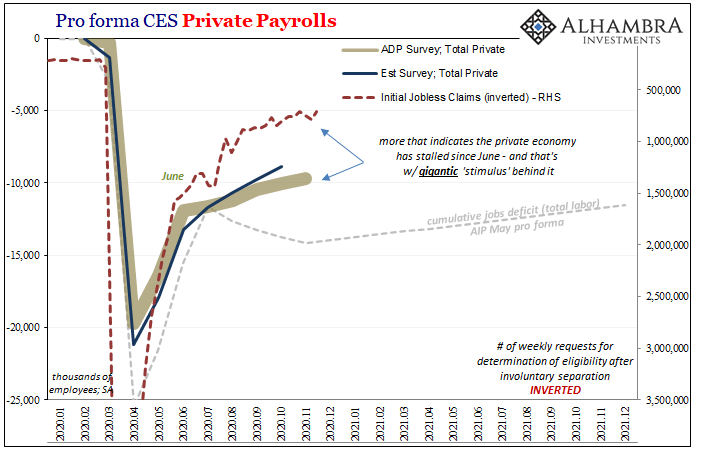

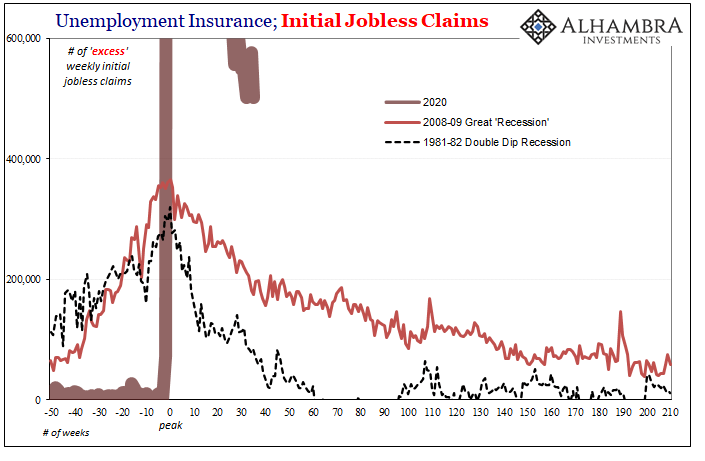

Initial jobless claims (Thursday ritual) dropped last week after two weeks having surged more than (revised) 10%. From 787,000 two weeks ago, the latest estimate (712k) indicates still more than 700,000 former American workers filing for insurance payment eligibility; another week which, before this year, would’ve been a record number. |

Pro forma CES Private Payrolls, 2020-2021 |

| That’s all the way through November.

Like the ISM PMI, it appears the overall economic situation continues to improve in absolute terms. It is the trends, the dramatic and persisting slowing of the rate of improvement, which portend a boatload of future problems. |

Unemployment Insurance, Initial Jobless Claims, 1980-2020 |

| Somehow, incoming government subsidies (not “stimulus”) plus the suddenly uncertain rollout of COVID vaccines (google: Pfizer “supply chain” snags) are, in some commentary, enough to render this slowdown moot anyway.

Forget today’s struggles, tomorrow’s government cash payments and vaccinations are all that matter. Other than the US$’s exchange value with the euro, even stocks aren’t jumping fully onboard this interpretation. And, as noted yesterday, oil’s got OPEC and record domestic inventories (indicative of the same summer slowdown) to carry forward until those future developments hopefully pan out. |

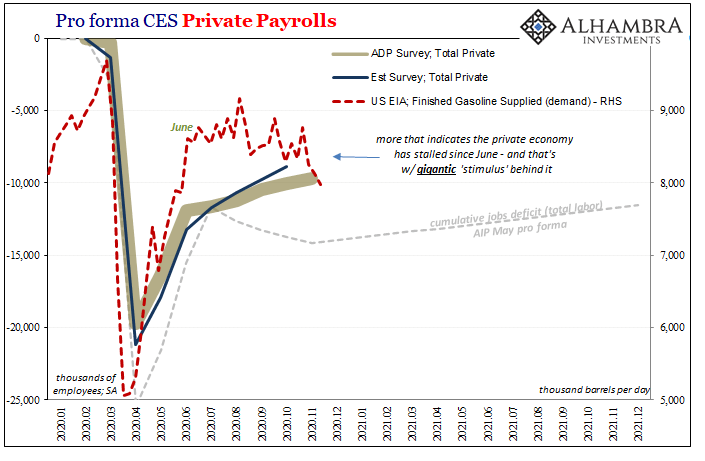

Pro forma CES Private Payrolls, 2020-2021 |

Pro forma CES Private Payrolls, 2020-2021 |

|

| They’re saying it’ll be easy to get the economy back up and running again once COVID is removed from the equation; which, you’ll recall, was exactly what was said when the reopening process began. Dead “V”, it wasn’t so easy after all so bring in the next set of dei ex machina.

Here we are six months later, COVID isn’t really as much of a problem but the economic factors holding back especially employment certainly are. Payroll numbers come tomorrow, and if they are anything like ADP’s initial estimates, we’ll be adding another nail to the “V’s” coffin which has already been hammered full of them. Thus, we’re left to wonder if the next “V”, which some claim is really a “K”, and that’s OK, isn’t that big of a difference. Shifting letters, moving the goalposts already, that, too, is very 2010-11 like. |

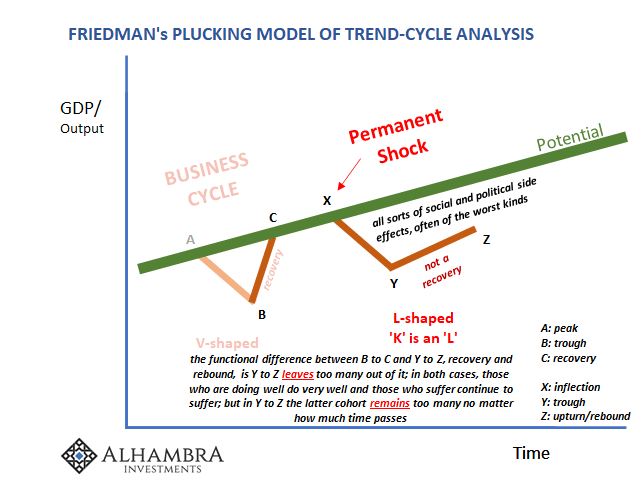

Friedman's Plucking Model of Trend-Cycle Analysis |

Tags: currencies,economy,employment,Featured,Federal Reserve/Monetary Policy,Initial Jobless Claims,ism non manufacturing index,jobless claims,Labor Market,Markets,newsletter,unemployment insurance