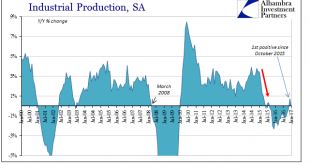

Industrial Production in the United States was flat in January 2017, following in December the first positive growth rate in over a year. The monthly estimates for IP are often subject to greater revisions than in other data series, so the figures for the latest month might change in the months ahead. Still, even with that in mind, there is no acceleration indicated for US industry. After suffering through a more than...

Read More »United States Economic Freedom Tumbles To Historic Low

After eight years of the regulation-happy Obama administration, the United States has undergone a huge slide into the 17th most economically free country in the world, according to the Heritage Foundation’s 2017 Index of Economic Freedom. Under president Obama, the federal government issued over 600 major regulations, costing the U.S. economy hundreds of millions of dollars. Those regulations were placed on top of...

Read More »Weekly Sight Deposits and Speculative Positions: Once again a new SNB intervention record

Headlines Week February 20, 2017 Recently inflation rose more quickly in the euro zone, but this was mostly caused by a temporary oil price effect. Therefore the ECB might be dovish for a longer period than the SNB. Consumer price inflation will decide who is more dovish. Ultimately inflation will depend on the two key parameters wages and rents. Rents will rise first in Switzerland, while the Euro zone has downwards...

Read More »Greenspan Says Gold “Ultimate Insurance Policy” as has “Grave Concerns About Euro”

“The eurozone isn’t working …” warns Greenspan “I view gold as the primary global currency” said Greenspan “Significant increases in inflation will ultimately increase the price of gold” “Investment in gold now is insurance…” Alan Greenspan, the former head of the Federal Reserve has warned that the euro may collapse, saying that he has “grave concerns” about its future. The imbalances in the economic strength of euro...

Read More »Weekly Speculative Position: Rising EUR shorts and falling CHF shorts point to weaker EUR/CHF

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »FX Weekly Preview: Number One Rule of the Game is Stay in the Game

Summary: Light economic calendar in the week ahead, but anticipation of US tax reform may underpin dollar and equities. European politics are in flux (France, Italy, Greece) and this may see spreads widen over Germany. Russia’s outlook was upgraded by Moody’s before the weekend, and China has announced no coal imports this year from North Korea. Brazil is expected to cut Selic by 75 bps. The week ahead is...

Read More »Emerging Markets: Preview of the Week Ahead

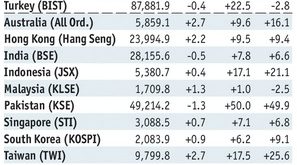

Stock Markets EM FX ended last week on a soft note, as some risk off sentiment crept back into the markets. The dollar gained broadly on Friday despite lower US rates as bonds rallied, the yen gained and equities sold off. Markit PMI for February Tuesday and FOMC minutes Wednesday could give the markets some further clues regarding Fed policy. We believe markets are underestimating the Fed’s capacity to tighten...

Read More »MacroVoices Presents: Jeffrey Snider – Understanding the Global US Dollar Shortage

MacroVoices Presents: Jeffrey Snider - Understanding the Global US Dollar Shortage

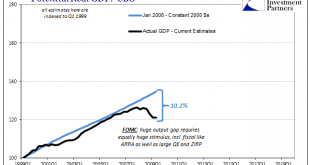

Read More »Their Gap Is Closed, Ours Still Needs To Be

There are actually two parts to examining the orthodox treatment of the output gap. The first is the review, looking backward to trace how we got to this state. The second is looking forward trying to figure what it means to be here. One final rearward assessment is required so as to frame how we view what comes next. As I suggested earlier this week, the so-called output gap started at the trough of the Great...

Read More »FX Weekly Review, February 13 – 18: Why still long the dollar?

Swiss Franc Currency Index The Swiss Franc index was mostly unchanged against the U.S. Dollar Index in the last week. One word about Marc Chandler’s argumentation below: Three types of investors are long the dollar: FX investors/speculators are long the dollar because of the difference in monetary policy (e.g. higher US rates). Cash investors, for example rich people from China and other Emerging Markets, currently...

Read More » SNB & CHF

SNB & CHF