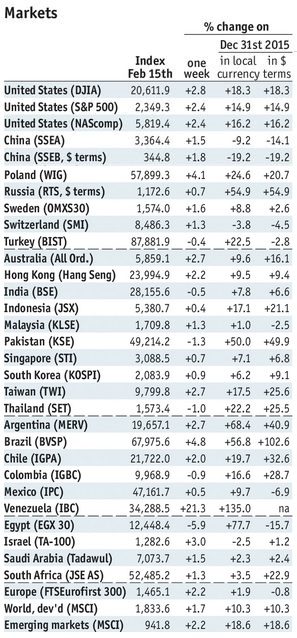

Stock Markets EM FX ended last week on a soft note, as some risk off sentiment crept back into the markets. The dollar gained broadly on Friday despite lower US rates as bonds rallied, the yen gained and equities sold off. Markit PMI for February Tuesday and FOMC minutes Wednesday could give the markets some further clues regarding Fed policy. We believe markets are underestimating the Fed’s capacity to tighten this year, which will eventually lead to stresses for EM. Stock Markets Emerging Markets February 15 Source: economist.com - Click to enlarge Taiwan Taiwan reports January export orders Monday, which are expected to rise 7.4% y/y vs. 6.3% in December. Q4 current account data will also be reported Monday. Taiwan reports January IP Thursday, which is expected to rise 2.7% y/y vs. 6.25% in December. The economic outlook is improving even as price pressures are rising. We believe the central bank will remain on hold at its next quarterly policy meeting in March. Israel Israel reports December manufacturing Monday. Data have been coming in strong, with GDP growing 6.2% annualized in Q4. Furthermore, inflation moved into positive territory in January for the first time since July 2014.

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stock MarketsEM FX ended last week on a soft note, as some risk off sentiment crept back into the markets. The dollar gained broadly on Friday despite lower US rates as bonds rallied, the yen gained and equities sold off. Markit PMI for February Tuesday and FOMC minutes Wednesday could give the markets some further clues regarding Fed policy. We believe markets are underestimating the Fed’s capacity to tighten this year, which will eventually lead to stresses for EM. |

Stock Markets Emerging Markets February 15 Source: economist.com - Click to enlarge |

TaiwanTaiwan reports January export orders Monday, which are expected to rise 7.4% y/y vs. 6.3% in December. Q4 current account data will also be reported Monday. Taiwan reports January IP Thursday, which is expected to rise 2.7% y/y vs. 6.25% in December. The economic outlook is improving even as price pressures are rising. We believe the central bank will remain on hold at its next quarterly policy meeting in March.

IsraelIsrael reports December manufacturing Monday. Data have been coming in strong, with GDP growing 6.2% annualized in Q4. Furthermore, inflation moved into positive territory in January for the first time since July 2014. All in all, the improving economic outlook supports our view that the central bank is unlikely to add any more stimulus via unconventional measures. However, we suspect it will continue to buy USD to prevent excessive shekel strength.

RussiaRussia reports January real retail sales Monday, which are expected at -5.1% y/y vs. -5.9% in December. The economy remains sluggish, but the 12.7% y/y jump in PPI for January will likely keep the central bank on cautious hold for now. Next policy meeting is March 24, and we see no move then.

KoreaKorea reports trade data for the first twenty days of February Tuesday. Bank of Korea meets Thursday and is expected to keep rates steady at 1.25%. CPI rose 2.0% y/y in January, right at the target. Low base effects suggest inflation will rise above target this year, which should keep the BOK leaning more hawkish.

MalaysiaMalaysia reports January CPI Wednesday, which is expected to rise 2.5% y/y vs. 1.8% y/y in December. While the central bank does not have an explicit inflation target, rising price pressures should keep Bank Negara leaning more hawkish. Next policy meeting is March 2, no change seen then.

BrazilBrazil reports mid-February IPCA inflation Wednesday. COPOM meets later that day and is expected to cut rates 75 bp to 12.25%. Brazil reports February IGP-M wholesale inflation and January central government budget data Thursday. Consolidated budget data will be reported Friday.

ColombiaColombia reports Q4 GDP Wednesday, which is expected to grow 1.4% y/y vs. 1.2% in Q3. The central bank then meets Friday and is expected to keep rates steady at 7.5%. However, the market is split. Of the 15 analysts polled by Bloomberg, 6 see a 25 bp cut and 9 see no cut. We lean towards a 25 bp cut after the bank delivered a hawkish surprise at the January meeting and kept rates steady.

SingaporeSingapore reports January CPI Thursday, which is expected to rise 0.6% y/y vs. 0.2% in December. It then reports January IP Friday, which is expected to rise 8.0% y/y vs. 21.3% in December. MAS does not have an explicit inflation target, but rising price pressures and an improving economy should keep it on hold at its April policy meeting. Over the course of the year, MAS should lean more hawkish.

PolandPoland central bank releases minutes from its last meeting Thursday. One MPC member has broached the possibility of a rate hike in 2017, ahead of the 2018 start that most believe. CPI rose 1.8% y/y in January, and low base effects are likely to push it above the 2.5% target this year. Next policy meeting is March 8, no change seen then.

MexicoMexico reports mid-February CPI Thursday, which is expected to rise 4.72% y/y vs. 4.78% in mid-January. If so, this would be the first deceleration in several months. Banco de Mexico will also release minutes from its last meeting that same day, when it hiked rates 50 bp. In light of recent MXN strength and perhaps easing price pressures, the central bank would probably like to end its tightening cycle. Next policy meeting is March 30, and much will depend on the global backdrop.

|

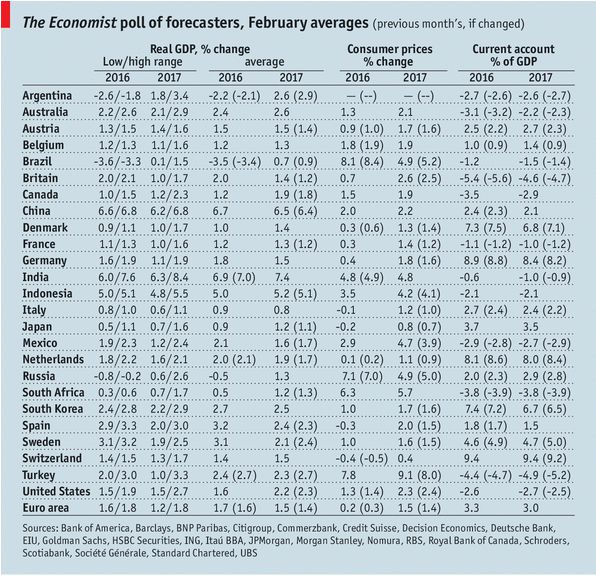

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, February 2017 Source: Economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter,win-thin