Headlines Week February 20, 2017 Recently inflation rose more quickly in the euro zone, but this was mostly caused by a temporary oil price effect. Therefore the ECB might be dovish for a longer period than the SNB. Consumer price inflation will decide who is more dovish. Ultimately inflation will depend on the two key parameters wages and rents. Rents will rise first in Switzerland, while the Euro zone has downwards pressures in the Southern countries. Wage pressures are weak in both. Wages are increasing more strongly only in Germany and Eastern European countries. FX week until February 20 The EUR/CHF fell to new lows. The average rate in the week was 1.0648. The SNB is apparently ready to let the pair slowly descend. A big Swiss bank bets on EUR/CHF 1.10 as soon as the ECB ends their bond buying program. But to our view EUR/CHF will touch parity first, because it will take at least 2-3 years until the ECB normalizes rates. Euro/Swiss Franc FX Cross Rate, February 20(see more posts on EUR/CHF, ) Source: markets.ft.com - Click to enlarge SNB sight deposits An increase in SNB sight deposits means that the central bank has intervened. Last week’s data: Once again a massive SNB intervention and a post Trump election record: 4.5 billion CHF at a EUR rate of 1.0648.

Topics:

George Dorgan considers the following as important: currency reserves. intervention, Featured, minimum reserves, monetary data, negative interest, newsletter, Reserves, sight deposits, SNB

This could be interesting, too:

investrends.ch writes SNB schreibt 2025 definitiven Gewinn von 26,1 Mrd Franken

investrends.ch writes Der Franken und die Grenzen der Geldpolitik

investrends.ch writes UBS-Prognose: Dollar tendiert seitwärts – Euro steigert sich

investrends.ch writes SNB passt Verzinsung von Sichtguthaben erneut nach unten an

Headlines Week February 20, 2017

Recently inflation rose more quickly in the euro zone, but this was mostly caused by a temporary oil price effect. Therefore the ECB might be dovish for a longer period than the SNB. Consumer price inflation will decide who is more dovish. Ultimately inflation will depend on the two key parameters wages and rents. Rents will rise first in Switzerland, while the Euro zone has downwards pressures in the Southern countries. Wage pressures are weak in both. Wages are increasing more strongly only in Germany and Eastern European countries. FX week until February 20 The EUR/CHF fell to new lows. The average rate in the week was 1.0648. The SNB is apparently ready to let the pair slowly descend. A big Swiss bank bets on EUR/CHF 1.10 as soon as the ECB ends their bond buying program. But to our view EUR/CHF will touch parity first, because it will take at least 2-3 years until the ECB normalizes rates. |

Euro/Swiss Franc FX Cross Rate, February 20(see more posts on EUR/CHF, ) Source: markets.ft.com - Click to enlarge |

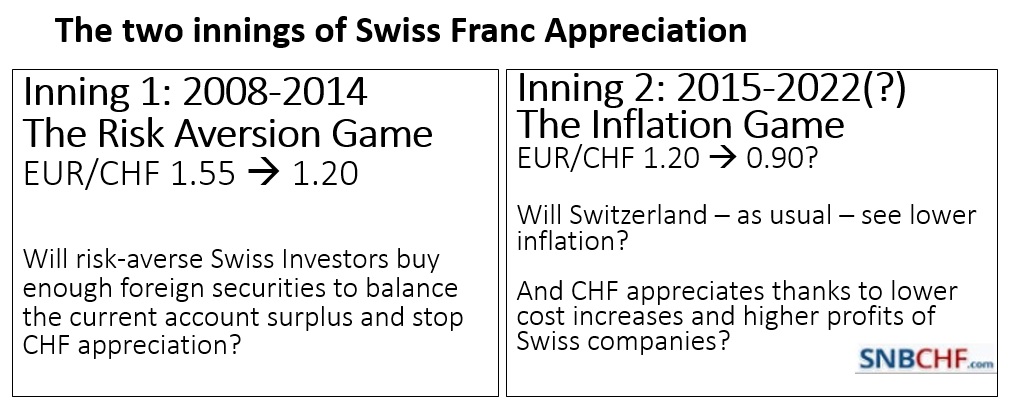

SNB sight depositsAn increase in SNB sight deposits means that the central bank has intervened. Last week’s data: Once again a massive SNB intervention and a post Trump election record: 4.5 billion CHF at a EUR rate of 1.0648. We should remind that this is clearly higher than the 0.90 that we expect in a couple of years. |

Change in SNB Sight Deposits January 2017(see more posts on sight deposits, ) Source: SNB - Click to enlarge Two Innings of Swiss Franc Appreciation |

Speculative PositionsSpeculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts.The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The reverse carry trade in form of the Long CHF started and lasted - without some interruptions - until the peg introduction in September 2011. In mid 2011, the long CHF trade became a proper carry trade - and not a reverse carry trade anymore - because investors thought that the SNB would hike rates earlier than the Fed. Last week’s data: Speculators increased their EUR net short position against the dollar, but lowered their CHF net shorts (vs. USD). This tendency confirms our view that EUR/CHF will move towards parity (if the SNB does not object…). |

Speculative Positions

source Oanda |

| Date of data (+ link to source) | avg. EUR/CHF during period | avg. EUR/USD during period | Events | Net Speculative CFTC Position CHF against USD | Delta sight deposits if >0 then SNB intervention | Total Sight Deposits | Sight Deposits @SNB from Swiss banks | “Other Sight Deposits” @SNB (other than Swiss banks) |

|---|---|---|---|---|---|---|---|---|

| 17 February | 1.0648 | 1.0613 | Improving Swiss consumer climate | -11484X125K | +4.5 bn. per week | 543.5 bn. | 468.0 bn. | 75.5 bn. |

| 10 February | 1.0659 | 1.0685 | Good US jobs report. | -14621X125K | +3.8 bn. per week |

539.0 bn.

|

464.5 bn.

|

74.5 bn.

|

| 03 February | 1.0681 | 1.0761 | US creates 227K new jobs. | -17140X125K | +2.4 bn. per week |

535.2 bn.

|

462.3 bn.

|

72.2 bn.

|

| 27 January | 1.0718 | 1.0725 | US Q4 GDP only +1.9% | -13644X125K | +0.5 bn. per week |

532.8 bn.

|

466.7 bn.

|

66.1 bn.

|

| 20 January | 1.0726 | 1.0663 | USD correction continues. | -13683X125K | +0.9 bn. per week | 532.3 bn. | 464.3 bn. | 68.0 bn. |

| 13 January | 1.0733 | 1.0593 | Fed meeting, USD correcting | -14246X125K | +1.7 bn. per week |

531.4 bn.

|

464.2 bn.

|

67.2 bn.

|

| 06 January | 1.0708 | 1.0499 | Good U.S. jobs report. | -13439X125K | +0.7 bn. per week |

529.7 bn.

|

467.6 bn.

|

62.1 bn.

|

For the full background of sight deposits and speculative positions see

SNB Sight Deposits and CHF Speculative Positions

Tags: currency reserves. intervention,Featured,minimum reserves,monetary data,negative interest,newsletter,Reserves,sight deposits