I don’t think Milton Friedman would have made much of chess player. For all I know he might have been a grand master or something close to that rank, but as much as his work is admirable it invites too the whole range of opposite emotion. He was the champion libertarian of the free market who rescued economics from the ravages of New Deal socialism, but in doing so he simply created the avenue for where Economics of...

Read More »How The US Government Let A Giant Bank Pin A Scandal On A Former Employee

The following is an excerpt from David Enrich’s nonfiction financial and legal thriller The Spider Network: The Wild Story of a Math Genius, a Gang of Backstabbing Bankers, and One of the Greatest Scams in Financial History. (Read part of the prologue here; another excerpt can be found here) This excerpt takes place shortly after the accused mastermind of the Libor scandal, Tom Hayes, is fired from his job at...

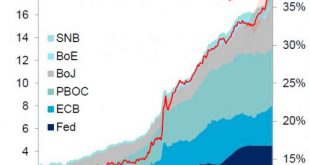

Read More »A Problem Emerges: Central Banks Injected A Record $1 Trillion In 2017… It’s Not Enough

Two weeks ago Bank of America caused a stir when it calculated that central banks (mostly the ECB & BoJ) have bought $1 trillion of financial assets just in the first four months of 2017, which amounts to $3.6 trillion annualized, “the largest CB buying on record.” Aggregate Balance Sheet Of Large Central Banks, 2000 - 2017 - Click to enlarge BofA’s Michael Hartnett noted that supersized central bank...

Read More »FX Daily, May 11: Canadian and New Zealand Dollars Get Whacked, While Greenback Consolidates

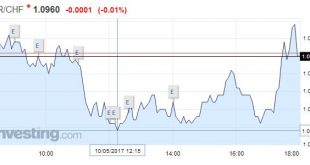

Swiss Franc Switzerland Consumer Price Index (CPI) YoY, April 2017(see more posts on Switzerland Consumer Price Index, ) Source: investing.com - Click to enlarge FX Rates The US dollar has been mostly confined to about a 30 pip range against the euro and yen in Asia and the European morning. Sterling is under a little pressure after a series of poor data, including larger than expected falls in manufacturing and...

Read More »Well connected: why the Swiss did well in Universitas 21

Study in Switzerland – it’s high ranked Switzerland has the second best higher education system in the world, according to the 2017 Universitas 21 report, just below the United States. Is it just resources or is there another factor in play? The small alpine nation was ahead of the United Kingdom (ranked third) and its near neighbours in the classification of 50 countries, compiled by the Universitas 21external link...

Read More »Swiss alleged to have spied inside German tax office

Espionage has inflamed a tax row between Germany and Switzerland (Keystone) German investigators believe a mole spied for the Swiss intelligence service inside a German tax office, which was trying to catch German tax dodgers. On Thursday, Swiss and German media published new details surrounding the case of an alleged Swiss spy arrested last week for industrial espionage in Frankfurt. Swiss public television, SRF, which...

Read More »Noose Or Ratchet

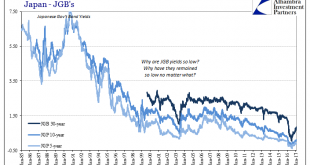

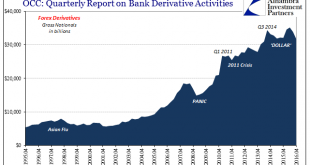

Closing the book on Q4 2016 balance sheet capacity is to review essentially forex volumes. The eurodollar system over the last ten years has turned far more in this direction in addition to it becoming more Asian/Japanese. In fact, the two really go hand in hand given the native situation of Japanese banks. As expected, data compiled by the Office of Comptroller of the Currency (OCC) shows the same negative tendencies...

Read More »Swiss Consumer Price Index in April 2017: Up +0.4 percent against 2016, +0.2 percent against last month

The consumer price index (IPC) increased by 0.2% in April 2017 compared with the previous month, reaching 100.9 points (December 2015=100). Inflation was 0.4% compared with the same month the previous year. These are the results of the Federal Statistical Office (FSO). Switzerland Consumer Price Index (CPI) YoY, April 2017(see more posts on Switzerland Consumer Price Index, ) Source: investing.com - Click to enlarge...

Read More »Weekly SNB Interventions and Speculative Positions: After French Elections

Headlines Week May 08, 2017 The centre-left politician Macron has won the French elections. He is a politician that – similar to Hollande four years ago – promises economic improvements, more investment, more jobs. As opposed to Hollande, he also advocates limitations on salaries and less social protection for workers, to restore France’s competitiveness. Mostly probably he will fail similar to his predecessor because...

Read More »FX Daily, May 10: Markets Adjust to North Korean Threat, Fifth Fall in US Oil Inventories and Trump Drama

Swiss Franc EUR/CHF - Euro Swiss Franc, May 10(see more posts on EUR/CHF, ) - Click to enlarge FX Rates Investors absorbed a few developments that might have been disruptive for the markets with little fanfare. North Korea’s ambassador to the UK warned that his country would go ahead with its sixth nuclear test, as South Korea elected a new president who wants to reduce tensions on the peninsula. The Dollar...

Read More » SNB & CHF

SNB & CHF