"V" welcomes back Charles for an in-depth discussion regarding Charles's blogs: TINA's Legacy: Free Money, Bread and Circuses and Collapse, How Higher Education Became an Obscenely Profitable Racket That Enriches the Few at the Expense of the Many (Student Debt-Serfs) and Want to Understand Rising Wealth Inequality? Look at Debt and Interest. Charles's website: http://www.oftwominds.com/ We are political scientists, editorial engineers, and radio show developers drawn together by a shared...

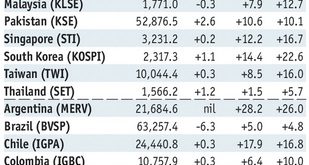

Read More »Emerging Markets: What has Changed

Summary Moody’s downgraded China’s rating from Aa3 to A1 with stable outlook. Reports suggest that the PBOC has informed local banks that it is changing the way it sets the daily fix. Moody’s downgraded Hong Kong’s rating to Aa2 from Aa1 with stable outlook. Philippine President Duterte declared martial law on Mindanao island. Egypt’s central bank unexpectedly hiked rates by 200 bp. S&P moved the outlook on...

Read More »Moving Closer to the Precipice

Money Supply and Credit Growth Continue to Falter The decline in the growth rate of the broad US money supply measure TMS-2 that started last November continues, but the momentum of the decline has slowed last month (TMS = “true money supply”). The data were recently updated to the end of April, as of which the year-on-year growth rate of TMS-2 is clocking in at 6.05%, a slight decrease from the 6.12% growth rate...

Read More »Swiss working conditions slip

The Swiss spend three hours more per week on average at the office than other Europeans, but working conditions are still good. (Keystone) While the overall health and well-being of Swiss employees is still good, a new survey shows that Switzerland has lost its place ahead of 34 other European countries when it comes to stress and autonomy in the workplace. In 2005, survey answers from Swiss employees on their working...

Read More »New LafargeHolcim CEO given market approval

Jenisch has driven performance under difficult circumstances at Sika - Click to enlarge The markets have welcomed Lafarge Holcim’s choice of chief executive to guide the company out of a reputational hole. Jan Jenisch, who will take over in October, has experienced difficult situations having spent the last two and a half years driving up Sika’s results against the backdrop of a shareholder civil war. Investors...

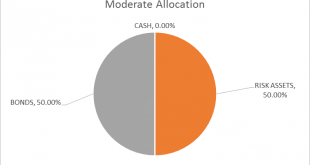

Read More »Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are, however, changes within the asset classes. We are reducing the equity allocation and raising the allocation to REITs. Based on the bond markets there has been little change in the growth and inflation outlook since the last asset allocation update. Based on...

Read More »FX Daily, May 26: Anxiety Levels Rise Ahead of Weekend

Swiss Franc The Euro has fallen by 0.01% to 1.0902 CHF. EUR/CHF - Euro Swiss Franc, May 26(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The markets are unsettled. It is not so much in the magnitude of moves as the breadth of the move. The nearly 1% rally in gold is a tell, but also the inability of equity market to follow the lead of the US markets, where the S&P 500 and NASDAQ set new records. US...

Read More »Poor not being pushed out of Swiss cities

Central Zurich – © Andreas Zerndl | Dreamstime.com It is widely believed that as the price of real estate climbs those on low incomes are forced out of city centres. A study by the University of Geneva, commissioned by the Swiss Federal Statistical Office focused on the period between 2010 and 2014, shows this is not true in Switzerland. Rich leaving the centres Those earning the most were the most likely to move and...

Read More »Great Graphic: OIl and the S&P 500

The first Great Graphic (created on Bloomberg) here shows the rolling 60-day correlation of the level of the S&P and the level of oil since the beginning of last year. In early 2016, the correlation was almost perfect, but steadily fell and spend a good part of the second half of the year negatively correlated. Late in the year, the correlation began recovering, and February reached almost 0.8. However, a month...

Read More »New Gold Pool at the BIS Basle: Part 2 – Pool vs Gold for Oil

This is Part 2 of a two-part series. The series focuses on collusive discussions and meetings that took place between the world’s most powerful central bankers in late 1979 and 1980 in an attempt to launch a central bank Gold Pool cartel to manipulate and control the free market price of gold. The meetings centered around the Bank for International Settlements (BIS) in Basle, Switzerland. Part 2 takes up where Part 1...

Read More » SNB & CHF

SNB & CHF