Authored by Kevin Muir via The Macro Tourist blog, After many months of fighting all the naysayers predicting the next big stock market crash, I am finally succumbing to the seductive story of the dark side, and getting negative on equities. I am often early, so maybe this means the rally is about to accelerate to the upside. I am willing to take that chance. It would be just like me to pound the table on the long side,...

Read More »FX Daily, June 16: Dollar Slips In Consolidation, but Extends Recovery Against the Yen

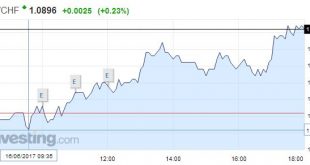

Swiss Franc The euro has appreciated by 0.23% to 1.0896 CHF. EUR/CHF - Euro Swiss Franc(see more posts on EUR/CHF, ) - Click to enlarge FX Rates As the market heads into the weekend, the US dollar is trading softer as it consolidates. It is within yesterday’s ranges against the major currencies but the Japanese yen. The dollar has made a dramatic recovery against the yen. It traded near JPY108.80 in the middle of...

Read More »Swiss state pension fund stops investing in arms firms

Cluster bombs are reviled for their indiscriminate effect and potential to kill and maim people if unexploded - Click to enlarge The leading Swiss state pension fund, Publica, has announced that it plans to disinvest from five weapons companies. This follows a national campaign by a responsible investment pension group to blacklist 15 international arms firms. According to a report by Swiss public radio, SRF, Publica,...

Read More »Great Graphic: Sticky Pass Through

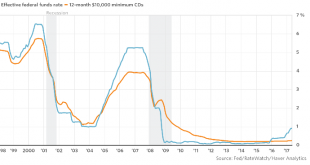

This Great Graphic was posted by Steve Goldstein at MarketWatch. The blue line shows the effective Fed funds rate. The orange line depicts the average interest rate on a $10,000 one-year CD. The Fed funds target rate has risen, but the rate of the average yield of the certificate of deposit has not risen. It is at 25 bp, an increase of five basis points over the past four years. Goldstein documents other evidence that...

Read More »Europe’s Non-linear

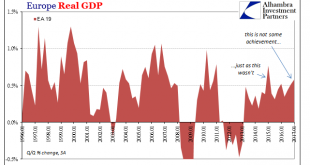

Europe is as we all are. Ben Bernanke wrote a few years ago that his tenure at the Fed must have been a success in his view because the US economy didn’t perform as badly as Europe’s. As usual, this technically true comparison is for any meaningful purpose irrelevant. For one, the European economy underperformed before 2008, too. Second, after 2008, really August 9, 2007, there isn’t nearly as much difference as...

Read More »Parabolic Coin

The Crypto-Bubble – A Speculator’s Dream in Cyberspace When writing an article about the recent move in bitcoin, one should probably not begin by preparing the chart images. Chances are one will have to do it all over again. It is a bit like ordering a cup of coffee in Weimar Germany in early November 1923. One had to pay for it right away, as a cup costing one wheelbarrow of Reichsmark may well end up costing two...

Read More »News conference Swiss National Bank, Thomas Jordan

Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank News conference of the Swiss National Bank, Berne, 16.06.2016 Thomas Jordan - Click to enlarge Introductory remarks by Thomas Jordan Ladies and gentlemen It is a pleasure for me to welcome you to the Swiss National Bank’s news conference. I will begin by explaining our monetary policy decision and our assessment of the economic situation. I will...

Read More »SNB Monetary Policy Assessment June 2017 and Comments

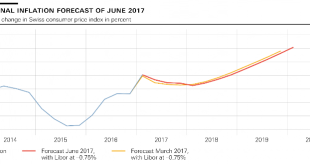

Swiss National Bank leaves expansionary monetary policy unchanged The Swiss National Bank (SNB) is maintaining its expansionary monetary policy, with the aim of stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB is to remain at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign...

Read More »News conference Swiss National Bank 2017, Fritz Zurbrügg

Fritz Zurbrügg, Vice Chairman of the Governing Board of the Swiss National Bank News conference of the Swiss National Bank, Berne, 15.06.2017 Fritz Zurbrugg - Click to enlarge Introductory remarks by Fritz Zurbrügg In my remarks today, I will present the key findings from this year’s Financial Stability Report, published by the Swiss National Bank this morning. In the first part of my speech, I will look at the...

Read More »Andréa M. Maechler: Introductory remarks, news conference

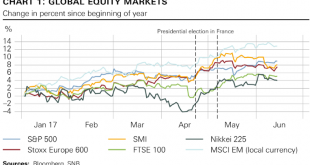

Andréa M. Maechler, Member of the Governing Board of the Swiss National Bank News conference of the Swiss National Bank, Berne, 15.06.2017 Complete text: PDF (478 KB) I will begin by reviewing the situation on the international financial markets. I will then address some developments on the Swiss money and foreign exchange markets – specifically the establishment of SARON as the leading reference rate for interest rate...

Read More » SNB & CHF

SNB & CHF