Summary: Light economic calendar in the week ahead, but anticipation of US tax reform may underpin dollar and equities. European politics are in flux (France, Italy, Greece) and this may see spreads widen over Germany. Russia’s outlook was upgraded by Moody’s before the weekend, and China has announced no coal imports this year from North Korea. Brazil is expected to cut Selic by 75 bps. The week ahead is short on economic data and long on anticipation. It could make for some choppy price action. The dollar’s uptrend of the first part of the month yielded to corrective forces last week, though the greenback finished the week on a firm note. Even among dollar bulls, the near-term outlook for the dollar is not clear. However, many, including ourselves, remain bullish over the medium-term. President Trump is expected to provide details of his tax plan when he addresses both houses of Congress at the end of the month. Remember, many economists has argued that the border adjustment would “automatically” send the dollar sharply higher. Also, lowering corporate tax schedules may get the headlines, but it is the effective tax rate that is key.

Topics:

Marc Chandler considers the following as important: AUD, Brazil, CAD, EUR, Featured, FX Trends, JPY, newsletter, Russia, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary:

Light economic calendar in the week ahead, but anticipation of US tax reform may underpin dollar and equities.

European politics are in flux (France, Italy, Greece) and this may see spreads widen over Germany.

Russia’s outlook was upgraded by Moody’s before the weekend, and China has announced no coal imports this year from North Korea. Brazil is expected to cut Selic by 75 bps.

The week ahead is short on economic data and long on anticipation. It could make for some choppy price action. The dollar’s uptrend of the first part of the month yielded to corrective forces last week, though the greenback finished the week on a firm note. Even among dollar bulls, the near-term outlook for the dollar is not clear. However, many, including ourselves, remain bullish over the medium-term.

President Trump is expected to provide details of his tax plan when he addresses both houses of Congress at the end of the month. Remember, many economists has argued that the border adjustment would “automatically” send the dollar sharply higher. Also, lowering corporate tax schedules may get the headlines, but it is the effective tax rate that is key. Will loopholes by closed? Will it be revenue neutral, as scored by nonpartisans such as the Congressional Budget Office (CBO)? Will debt servicing remain tax deductible?

We are persuaded that the reason that capital expenditures are not more robust is not that interest rates are too high or that businesses do not have access to capital. Therefore, even if tax reform boosted after-tax profits, it would not necessarily boost investment or growth or employment. It would more likely boost returns to shareholders by funding share buyback programs and dividend payouts.

United StatesThe US President bemoans the poor economy he inherited. The New York Fed’s GDP tracker see Q1 growth a little more than 3%, while the Atlanta Fed’s model is a little below 2.5%. The point is that after a little disappointment in Q4 16, when the US economy appears to have grown at what the Fed regards as the sustainable pace (~1.8%), the economy appears to have re-accelerated. Practically every economic report last week, including consumer prices, retail sales, and industrial production, and the Empire and Philly February surveys, were above expectations. The Fed’s leadership–Yellen, Fischer, and Dudley–sounded increasingly confident about the trajectory of the economy and prices. While a March hike may seem soon, but May is looking particularly interesting. As we have argued, the Fed is a bit hamstrung by its own transparency measures. It has regularly scheduled quarterly press conferences, which are used to explain policy and policy views (economic projections). In effect, this halves the number of “live” meetings to four. As the pace of normalization is poised to accelerate, it is clearly in the Fed’s interest to re-animate, as it were, the other half. To do so requires the Fed to raise raises at a non-quarterly meeting, and May is next to such opportunity. Others are drawing the same conclusion from the Fed’s comments, especially Yellen’s testimony. Last week, the implied yield on the March Fed funds futures contract ticked up one basis point to 0.69% yield. The implied yield on the May contract rose 3.5 bp to 0.785%. The June contract’s implied yield rose three basis points to 0.85%. Some caution that the market has a Fed hike and tax reform discounted. Short-term positioning, they argue, is already extremely long dollars. While some tax reform may indeed be anticipated, and Yellen acknowledged that the anticipation of fiscal stimulus might be helping elevate equity prices, remember the argument is that due to the economic identities and purchasing power parity that the dollar will rise to offset the border tax (20%-25%). Clearly, with the dollar down against all the major currencies so far this year, it is hard to say tax reform is fully reflected in current prices. It is true that one hike in H1 17 has been largely discounted. A second has also been priced into the strip, but the market is pricing in about a one in four chance of a third hike. This has room to adjust. And the speculative market does not appear to be extremely long dollars. The latest CFTC Commitment of Traders report that covers through February 14, show the net short euros to be near seven-month lows, and the speculative participants are short US dollars against the Canadian, Australian and New Zealand dollars. In fact, the speculators in the futures have not had such a large net long Canadian dollar position in five months. The net long speculative position in Australian dollars is the largest in more than two months. Since the end of last year, speculators have cut the net short yen positions by a third. The FOMC minutes release is the highlight for the US this week. After the Yellen’s recent testimony and comments from various other officials, it the minutes is unlikely to add much to the already available information set. It may be interesting to see how the Fed’s balance sheet was discussed and the preliminary thinking about fiscal policy initiatives. Yellen batted away concerns that Dodd-Frank was inhibiting lending and bank profitability. She pointed to the dramatic increase in commercial and industry loans and the health of US banks both in absolute terms and about other countries that did not impose it (like European banks). Dodd-Frank may eventually be treated like the Affordable Care Act. Rather than dismantling it and replacing it, much of which requires 60 votes in the Senate vs. the 54 held by Republicans), relaxing the discretionary enforcement, some repealing, some modifying or replacing, but when all is said and done, much will also likely remain. |

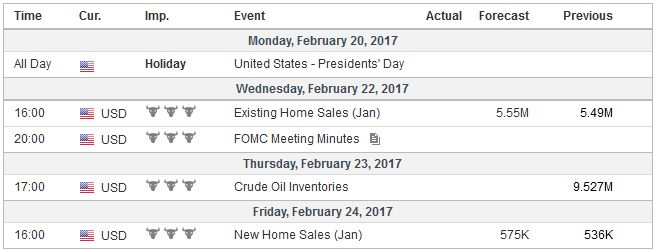

Economic Events: United States, Week February 20 |

EurozoneEuropean politics remains very much in the fore. However, it is a work in progress, and it is too early to expect an end game. Even the finance ministers meeting to start the week is unlikely to resolve matters with Greece. Greece does not need funds until July. One of the rules of brinkmanship is that has to go to the brink. The key issue now is whether the IMF capitulates, contribute funds and agrees that Greece needs to achieve a 3.5% primary budget surplus next year, or whether Germany (and the Netherlands) accept that Greece is a European problem that Europe can and should address without the IMF’s money (but perhaps with its expertise).A Reuters report at the end of last week suggested the former, while other reports pointed to some softening of the German stance on the necessity of the IMF. Just as many investors began feeling more comfortable with French politics, reflected in the 10-year spread narrowing from 77 bp on February 6 to 66 bp on February 16, a new twist to the drama unfolding. There was an initiative to run a united left ticket, the Socialists, to be led by its left-wing candidate Hamon, the former Socialist, Melenchon’s faction and, the Greens, under Jadot’s leadership. Such a coalition is seen taking votes away from Macron, who had moved into second as Fillion is snarled in a scandal. A left candidate running against Le Pen would give the National Front its best chance of winning the second round. The prospects spooked investors, and the premium widened again. The 10-year spread rose back to 73 bp before the weekend. The two-year premium rose to 32 bp, the highest since the mid-2013. It stood at 11 bp at the end of 2016. The simmering political drama in Italy may also be taking a turn. Former Prime Minister Renzi stepped down as the head of the center-left PD, which sets up a formal leadership context, probably in April or May. It would seem to reduce the chances of an early election. Parliament’s term ends in February 2018. There is still risk that the left-wing of the PD splits off to form their own party, although polls suggest it would not do well in an election. Estimates suggest, such a schism could see a score of Deputies and a dozen Senators leave. It could weaken the current PD government and work to the benefit of the 5-Star Movement, which is having its difficulties in governing the city of Rome where it had won a local election last spring. |

Economic Events: Eurozone, Week February 20 |

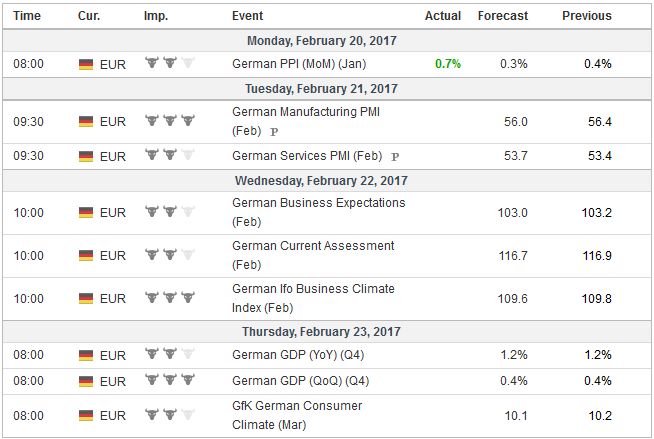

GermanyIn contrast to the political drama, the economic impulses have told a story of steady growth and prices (excluding energy). Markit will report the preliminary February PMIs. The composite is expected to ease slightly to 54.3 (from 54.4). To put it in perspective, consider that the three-month average is 54.2 and the six-month average is 53.6. The 12-month average is 53.3. It is the picture of slow and steady improvement. The January reading of 54.4 was the highest since the time series began in early 2014. Similarly, quarterly GDP has averaged roughly 0.4% a quarter for the past four, eight, and 12 quarters. |

Economic Events: Germany, Week February 20 |

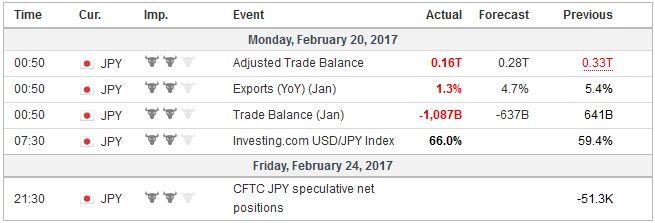

JapanJapan reports its January trade balance.For over two decades, Japan’s January balance always deteriorates from December. The median guesstimate in the Bloomberg survey for a deficit of JPY626 bln after a JPY648 bln deficit in January 2015, and a December 2015 surplus of JPY641 bln. Despite the powerful seasonal factors, the underlying signal, that trade is improving, that imports and exports are improving, is likely to be sustained. Imports, which have been contracting on a year-over-year basis since the start of 2015 have begun recovering and may have moved into positive ground in January. Exports had been negative since Q4 2015 but turned positive in December 2016, and likely remained around 5% in January. |

Economic Events: Japan, Week February 20 |

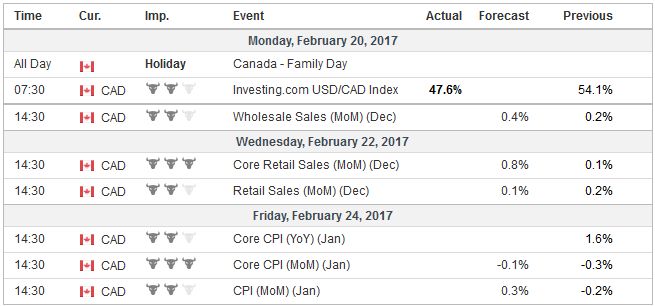

CanadaCanada reports retail sales and consumer prices in the days ahead.Weak auto sales are expected to have flattened the headline to zero after a 0.2% increase in November. However, excluding auto, Canadian retail sales may have risen 0.6% after an unchanged report in November. Recall that Canada had also had strong jobs growth in December, and this may warn of upside risks. Consumer prices likely rose in January. The median expectation is for a 0.4% increase, which due to the base effect would lift the year-over-year rate to 1.6% from 1.5%. |

Economic Events: Canada, Week February 20 |

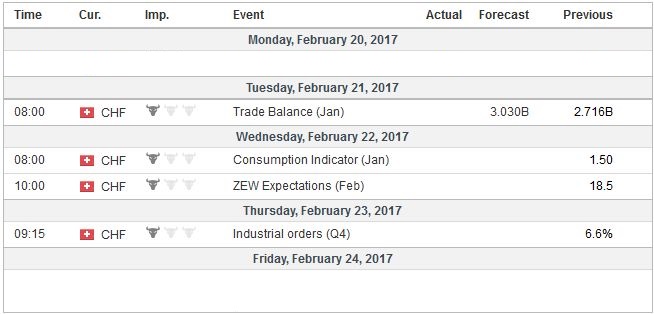

Switzerland |

Economic Events: Switzerland, Week February 20 |

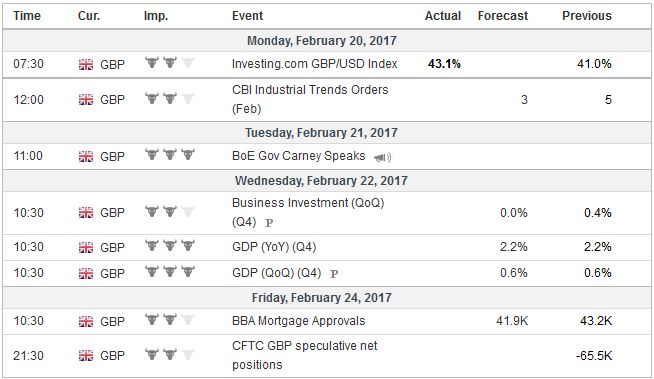

United Kingdom |

Economic Events: United Kingdom, Week February 20 |

China

China unexpectedly announced that it would not purchase coal from North Korea this year. This was understood as a sign of Beijing’s increasing frustration with the regime after the latest test of an intermediate range missile and the assassination of Kim Jong Nam, the half-brother of Kim Jong Un. Coal exports to China are thought to be North Korea’s largest export. China’s move will intensify the economic pressure on North Korea. North Korea’s missile tests have justified the establishment of a missile defense system in South Korea that also can, of course, be directed at others in the region, including China. China’s move may also be seen implementing the UN agreement, and is consistent with a political and economic solution. Some may see it as an overture to the new US Administration, and underscores another potential area where cooperation between the US and China can be helpful.

With rising terms of trade, the long-term decline in business investment in Australia should be winding down. With a few exceptions, capex has been contracting since the second half of 2012. The 20-quarter average (five years) fell into negative territory in Q2 16. The decline in the eight-quarter average (two years) has accelerated to stand atminus4.3%. It has been negative since Q1 15. The median forecast is for a 0.5% decline in Q4 16 after a 4% decline in Q3 16. A weaker report could fan speculation of a rate cut in Q2 and reinforce the cap for the Australian dollar near $0.7700.

We note that Moody’s upgraded its outlook for Russian credit to stable. The Ba1 rating is one step below investment grade, but if Russia continues its fiscal consolidation, oil prices stay firm, and the economy continues to emerge from an almost two-year recession, investment grade status may be possible later this year. Russia’s 5-year CDS finished last week near 1.82%, which is just below Italy’s CDS (1.87%). The ruble has appreciated 4.8% this year, tying it with the Taiwan dollar for fourth place among emerging market currencies.

Last year, the ruble’s gain of 20.1% put it in second place behind the Brazilian real, which rose nearly 21%. Brazil’s easing cycle is expected to take another step. The Selic is expected to be cut by another 75 bp to bring it to 12.25%. It peaked at 14.25%, and this would be the fourth move in the cycle. Inflation has fallen much faster. It has been halved. Since shortly after the US election last November, the dollar has fallen nearly 13.5% against the Brazilian real. On February 16 a potential reversal pattern was recorded. Initial resistance is seen in the BRL3.10-BRL3.15 band.

Tags: #USD,$AUD,$CAD,$EUR,$JPY,Brazil,Featured,newsletter,Russia