The latest non-farm payroll report is unlikely to make the Fed deviate from plans for policy normalisation.All in all, today’s employment report was healthy. In the end, job creation was actually quite robust overall in Q2, ‘aggregate weekly payrolls’ rose strongly q-o-q, and if unemployment rebounded a little in June, it was only because of higher participation, not a lack of employment growth. However, once again, wage data brought some disappointment, with average hourly earnings increasing by less than expected in June, although we continue to expect wage increases in the US to gradually pick up over the coming quarters.We are not modifying our scenario for US economic growth and monetary policy in light of the latest statistics. Our forecast for US GDP growth of 2.7% q-o-q annualised

Read More »Articles by Bernard Lambert

U.S. consumer spending picks up, but inflation is still soft

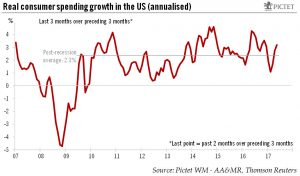

June 30, 2017Just-released figures lead us to revise our forecasts for US spending and inflation.Real consumer spending increased by just 0.1% month-on-month in May. However, Q1 and April consumption figures were revised higher. The overall result was that between Q1 and April-May, US personal consumption grew by a strong 3.2% annualised. The strong bounce back in consumption growth expected has been confirmed, so that our forecast of 2.7% growth in consumer spending for Q2 overall now looks too low. We are therefore revising it up to 3.0%.The third estimate for Q1 GDP was published this week: GDP growth was revised up from 1.2% q-o-q annualised to 1.4%, whereas consensus expectations had been for the numbers to remain unchanged. Higher consumer spending and exports were partly offset by lower

Read More »Fed on the road to normalisation, People’s Bank of China stands pat

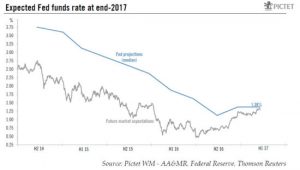

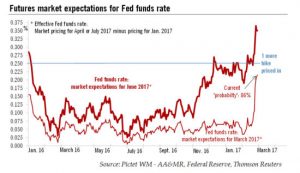

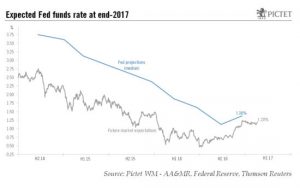

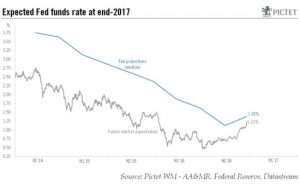

June 15, 2017The Fed is on track to hike rates once more in 2017, with balance-sheet reduction later this year set to tighten policy further. China’s PBoC is taking a relaxed view of the Fed’s policy changes.As was widely expected, the Federal Reserve decided at latest policy meeting on June 14 to raise the Fed funds rate target range by 25bp to 1.0%-1.25%. The Fed appeared relatively upbeat on the economy, downplayed the recent weakness in inflation numbers and left unchanged its median projections for Fed funds rates–one more quarter-point hike in H2 2017 and three additional hikes in 2018. These projections are well above market expectations, but are in line with our own expectations for rate policy this year and next.However, we now expect that the Fed will announce the beginning of its balance

Read More »U.S. job creation softens, but unemployment lowest in 16 years

June 2, 2017The May nonfarm payroll report was mixed, but still unlikely to modify the case for a Fed hike this month. We still expect the Fed to raise rates twice more this year (in June and September).May was a mixed month for US employment data. Job creation was softer than expected, the figures for the previous couple of months were revised down and average hourly earnings data were somewhat disappointing. However, the unemployment rate unexpectedly fell further, reaching its lowest level since March 2001.Non-farm payroll employment rose by a soft 138,000 month-on-month in May, below consensus expectations. Moreover, figures for March and April were revised down by a cumulative 66,000. Unexpectedly, the US unemployment rate fell further, from 4.4% in April to 4.3% in May, and is now even further

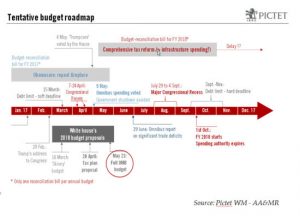

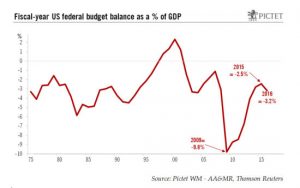

Read More »Trump’s proposed budget is light on details

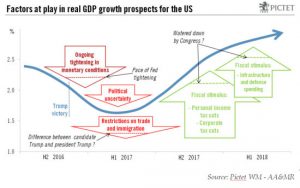

May 24, 2017Heavy on spending cuts, but containing dubious revenue calculations, the president’s budget plan is unlikely to be adopted by Congress. But we still expect tax cuts by year’s end.President Trump’s budget request was issued yesterday. Higher defence and infrastructure spending are proposed, more than compensated for by drastic cuts in other spending. The consequence is that total outlays are reduced dramatically.On the revenue side, the budget plan was very short on details. It assumes that tax cuts will be neutral for the deficit. And it seems the positive effect of the ‘economic feedback’ was actually counted twice. Moreover, the economic assumptions are very optimistic.GDP growth is supposed to average 2.9% between 2017 and 2027. Given the deep cuts in federal spending envisaged, the tax cuts would need to be massive to push growth up to those levels. And with the economy close to full employment and with potential US growth estimated to be around 1.8% currently (and unlikely to accelerate rapidly), the Fed is certain to react aggressively to avoid overheating. In short, it is hard to imagine that the kind of growth outlined in the White House budget can be achieved, particularly with a restrictive immigration policy.

Read More »U.S. consumer spending showing signs of rebound

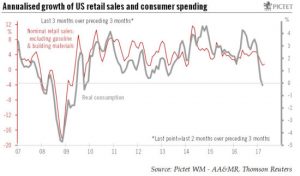

May 12, 2017After a weak first quarter, consumer spending in the US is showing healthier signs. We remain upbeat about prospects for the rest of this year too.Core retail sales in the US rose by 0.2% m-o-m in April, below consensus expectations (+0.4%). However, retail sales for March were revised up by 0.2%.The result was that between Q1 and April, nominal core retail sales grew by a healthy 3.6% annualised, following an increase of 3.5% q-o-q in Q1 and 3.1% in Q4 2016. However, although up month on month (m-o-m) in April, car sales still contracted between Q1 and April.Nevertheless, the marked decline in car sales witnessed in Q1 is unlikely to be repeated in Q2, consumption of utilities is rebounding sharply and, following a strong rise in Q1, gasoline prices are falling back again.Together with reasonably upbeat core retail sales, these elements support the view that Q1’s near-stagnation in consumer spending will be followed by solid growth in Q2 (to a rate of around 2.7% q-o-q annualised in our view). And we remain upbeat on consumer spending in the second half of 2017 as well.

Read More »US unemployment falls to fresh cyclical low

May 5, 2017US average hourly earnings data were slightly disappointing in April, but the non-farm payroll figure was robust and the unemployment rate continued to decline.Non-farm payroll employment rose by a solid 211,000 in April, above consensus expectations.Unexpectedly, the US unemployment rate continued to fall from 4.5% in March to 4.4% in April, and is now significantly below the Fed’s median estimate for full employment (4.8%).However, wage data were somewhat disappointing, with the pace of hourly wage growth falling from a downwardly revised 2.6% in March to 2.5% in April while the strength of job creation last month is partly due to unusually warm weather and followed a soft reading for March.All in all, today’s employment report was upbeat. Admittedly, average hourly earnings disappointed somewhat, but job creation remains basically healthy. In our view, this rosy picture reinforces the probability that the Fed will hike rates in June.We are not modifying our scenario for US economic growth and monetary policy in light of the latest statistics. Our forecast that US GDP will grow by 2.7% q-o-q annualised in Q2 remains unchanged, as do our projections for yearly average growth of 2.0% in 2017.

Read More »US economic prospects look good

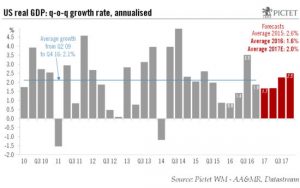

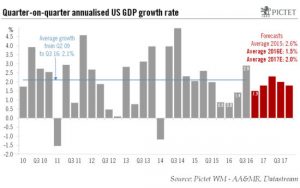

April 28, 2017After soft GDP in first quarter, we expect a significant rebound in the current quarter. The underlying strength of the US economy remains intact.US GDP growth decelerated from 2.8% in H2 2016 to 0.7% quarter on quarter (q-o-q) annualised in Q1, slightly below consensus expectations (1.0%). However, this weak reading is mainly due to statistical anomalies (growth tends to be lower in Q1) and transitory factors that weighed on consumer spending and stockbuilding. However, fixed investment growth picked up encouragingly. More generally, with improving world growth, supportive overall financial conditions in the US, upbeat forward indicators on fixed investment and the prospect of some fiscal stimulus next year, we remain confident on prospects for US economic growth. In Q2, consumer spending growth should bounce back sharply, fixed investment growth is likely to remain strong and the pace of stockbuilding should recover. We therefore expect GDP growth to recover to 2.7% q-o-q annualised in Q2.Turning to H2, some important fundamental factors should continue to support demand. World demand is improving at last, the trade-weighted dollar has fallen back sharply over the past few months and overall financial conditions appear quite supportive.

Read More »Markets react well to Fed hike

March 16, 2017Financial conditions remain accommodative, perhaps setting the stage for next hike in June.In line with what almost every forecaster was expecting, the Federal Open Market Committee (FOMC) decided at its latest policy meeting to raise the Fed funds rate target range by 25bp to 0.75%-1.0%. Fed Chair Janet Yellen explained that the decision to raise rates was appropriate “in light of the economy’s solid progress toward our goals of maximum employment and price stability“. Financial markets reacted surprisingly well to the announcement, and broad financial conditions didn’t actually tighten. Indeed, stocks rose, long-term rates fell and the dollar –on a broad trade-weighted basis – depreciated by almost 1.0% on the news.As far as the economic situation is concerned, hardly surprisingly, the Fed sounded slightly more upbeat then before, notably on inflation. However, it also modified its statement to highlight that its inflation target was symmetric, which seems to have interpreted in a dovish way by the market. Overall, there were only modest changes in the wording of the statement compared to the previous one, with the Fed repeating the mantra that rate hikes should be gradual. In sum, the statement was probably less hawkish than expected. Changes in the FOMC’s economic projections were pretty minimal.

Read More »Healthy job reports open the way to rate increases

March 10, 2017Job metrics continue to improve in the US, but our GDP estimate for this year remains unchanged.February’s US non-farm payroll figure was strong (although partly due to temporary factors and unusually mild weather), with non-farm payrolls rising 235,000, above expectations. Other data in the February employment report were also upbeat. The US unemployment rate fell back from 4.8% to 4.7% in February, slightly below the Fed median estimate for full employment (4.8%). And the U6 measure of underemployment fell to a cyclical low of 9.2%. Wage data were in line with expectations. Y-o-y increases rebounded from 2.6% in January to 2.8% in February, moving back to the cyclical high recorded in December (2.8%).All in all, today’s employment report was encouraging. Although boosted by temporary distortions, job creation was solid and both the unemployment rate (U3) and the U6 measure of underemployment declined. And, as expected, the y-o-y pace of wage increases bounced back in February. All this reinforces the probability that the Fed will hike rates by 25 bps next week.We are not modifying our scenario for US economic growth and monetary policy in light of the latest statistics. Our forecast that US GDP will grow by 1.7% q-o-q annualised in Q1 remains unchanged, as do our projections for yearly average growth of 2.0% in 2017.

Read More »Early rate hike means change in our U.S. rates scenario

March 6, 2017Hawkish comments from several Fed officials mean we now expect three quarter-point rate hikes from the Fed this year, with the first coming this month.As we don’t expect any big negative surprise in the February employment report (to be released on Friday), the probability of a hike next week has risen sharply. We are therefore changing our forecasts for Fed rates this year. Our main scenario is now that the Fed will first hike in March, instead of June. Moreover, to be more consistent with our US GDP growth (2.0% this year) and inflation forecasts (core PCE inflation at 2.1% at end-2017), we now expect two more hikes in the second half of this year (one in September, the other in December), bringing the mid-point of the Fed funds rate target range to 1.375% by year’s end.There seem to be three factors at play behind the Fed’ change of tone:A robust economy, including strong economic data in the US and abroad, further improvement in the US labour market, gradually rising inflation, and large increases in household and business confidence.Lower downward risks to the US economy, both at home and from abroad. Although details are scarce, prospects of a more simulative budgetary policy also mean fewer risks for the US economy.

Read More »Trump’s fiscal stimulus package may well be delayed

March 1, 2017Trump’s speech to Congress proved short on detail when it came to his main economic policy proposals. However, we believe a potentially significant fiscal package will eventually be approved.In his first speech to Congress yesterday, President Trump sounded more presidential but was short of specifics on many of his main policy proposals. He once again complained that US companies are facing higher barriers than their foreign counterparts, but didn’t elaborate on how specifically he intended to remedy this situation. Most notably, there was a lack of details on his tax reform package and the president did not provide any firm opinion on the controversial “border tax adjustment”.We are left with the House Republicans’ plan for a 20% border tax. This new tax plan is closer to a European-style value-added-tax (VAT) system, the main difference being that it allows firms to deduct wages. Importantly, switching to a ‘border tax adjustment’ would generate substantial additional tax revenues for the US (of around USD1,200 bn over 10 years). Without it, the projected sharp cut in the headline corporate tax rate that the Trump administration is seeking would be difficult to achieve.In his speech, Trump was more precise on his proposals for defence spending (up by $54 bn in 2018) and on infrastructure (an extra $1,000 bn over the next decade).

Read More »Solid U.S. retail sales follow Fed’s upbeat economic assessment

February 15, 2017Amid signs of robust consumer spending, we still expect two rate hikes from the Fed this year.Core retail sales in the US rose by a solid 0.4% m-o-m in January, above consensus expectations. Moreover, December’s figure was revised up. The result was that between Q4 and January, core retail sales grew by a robust 4.2% annualised. We forecast that consumer spending will grow by around 2.2% q-o-q annualised in Q1, after 2.5% in Q4 2016.All in all, we remain optimistic about consumer spending growth in the US and expect it to rise at an annual rate of 2.5% in 2017, compared with 2.7% in 2016.We expect the Trump administration’s measures on the trade and immigration fronts to prove limited, while substantial personal income tax cuts are likely sometime in H2 2017. And although the recent rebound in oil prices will likely weigh on real incomes, a higher dollar and upward pressure on wages should mitigate the fallout. In addition, employment growth should remain healthy and consumer confidence is upbeat.On February 14, Fed Chairwoman Janet Yellen’s testimony to Congress was perceived as slightly hawkish, although in our view it didn’t contain any meaningful surprises.Yellen was upbeat on the economic outlook and repeated that several hikes were likely in 2017. However, she didn’t really give a strong hint of a near-term hike.

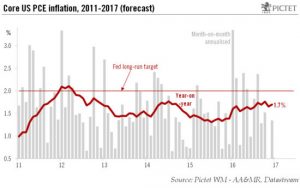

Read More »US inflation still low at end-2016, our forecast unchanged for 2017

February 1, 2017Virtually static in 2016, we continue to believe that core inflation will pick up only modestly in 2017.Core PCE inflation in the US settled at 1.7% y-o-y in December, in line with consensus and exactly the same rate as in February 2016. We continue to believe that PCE core inflation will pick up only modestly in 2017, ending the year at around 2.1%.Following a significant pick-up between October 2015 and February 2016 , y-o-y core PCE inflation stabilised at around 1.6%-1.7% for the remainder of 2016. It is worth noting that the core PCE inflation reading of 1.7% in December is actually lower than what we were expecting at the beginning of last year (1.9%), although our forecast was below consensus estimates at that time. This increases our confidence in our long-held view that core inflation will accelerate only moderately in 2017.True, wage increases have picked up, at least by some measures. However, wage inflation remains modest for the time being, and we think the impact of wage increases on overall core inflation should prove muted in 2017. The fiscal stimulus the Trump administration is widely expected to introduce may not have a positive impact on growth before 3Q 2017, and its impact on inflation may not be visible before 2018.

Read More »US GDP picked up in 2H 2016; outlook for 2017 unchanged

January 27, 2017In spite of softness in headline Q4 GDP figure, growth momentum in the US picked up in the second half of 2016 and should be underpinned by fiscal stimulus later this year.US GDP growth decelerated from 3.5% in Q3 to 1.9% quarter-on-quarter annualised in Q4, below consensus expectations of 2.2%. However, this soft reading was mainly due to a reversal of the surge in soybean exports in the previous quarter, while growth in final domestic demand picked up from 2.1% in Q3 to 2.5% in Q4. Overall, it is probably more meaningful to look at growth by semester rather than by quarter. In the second half of last year, GDP growth averaged a strong 2.7%, following a weak 1.1% in the first half.Looking forward, the recent substantial tightening in monetary conditions should weigh on US growth in the first six months of 2017, while fiscal stimulus should boost it in the second half. Although there has been a significant correction over the past two weeks, on a trade-weighted basis the US dollar is still some 3.5% higher than it was just before Donald Trump won the presidency. Together with the spike in long-term interest rates and the 25bp Fed’s hike in December, this has resulted in a marked tightening of monetary conditions. We estimate the tightening over the past four months to be equivalent to an increase of around 120 basis points in short-term rates.

Read More »Fed revises rate projections higher: ours remain unchanged

December 15, 2016Given the ongoing tightening in monetary conditions, we are leaving our forecasts for two Fed rate hikes next year unchanged for the time being.The decision by the Fed this week to raise the Fed funds rate target range by 25bp to 0.5%-0.75% was widely expected. More surprisingly for the market was certainly the upward revisions in the (in)famous ‘dot plot’. The Federal Open Market Committee’s (FOMC) median forecast for Fed funds rates at the end of 2017 was shifted up by 25bp, to 1.375%, which implies three quarter-point hikes in 2017 (instead of two). The upward revisions in rate projections led to a sharp market reaction. Equity markets fell and long-term rates and the dollar rose, which further tightened monetary conditions.We estimate that, including the 25bp hike in the Fed funds rate, overall monetary conditions have tightened by around 100bp in short-term rate equivalent over the past two months (including the post-Fed meeting moves). This is the main reason why we are reluctant to be more hawkish in our forecast for the Fed funds rate next year. For the time being, we are sticking with our scenario of two 25bp hikes in 2017. We continue to expect the FOMC to raise rates twice in 2017, most probably in June and December, bringing the mid-point of the Fed funds rate target range to 1.125%.

Read More »Healthy U.S. jobs report points to early rate hike

December 2, 2016The unemployment rate fell to a fresh cyclical low in November, and while wage growth disappointed, we expect it to pick up progressively next year.US non-farm payroll employment rose by a healthy 178,000 month-on-month (m-o-m) in November, in line with consensus expectations. Unexpectedly, the US unemployment rate fell further in November, to 4.6% from 4.9% in October, reaching its lowest level in more than nine years. At 4.6%, the US unemployment rate is now below the median rate of 4.8% that policy makers at the Fed feels corresponds to full employment. And the U6 measure of underemployment also fell to a fresh cycle low of 9.3%.Wage data disappointed. The year-on-year increase in wages fell to 2.5% in November. However, this series is notoriously volatile and the pace of increase recorded the previous month (2.8%) was a cyclical high. In addition, aggregate weekly payrolls (a proxy for household income) grew quite strongly between Q3 and October-November. For our part, we continue to expect wage increases in the US to gradually pick up over the coming quarters.All in all, today’s employment report was reasonably encouraging. Job creation was healthy and both the unemployment rate (U3) and the U6 measure of underemployment declined to fresh cycle lows.

Read More »U.S. growth to slow in H1 2017 before rising again in H2

November 30, 2016The tightening of monetary conditions is impeding near-term prospects for the US. But a probable fiscal stimulus will help revive growth again in the latter part of 2017.US GDP growth was revised up from 2.9% to 3.2% for the third quarter. The main reason was a higher estimate of growth in consumer spending. Turning to Q4, economic data published so far have been mixed. Data on consumption in October were a bit disappointing. And advance estimates for the trade deficit and inventories showed a noticeable deterioration. However, data on housing and business investment were quite upbeat, while consumer confidence bounced back sharply in November. Our forecast that US GDP will grow by 1.5% in Q4 remains unchanged.The ongoing tightening in monetary conditions should weigh on growth in H1 2017, while fiscal stimulus should boost it in H2. We take into account the ongoing pronounced tightening of monetary conditions. The rise in the trade-weighted dollar since the presidential election along with the spike in long-term interest rates has resulted in a marked tightening of monetary conditions in the US. We estimate this tightening to be equivalent to an increase of around 75 basis points in short-term rates.Our growth forecasts therefore remain unchanged. We believe that GDP growth will slow to some 1.7% on average in H1 2017 in the US, before picking up to 2.4% in H2.

Read More »2017 growth forecast for U.S. remains unchanged for now

November 15, 2016Recent data shows that consumer spending remains on track, but we see prospects dimming for economic growth in H1 2017, before rising again in H2 thanks to fiscal stimulus.Figures released on November 15 show that core retail sales in the US rose by a strong 0.8% month over month in October, well above consensus expectations. Moreover, figures for the previous months were revised up. We believe consumer spending will grow by around 2.5% q-o-q annualised in Q4 (2.1% in Q3) and that it should settle at 2.5% on average in 2017 as well (after 2.6% in 2016).There is greater uncertainty over prospects for GDP growth in the US. However, we are basically working on two hypotheses. First, although Congress is likely to water down Trump’s budgetary proposals, we still expect a substantial fiscal stimulus programme that could add 0.5-1.0% to US GDP in 2017-2018. The positive impact should start to be felt by the autumn of 2017. Second, our best guess remains that president Trump will prove much more moderate than candidate Trump when it comes to trade protectionism and clamping down on immigration. We therefore expect measures in these areas to have only a very modest impact on growth and inflation, at least for next year.The US dollar has appreciated by more than 3% since Trump won the presidency, moving slightly above the highs seen at the beginning of this year.

Read More »Healthy payroll number in the U.S., strong increase in wages

November 4, 2016Latest job numbers along with acceleration in wage growth reinforces the case for December rate hike.October’s non-farm payroll figure was healthy, with upward revisions for the previous two months. The unemployment rate inched down and year-on-year (y-o-y) wage increases reached a fresh cyclical high. The latest data tend to strengthen the case for a Fed hike in December.Non-farm payroll employment in the US rose by 161,000 m-o-m in October, marginally below consensus expectations. However, figures for August and September were revised up by a cumulative 44,000. The US unemployment rate dropped to 4.9%, in line with expectations, while the U6 measure of underemployment fell from 9.7% in September to 9.5% in October. The U6 measure (a wider gauge of unemployment) declined from 9.7% in September to 9.5% in October, after having remained stable over several months.The rest of the October nonfarm payroll report was also upbeat. Wages rose by a strong 0.4% m-o-m in October and by 2.8% y-o-y, a new cyclical high. And aggregate weekly payrolls (a proxy for household income) grew quite strongly between Q3 and October. All in all, the latest statistics suggest there has been a pick-up in the pace of wage increases over the past year or so (from 2.1% y-o-y on average in Q1 2015 to 2.7% y-o-y on average over the past three months).

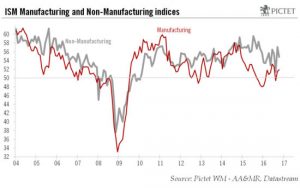

Read More »ISM indices point to healthy U.S. growth in October

November 3, 2016Other data have been more mixed and our forecast for U.S. growth remains unchanged for Q4.The ISM Manufacturing index increased modestly in October, to 51.9 from 51.5 in September, slightly above consensus expectations (51.7). However, following a sharp increase to 57.1 in September, the Non-manufacturing index fell back to 54.8 in October, below consensus expectations (56.0).The rebound in the ISM manufacturing index over the past two months confirmed that the declines in the dollar’s trade-weighted value and the rebound in oil prices recorded in H1 have been giving some support to manufacturing activity in the US. However, the improvement remains modest so far. As for the ISM Non-manufacturing index, having reached its highest level in 11 months in September, the reading for October still suggests that activity in US non-manufacturing remains pitched at reasonably high levels.Taken together, the two indices point to US GDP growth of 2.4% in October following average growth of 2.3% in Q3 and 2.5% in Q2. However, while they might be timely and useful indicators of the strength of business activity, ISM surveys are not very reliable at forecasting short-term GDP growth.Other data published recently have been mixed. Auto sales increased by more than expected in October.

Read More »Modest changes in latest Fed statement

November 3, 2016The statement at the end of the Fed’s latest policy meeting did hint at increasing inflation and seemed to prepare the ground for a December rate hike.As widely expected, the Federal Open Market Committee (FOMC) remained on hold at its policy meeting on November 2 meeting and there were only slight modifications in the FOMC statement.The Fed modestly upgraded its assessment of inflation and provided further hints of a December rate rise, saying that the case for a hike “has continued to strengthen” and that the Committee is now only waiting for “some” further evidence of progress toward its goals. Unsurprisingly, markets did not change their pricing of the probability of a rates hike in December following this uneventful FOMC meeting. The markets still see a 70% chance of a rate rise in December.There was a modest downgrade in the Fed’s assessment of consumer spending growth—hardly a surprise following the deceleration seen in Q3, but it upgraded its assessment of inflation. A few words saying that inflation “has increased somewhat since earlier this year” were added to the FOMC statement and the Fed highlighted that market-based measures of inflation expectations “have moved up” (but remain low). Moreover, the sentence saying “inflation is expected to remain low in the near term” was taken out of the FOMC statement.The FOMC is clearly keeping a tightening bias.

Read More »Core US inflation should rise only modestly

October 31, 2016Amid conflicting wage signals and low inflation expectations, core US prices look like rising only gradually to end 2017.Core US personal consumption expenditure (PCE) inflation remained stable at 1.7% year on year (y-o-y) in September, in line with consensus expectations. We continue to believe that core PCE inflation will pick up modestly over the coming months. Our forecast that it will reach 1.9% y-o-y by year-end and 2.1% in December 2017 remains unchanged.Labour market slack has diminished markedly and wage increases have started to pick up, at least by some measures. However, wage inflation remains modest for the time being, and we think the impact of wage increases on overall core inflation should remain muted for now.The global economic backdrop is not conducive to much higher US inflation – quite the opposite in fact. Inflation remains pretty low worldwide, and deflationary forces are still present, limiting pricing power in the US. As for domestic inflation expectations, the situation continues to appear actually quite disturbing, having declined noticeably over the past couple of years.As regards wage inflation, we note that the 3Q Employment Cost Index (ECI) report, generally considered the most reliable measure of wage and salary trends in the US, shows no meaningful pick-up in wage increases. In fact, the y-o-y rise in the ECI decelerated marginally from 2.

Read More »Strong U.S. GDP report conceals softness of some components

October 28, 20163Q GDP growth was flattered by a temporary surge in soybean exports, while consumer spending was disappointing. However, our 2016 and 2017 growth forecasts remain unchanged.On the back of a temporary surge in exports, real US GDP grew by a strong 2.9% in Q3, above consensus expectations. Our yearly average forecasts that US GDP will grow by 1.5% in 2016 and 2.0% in 2017 remain unchanged. The robust rate of expansion in Q3 needs to put in proper context. First, it is partly linked to a temporary surge in soybean exports. And second, it followed three consecutive quarters of very meagre expansion. Growth actually inched up only marginally from 1.3% in Q2 to 1.5% in Q3 on a year-on-year basis, still well below the average 2.1% pace recorded since the end of the last recession in Q2 2009.It is also worth noting that consumer spending growth was somewhat disappointing, with growth in final domestic demand actually decelerating from 2.4% in Q2 to 1.4% in Q3. And the strong growth in exports (+10.0%) was mainly linked to a surge in soybean exports that will likely prove temporary. Given the surge in soybean exports will likely go into reverse in the short term, we are cutting our growth forecasts for Q4 2016 from 2.0% q-o-q annualised to 1.5%.

Read More »Soft U.S. retail data conceals healthy consumer spending

October 14, 2016Macroview Our forecasts for US GDP growth remain unchanged, and we continue to expect a 25bp rate hike in December, followed by two others in 2017. Core retail sales in the U.S. rose by ‘only’ 0.1% month on month ( m-o-m) in September, below consensus expectations. Moreover, the July number was revised down. The result was that core retail sales were almost flat (+0.3% quarter on quarter (q-o-q) annualised in Q3), much lower than the 6.9% rise seen in Q2. Nevertheless, we continue to believe consumer spending grew by around 2.7% q-o-q annualised in Q3, following a rise of 4.3% in Q2. The fact that consumer spending growth probably softened as the third quarter advanced suggests sluggish momentum as we move into the fourth quarter. However, our forecasts that US GDP will grow by 2.5% q-o-q annualised in Q3 and 2.0% in Q4 remain unchanged, as do our projections for yearly average growth of 1.5% in 2016 and 2.0% in 2017.We remain reasonably optimistic on US consumer-spending growth. Employment growth will probably slow down somewhat over the coming months but should remain relatively healthy, while wage increases are likely to continue to pick up gradually. And although there has been a noticeable fall in the savings rate so far this year, it remains relatively high when compared to the level of consumer confidence and to household wealth trends.

Read More »U.S. data remain mixed

September 30, 2016Data released on 30 September continued to tally with our forecast of 1.5% GDP growth in the US for 2016 and a slow rise in core inflation to 1.9%. According to the Bureau of Economic Analysis (BEA), real consumer spending in the US fell 0.1% m-o-m in August, below consensus expectations. However, the figure for July was left unchanged, so that between Q2 and July-August, US personal consumption grew by 2.9% annualised.Other US data published in recent days has been mixed. Pending home sales fell to a seven-month low in August, and the advance estimate for wholesale inventories was soft. However, core capital goods orders continued to rebound, consumer confidence rose to its highest level since 2007 and, importantly for Q3 GDP, the advance estimate of August’s trade balance was surprisingly favourable.We remain sanguine on US consumer-spending growth. Although employment growth will probably slow somewhat, it should remain healthy. And the pace of wage increases is likely to pick up progressively. Moreover, consumer confidence remains upbeat and the still-high savings rate may well fall further. This should support personal consumption down the road. Our forecast that personal consumption growth will settle at around 2.7% q-o-q annualised in Q3 (after 4.3% in Q2) remains unchanged, as does our forecast that US GDP will grow 2.5% in the third quarter.

Read More »A December Fed rate hike is looking likely

September 22, 2016While the Fed stood pat at its September meeting, we continue to expect one quarter-point rise in rates this year, and two more in 2017. The Federal Open Market Committee (FOMC) left interest rates unchanged at the end of its latest policy meeting on September 21. However, the Fed adopted a more hawkish tone, reintroduced in its statement a sentence saying risks in the US economy were roughly balanced, and affirmed that the case for a rate hike has strengthened. Significantly, three voting members dissented from the FOMC decision, preferring an immediate hike. Moreover, 14 out of 17 FOMC members (82%) still expect one hike or more before this year is out.In the end, the FOMC judged it appropriate to remain cautious for the moment and to wait for more evidence of progress towards the Fed’s objectives in terms of employment and inflation. This seems logical to us. Given the sensitivity of financial markets and exchange rate markets to Fed behaviour, and given growing divergence with other central banks’ policies, treading carefully makes sense. Overall, the 21 September meeting confirmed what we have repeated many times: the trajectory of monetary policy will be highly data dependent and the Fed will act very carefully to avoid any unwanted tightening of monetary conditions.

Read More »Core retail sales weak in August, but U.S. consumption still healthy

September 15, 2016Macroview In spite of poor August retail report, we remain reasonably sanguine on US consumer spending growth over the near term. Today’s US retail sales report for August was surprisingly downbeat, with core retail sales recording their second monthly decline in a row. Core retail sales in the US fell by 0.1% month over month (m-o-m) in August, worse than consensus expectations. Moreover, June and July numbers were revised down by a cumulative 0.2%. The result was that between Q2 and July-August, core retail sales grew by a meagre 0.9% annualised, much lower than the quarter-over-quarter (q-o-q) rise of 6.9% seen in Q2.Nevertheless, overall personal consumption was very strong in July. Even with downward revisions and a soft reading for August, our forecast of 2.7% consumer spending growth q-o-q annualised in Q3 (following +4.4% in Q2) remains eminently achievable.Employment and household income should continue to grow at a healthy clip, US consumer confidence is relatively upbeat and the still-high saving rate may continue to fall. Employment growth will probably slow down somewhat over the coming months but should nevertheless remain relatively healthy, while wage increases are likely to pick up gradually. All these factors should support household spending in the US in the months ahead.Other US economic data published over the past few days have been mixed.

Read More »Putting fall in U.S. business surveys into context

September 7, 2016Macroview The ISM manufacturing and nonmanufacturing surveys for August declined sharply. But these surveys are not necessarily a good predictor of economic growth The ISM Manufacturing index in the US fell heavily in August. The 49.4 reading was well below consensus expectations (52.0) and its lowest level since January 2016. The Non-Manufacturing index painted a similar picture, recording its worst monthly fall since the recession of 2008-2009. It dropped from 55.5 in July to 51.4 in August, well below consensus expectations (55.0). Taken together, the two indices point to US GDP growth of 1.1% in August and 1.9% so far in Q3.But while these results are disheartening, the ISM surveys are not very reliable at forecasting short-term GDP growth and they need to be seen in context. For example, ISM indices had been pointing to 2.5% GDP growth in Q2, whereas growth turned out to be only 1.1%. And the sharp monthly fall in the August ISM manufacturing index number follows surprisingly robust numbers for June and July. The fall registered in August simply brought it back in line with trend. Moreover, while the Markit Manufacturing PMI (the other main survey on manufacturing activity) also dropped in August, it remains well above its ISM counterpart. So the overall picture in the manufacturing sector is probably less disheartening than the headline ISM figure suggests.

Read More »Our US scenario remains unaltered after mixed jobs report

September 2, 2016A soft monthly payroll number conceals health of the US jobs market, but a Fed rate hike may not come until December. Non-farm payroll employment rose by a modest 151,000 month on month (m-o-m) in August, below consensus expectations. Moreover, the unemployment rate remained unchanged, wage increases were soft, and the average work week declined surprisingly. However, the disappointing August nonfarm payroll number followed solid numbers in June and July. Overall, job creation has been a healthy 213,000 per month on average so far in Q3. Meanwhile, the US unemployment rate remained unchanged for the third month in a row in August and at 4.9% is at the same level as in January. This rate is marginally higher than what the Fed considers is full employment (4.8%). However, the Fed has repeated many times that the unemployment rate probably underestimates the resources available in the labour market.The rest of the August nonfarm payroll report was soft. Wages rose by only 0.1% m-o-m in August and the average work week declined, surprisingly, to 34.3 hours, from a downwardly revised 34.4 hours in July. Nevertheless, aggregate weekly payrolls (a proxy for household income) grew quite solidly between Q2 and July-August.

Read More »