The May nonfarm payroll report was mixed, but still unlikely to modify the case for a Fed hike this month. We still expect the Fed to raise rates twice more this year (in June and September).May was a mixed month for US employment data. Job creation was softer than expected, the figures for the previous couple of months were revised down and average hourly earnings data were somewhat disappointing. However, the unemployment rate unexpectedly fell further, reaching its lowest level since March 2001.Non-farm payroll employment rose by a soft 138,000 month-on-month in May, below consensus expectations. Moreover, figures for March and April were revised down by a cumulative 66,000. Unexpectedly, the US unemployment rate fell further, from 4.4% in April to 4.3% in May, and is now even further

Topics:

Bernard Lambert considers the following as important: Macroview, US nonfarm payrolls, US underemployment, US unemployment, US wage growth

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The May nonfarm payroll report was mixed, but still unlikely to modify the case for a Fed hike this month. We still expect the Fed to raise rates twice more this year (in June and September).

May was a mixed month for US employment data. Job creation was softer than expected, the figures for the previous couple of months were revised down and average hourly earnings data were somewhat disappointing. However, the unemployment rate unexpectedly fell further, reaching its lowest level since March 2001.

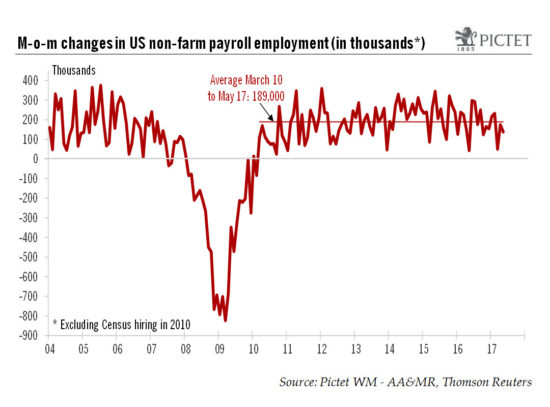

Non-farm payroll employment rose by a soft 138,000 month-on-month in May, below consensus expectations. Moreover, figures for March and April were revised down by a cumulative 66,000. Unexpectedly, the US unemployment rate fell further, from 4.4% in April to 4.3% in May, and is now even further below the Fed’s median estimate for full employment (4.7%). The U6 measure of underemployment also fell to a fresh cyclical low of 8.6% in April. But wage data were somewhat disappointing for the second month in a row. The year-on-year increase was revised down from 2.6% to 2.5% for March, and remained unchanged at 2.5% in April.

All in all, while still healthy for this stage of the cycle, job creation seems to have slowed somewhat over the past few months. And average hourly earnings disappointed for the second month in a row. However, the unemployment rate (U3) and the U6 measure of underemployment have declined very substantially over the past three months, confirming our view that the Fed will hike rates in June.

We are not modifying our scenario for US economic growth and monetary policy in light of the latest statistics. Our forecast that US GDP will grow by 2.7% quarter-on-quarter annualised in Q2 remains unchanged, as do our projections for yearly average growth of 2.0% in 2017. We also continue to forecast that the Fed will hike rates again by 25 basis points in both June and September, and that later this year it will likely announce the start of balance sheet reduction at the beginning of 2018. However, following the publication of the minutes of the Federal Open Market Committee’s 3-4 May meeting, the probability that the Fed actually starts reducing its securities holdings earlier has increased meaningfully.