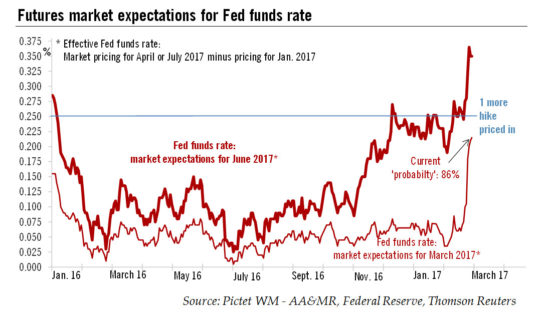

Hawkish comments from several Fed officials mean we now expect three quarter-point rate hikes from the Fed this year, with the first coming this month.As we don’t expect any big negative surprise in the February employment report (to be released on Friday), the probability of a hike next week has risen sharply. We are therefore changing our forecasts for Fed rates this year. Our main scenario is now that the Fed will first hike in March, instead of June. Moreover, to be more consistent with our US GDP growth (2.0% this year) and inflation forecasts (core PCE inflation at 2.1% at end-2017), we now expect two more hikes in the second half of this year (one in September, the other in December), bringing the mid-point of the Fed funds rate target range to 1.375% by year’s end.There seem to be three factors at play behind the Fed’ change of tone:A robust economy, including strong economic data in the US and abroad, further improvement in the US labour market, gradually rising inflation, and large increases in household and business confidence.Lower downward risks to the US economy, both at home and from abroad. Although details are scarce, prospects of a more simulative budgetary policy also mean fewer risks for the US economy.

Topics:

Bernard Lambert considers the following as important: Fed rate forecast, Fed rate hikes, Macroview, us financial conditions, US monetary policy

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Hawkish comments from several Fed officials mean we now expect three quarter-point rate hikes from the Fed this year, with the first coming this month.

As we don’t expect any big negative surprise in the February employment report (to be released on Friday), the probability of a hike next week has risen sharply. We are therefore changing our forecasts for Fed rates this year. Our main scenario is now that the Fed will first hike in March, instead of June. Moreover, to be more consistent with our US GDP growth (2.0% this year) and inflation forecasts (core PCE inflation at 2.1% at end-2017), we now expect two more hikes in the second half of this year (one in September, the other in December), bringing the mid-point of the Fed funds rate target range to 1.375% by year’s end.

There seem to be three factors at play behind the Fed’ change of tone:

- A robust economy, including strong economic data in the US and abroad, further improvement in the US labour market, gradually rising inflation, and large increases in household and business confidence.

- Lower downward risks to the US economy, both at home and from abroad. Although details are scarce, prospects of a more simulative budgetary policy also mean fewer risks for the US economy.

- Easier financial conditions, with the trade-weighted US dollar falling back again after its sharp appreciation between the November elections and mid-January. The same is true for broader measures of financial conditions. With equity markets sharply up and corporate bond spreads tightening, financial conditions have eased back markedly over the past four months or so