Summary:

Sorry for the disruption of the regular commentary. Still, the monthly will be posted tomorrow. There is a key divide in the market. One camp sees the US tariff threats as bluster and a negotiating tactic. The other camp, which I find myself in, thinks something more serious is happening. The US voted against Europe and with Russian and Iran at the UN for the first time in 45 years on European issues. Martin Wolf, the erstwhile economic editor at the Financial Times had an editorial yesterday which claimed the that US was now the enemy of the West. The market moved from “tariff fatigue” to complacency. Yesterday, Trump reiterated that the 25% tariffs on Canada and Mexico are still on track for March 4. He indicated another 10% tariff hike on China and

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Currency Movement, Featured, newsletter

This could be interesting, too:

Sorry for the disruption of the regular commentary. Still, the monthly will be posted tomorrow. There is a key divide in the market. One camp sees the US tariff threats as bluster and a negotiating tactic. The other camp, which I find myself in, thinks something more serious is happening. The US voted against Europe and with Russian and Iran at the UN for the first time in 45 years on European issues. Martin Wolf, the erstwhile economic editor at the Financial Times had an editorial yesterday which claimed the that US was now the enemy of the West. The market moved from “tariff fatigue” to complacency. Yesterday, Trump reiterated that the 25% tariffs on Canada and Mexico are still on track for March 4. He indicated another 10% tariff hike on China and

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Currency Movement, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Sorry for the disruption of the regular commentary. Still, the monthly will be posted tomorrow.

There is a key divide in the market. One camp sees the US tariff threats as bluster and a negotiating tactic. The other camp, which I find myself in, thinks something more serious is happening. The US voted against Europe and with Russian and Iran at the UN for the first time in 45 years on European issues. Martin Wolf, the erstwhile economic editor at the Financial Times had an editorial yesterday which claimed the that US was now the enemy of the West.

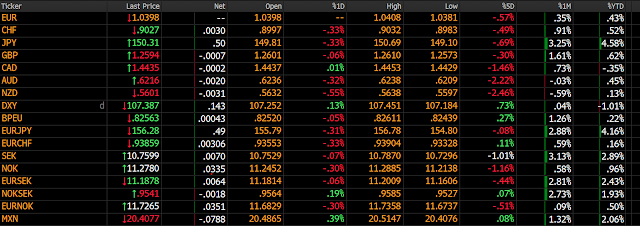

The market moved from “tariff fatigue” to complacency. Yesterday, Trump reiterated that the 25% tariffs on Canada and Mexico are still on track for March 4. He indicated another 10% tariff hike on China and threatened a 25% tariff on European autos (and other goods). The Dollar Index rallied almost 0.80% yesterday, the most since January 2.

Some ask, “ What happened to the Trump trade of a stronger dollar?” Against the G10 currencies, the dollar is down this year against all but the Canadian dollar. I think that misses how the markets work. They are an anticipatory mechanism. The Dollar Index rallied 10% from the end of September through January 13, a week before the inauguration. This is buying the rumor. Just as others wanted to buy the dollar on Trump’s second term, the earlier longs were happy to sell it to them. After buying the rumor, the fact was sold.

There does seem to be another shift in market psychology to consider. At first, many focused on the inflationary implications of the tariffs, but now, with some poor consumer confidence numbers, the market is now more sensitive to the “demand” destruction nature of the tariffs and the negative consequences of the uncertainty. Then there is concern about the government layoffs. In addition, there will be formal and informal retaliation against the US. There appears to be a consumer boycott against US goods taking off in Canada. Canada buys almost as many goods (dollar value) from the US and the EU.

In any event, the growth scare has helped drive US yields lower. The US 10-year yield tested 4.22% today. It peaked the day after the Dollar Index near 4.80%. Today’s low yield print is the lowest since mid-December. The two-year yield briefly slipped below 4.02% today, the lowest level since last October. It is 40 bp below the peak, with the Dollar Index on January 13. The Fed funds futures have about an 88% chance of next Fed cut in June and it is fully discounted in July. The market has 61 bp of cuts discounted. That is two cuts fully and almost a 50% of a third. Fed funds target is now 4.25%-4.50%. The market has the year-end implied rate of 3.72%. As recently as February 4, it was a little above 4%.

We have been looking for the dollar to recover on the tariff idea and recognized that the dollar’s setback since February 3 has stretched momentum indicators. Simply put the dollar was oversold and the news stream seemed to be moving in its direction. What is new is that the dollar’s recovery this week happened with falling rather than rising interest rates.

As the calendar turns to March, next week highlights include the March 4 US tariffs, the ECB rate cut on March 6, and US employment data (median forecast in Bloomberg’s survey is for a 158k rise in nonfarm payrolls (143k in January). Of those, private sector jobs are seen rising by 130k (111k in January). Note that state and local governments may be adding jobs more than the federal government is cutting, but that seems likely to change in the coming months.

Tags: Currency Movement,Featured,newsletter