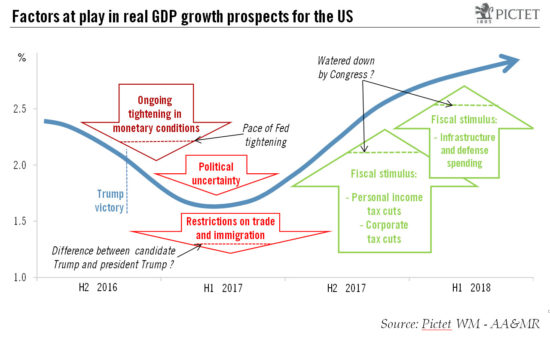

The tightening of monetary conditions is impeding near-term prospects for the US. But a probable fiscal stimulus will help revive growth again in the latter part of 2017.US GDP growth was revised up from 2.9% to 3.2% for the third quarter. The main reason was a higher estimate of growth in consumer spending. Turning to Q4, economic data published so far have been mixed. Data on consumption in October were a bit disappointing. And advance estimates for the trade deficit and inventories showed a noticeable deterioration. However, data on housing and business investment were quite upbeat, while consumer confidence bounced back sharply in November. Our forecast that US GDP will grow by 1.5% in Q4 remains unchanged.The ongoing tightening in monetary conditions should weigh on growth in H1 2017, while fiscal stimulus should boost it in H2. We take into account the ongoing pronounced tightening of monetary conditions. The rise in the trade-weighted dollar since the presidential election along with the spike in long-term interest rates has resulted in a marked tightening of monetary conditions in the US. We estimate this tightening to be equivalent to an increase of around 75 basis points in short-term rates.Our growth forecasts therefore remain unchanged. We believe that GDP growth will slow to some 1.7% on average in H1 2017 in the US, before picking up to 2.4% in H2.

Topics:

Bernard Lambert considers the following as important: Macroview, US fiscal stimulus, US GDP forecast, US growth, US inflation

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The tightening of monetary conditions is impeding near-term prospects for the US. But a probable fiscal stimulus will help revive growth again in the latter part of 2017.

US GDP growth was revised up from 2.9% to 3.2% for the third quarter. The main reason was a higher estimate of growth in consumer spending. Turning to Q4, economic data published so far have been mixed. Data on consumption in October were a bit disappointing. And advance estimates for the trade deficit and inventories showed a noticeable deterioration. However, data on housing and business investment were quite upbeat, while consumer confidence bounced back sharply in November. Our forecast that US GDP will grow by 1.5% in Q4 remains unchanged.

The ongoing tightening in monetary conditions should weigh on growth in H1 2017, while fiscal stimulus should boost it in H2. We take into account the ongoing pronounced tightening of monetary conditions. The rise in the trade-weighted dollar since the presidential election along with the spike in long-term interest rates has resulted in a marked tightening of monetary conditions in the US. We estimate this tightening to be equivalent to an increase of around 75 basis points in short-term rates.

Our growth forecasts therefore remain unchanged. We believe that GDP growth will slow to some 1.7% on average in H1 2017 in the US, before picking up to 2.4% in H2. On a yearly average basis, growth should accelerate to 2.0% next year, against 1.5% in 2016.

Core US PCE inflation, the Fed’s favourite gauge of price rises, remained stable at 1.7% y-o-y in October, in line with consensus expectations.

Trump’s victory means upward risks for US inflation. However, as we do not expect fiscal stimulus to start to have a positive impact on growth before 3Q 2017, the impact on inflation may not be visible before 2018. And we believe the effects of any trade and immigration restrictions imposed by the Trump administration will prove limited, with a very modest impact on inflation. Moreover, the appreciation of the trade-weighted dollar since the elections will contribute to lowering inflation over the coming few months.

Our base scenario that core PCE inflation will pick up only modestly over the coming months remains unchanged. We continue to expect core PCE inflation to end this year at 1.9% and next year at 2.1% (2.4% for total PCE inflation).