Amid signs of robust consumer spending, we still expect two rate hikes from the Fed this year.Core retail sales in the US rose by a solid 0.4% m-o-m in January, above consensus expectations. Moreover, December’s figure was revised up. The result was that between Q4 and January, core retail sales grew by a robust 4.2% annualised. We forecast that consumer spending will grow by around 2.2% q-o-q annualised in Q1, after 2.5% in Q4 2016.All in all, we remain optimistic about consumer spending growth in the US and expect it to rise at an annual rate of 2.5% in 2017, compared with 2.7% in 2016.We expect the Trump administration’s measures on the trade and immigration fronts to prove limited, while substantial personal income tax cuts are likely sometime in H2 2017. And although the recent rebound in oil prices will likely weigh on real incomes, a higher dollar and upward pressure on wages should mitigate the fallout. In addition, employment growth should remain healthy and consumer confidence is upbeat.On February 14, Fed Chairwoman Janet Yellen’s testimony to Congress was perceived as slightly hawkish, although in our view it didn’t contain any meaningful surprises.Yellen was upbeat on the economic outlook and repeated that several hikes were likely in 2017. However, she didn’t really give a strong hint of a near-term hike.

Topics:

Bernard Lambert considers the following as important: Fed monetary policy, Fed policy, Macroview, US consumer spending, US retail sales

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Amid signs of robust consumer spending, we still expect two rate hikes from the Fed this year.

Core retail sales in the US rose by a solid 0.4% m-o-m in January, above consensus expectations. Moreover, December’s figure was revised up. The result was that between Q4 and January, core retail sales grew by a robust 4.2% annualised. We forecast that consumer spending will grow by around 2.2% q-o-q annualised in Q1, after 2.5% in Q4 2016.

All in all, we remain optimistic about consumer spending growth in the US and expect it to rise at an annual rate of 2.5% in 2017, compared with 2.7% in 2016.

We expect the Trump administration’s measures on the trade and immigration fronts to prove limited, while substantial personal income tax cuts are likely sometime in H2 2017. And although the recent rebound in oil prices will likely weigh on real incomes, a higher dollar and upward pressure on wages should mitigate the fallout. In addition, employment growth should remain healthy and consumer confidence is upbeat.

On February 14, Fed Chairwoman Janet Yellen’s testimony to Congress was perceived as slightly hawkish, although in our view it didn’t contain any meaningful surprises.

Yellen was upbeat on the economic outlook and repeated that several hikes were likely in 2017. However, she didn’t really give a strong hint of a near-term hike. She also repeated that there was not enough clarity for the Fed to factor in any change in US fiscal and other policies for the time being. In answer to a question, Yellen reiterated that the Fed’s balance sheet will not be used as an active monetary policy tool.

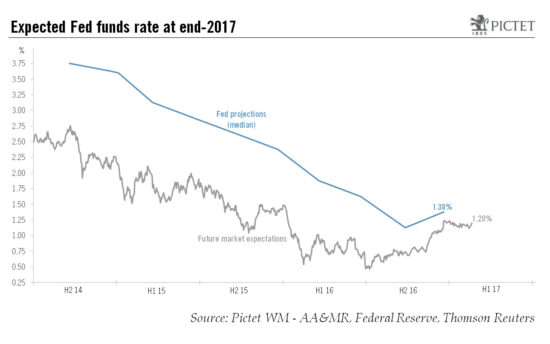

Our scenario for US monetary policy therefore remains unchanged. We expect the Fed to raise rates twice in 2017, most probably in June and December, bringing the mid-point of the Fed funds rate target range to 1.125%. We also continue to expect that the Fed will start to reduce the pace of reinvestment sometime in H1 2018.