The Fed is on track to hike rates once more in 2017, with balance-sheet reduction later this year set to tighten policy further. China’s PBoC is taking a relaxed view of the Fed’s policy changes.As was widely expected, the Federal Reserve decided at latest policy meeting on June 14 to raise the Fed funds rate target range by 25bp to 1.0%-1.25%. The Fed appeared relatively upbeat on the economy, downplayed the recent weakness in inflation numbers and left unchanged its median projections for Fed funds rates–one more quarter-point hike in H2 2017 and three additional hikes in 2018. These projections are well above market expectations, but are in line with our own expectations for rate policy this year and next.However, we now expect that the Fed will announce the beginning of its balance

Topics:

Bernard Lambert considers the following as important: China monetary policy, Fed balance sheet reduction, Fed policy normalisation, Fed rate policy, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The Fed is on track to hike rates once more in 2017, with balance-sheet reduction later this year set to tighten policy further. China’s PBoC is taking a relaxed view of the Fed’s policy changes.

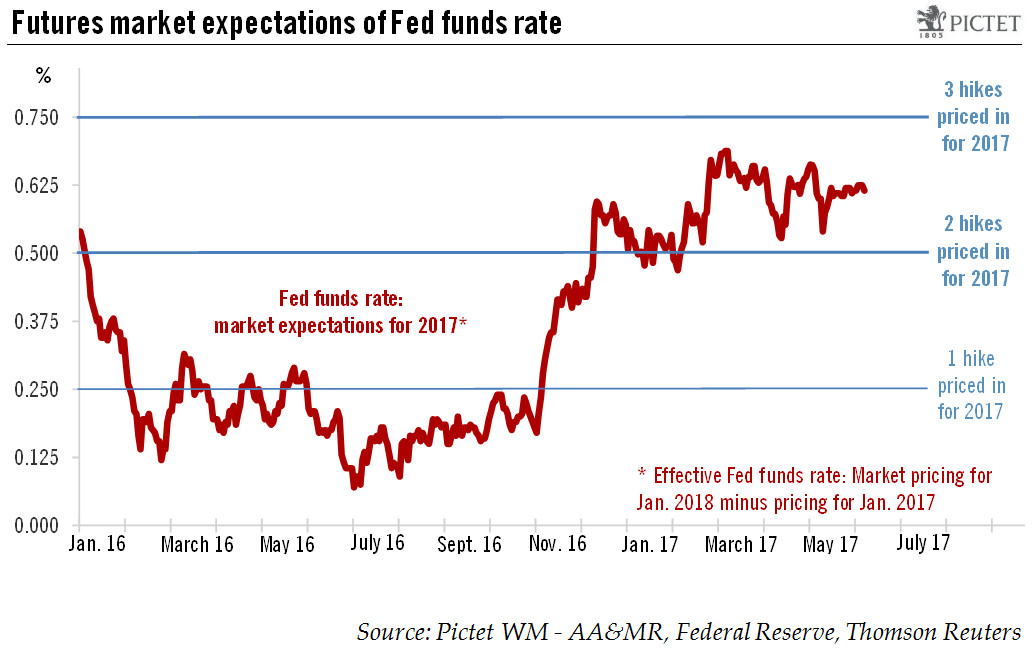

As was widely expected, the Federal Reserve decided at latest policy meeting on June 14 to raise the Fed funds rate target range by 25bp to 1.0%-1.25%. The Fed appeared relatively upbeat on the economy, downplayed the recent weakness in inflation numbers and left unchanged its median projections for Fed funds rates–one more quarter-point hike in H2 2017 and three additional hikes in 2018. These projections are well above market expectations, but are in line with our own expectations for rate policy this year and next.

However, we now expect that the Fed will announce the beginning of its balance sheet reduction programme in September (instead of December, as we previously thought) and that the next quarter-point hike rate will come in December (instead of September). These changes in expectations come after the Fed provided more details of its balance sheet normalisation plans and its mention that the programme could start relatively soon.

Over Q4 2017 and 2018, Fed securities holdings are likely to be reduced by slightly more than $400bn in all, and constitute a further move in the direction of monetary policy. Although firm estimates are almost impossible to make, we consider that balance-sheet reduction in Q4 2017 and 2018 will be roughly equivalent to a 25bp Fed funds rate hike.

After the Fed hike, the People’s Bank of China (PBoC) decided to stay put, keeping the interest rates for its reverse repo operations unchanged. This is because the alleviation of downward pressure on the renminbi has made it much less compelling for the PBoC to follow the Fed’s monetary policy closely than before.

The wide rate spreads between China and the US provide a strong buffer for the renminbi to resist depreciation against the USD when interest rates rise in the US. The PBoC’s recent policy change regarding the fixing rate has also improved market expectations.

Looking forward, we expect the PBoC to continue to maintain a neutral monetary policy stance with some tightening bias. But any tightening will be targeted specifically at the financial sector, aiming to curb speculation and trying to put additional strains on the real economy.