Latest job numbers along with acceleration in wage growth reinforces the case for December rate hike.October’s non-farm payroll figure was healthy, with upward revisions for the previous two months. The unemployment rate inched down and year-on-year (y-o-y) wage increases reached a fresh cyclical high. The latest data tend to strengthen the case for a Fed hike in December.Non-farm payroll employment in the US rose by 161,000 m-o-m in October, marginally below consensus expectations. However, figures for August and September were revised up by a cumulative 44,000. The US unemployment rate dropped to 4.9%, in line with expectations, while the U6 measure of underemployment fell from 9.7% in September to 9.5% in October. The U6 measure (a wider gauge of unemployment) declined from 9.7% in September to 9.5% in October, after having remained stable over several months.The rest of the October nonfarm payroll report was also upbeat. Wages rose by a strong 0.4% m-o-m in October and by 2.8% y-o-y, a new cyclical high. And aggregate weekly payrolls (a proxy for household income) grew quite strongly between Q3 and October. All in all, the latest statistics suggest there has been a pick-up in the pace of wage increases over the past year or so (from 2.1% y-o-y on average in Q1 2015 to 2.7% y-o-y on average over the past three months).

Topics:

Bernard Lambert considers the following as important: Macroview, US employment, US nonfarm payrolls, US wage growth, US wages

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Latest job numbers along with acceleration in wage growth reinforces the case for December rate hike.

October’s non-farm payroll figure was healthy, with upward revisions for the previous two months. The unemployment rate inched down and year-on-year (y-o-y) wage increases reached a fresh cyclical high. The latest data tend to strengthen the case for a Fed hike in December.

Non-farm payroll employment in the US rose by 161,000 m-o-m in October, marginally below consensus expectations. However, figures for August and September were revised up by a cumulative 44,000. The US unemployment rate dropped to 4.9%, in line with expectations, while the U6 measure of underemployment fell from 9.7% in September to 9.5% in October. The U6 measure (a wider gauge of unemployment) declined from 9.7% in September to 9.5% in October, after having remained stable over several months.

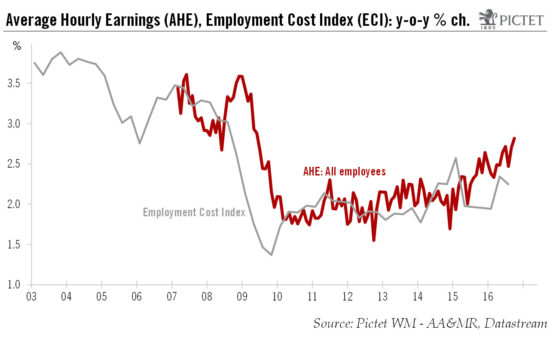

The rest of the October nonfarm payroll report was also upbeat. Wages rose by a strong 0.4% m-o-m in October and by 2.8% y-o-y, a new cyclical high. And aggregate weekly payrolls (a proxy for household income) grew quite strongly between Q3 and October. All in all, the latest statistics suggest there has been a pick-up in the pace of wage increases over the past year or so (from 2.1% y-o-y on average in Q1 2015 to 2.7% y-o-y on average over the past three months).

Although the quarterly Employment Cost Index – the most reliable measure of wages and salaries – is pointing to a much less blatant acceleration in wage increases, we continue to expect wage increases in the US to gradually pick up over the coming few quarters.

The October payroll and wage data reinforces the case for a 25 bp Fed hike in December, as per our forecast. Our projections for yearly average US GDP growth of 1.5% in 2016 and 2.0% in 2017 remain unchanged.