Given the ongoing tightening in monetary conditions, we are leaving our forecasts for two Fed rate hikes next year unchanged for the time being.The decision by the Fed this week to raise the Fed funds rate target range by 25bp to 0.5%-0.75% was widely expected. More surprisingly for the market was certainly the upward revisions in the (in)famous ‘dot plot’. The Federal Open Market Committee’s (FOMC) median forecast for Fed funds rates at the end of 2017 was shifted up by 25bp, to 1.375%, which implies three quarter-point hikes in 2017 (instead of two). The upward revisions in rate projections led to a sharp market reaction. Equity markets fell and long-term rates and the dollar rose, which further tightened monetary conditions.We estimate that, including the 25bp hike in the Fed funds rate, overall monetary conditions have tightened by around 100bp in short-term rate equivalent over the past two months (including the post-Fed meeting moves). This is the main reason why we are reluctant to be more hawkish in our forecast for the Fed funds rate next year. For the time being, we are sticking with our scenario of two 25bp hikes in 2017. We continue to expect the FOMC to raise rates twice in 2017, most probably in June and December, bringing the mid-point of the Fed funds rate target range to 1.125%.

Topics:

Bernard Lambert considers the following as important: dot plot, Fed dots, Macroview, US Fed hike, US rate projections

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Given the ongoing tightening in monetary conditions, we are leaving our forecasts for two Fed rate hikes next year unchanged for the time being.

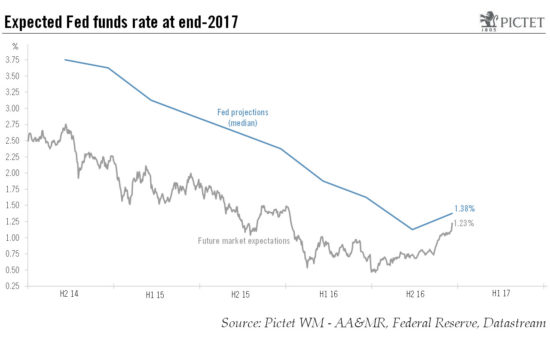

The decision by the Fed this week to raise the Fed funds rate target range by 25bp to 0.5%-0.75% was widely expected. More surprisingly for the market was certainly the upward revisions in the (in)famous ‘dot plot’. The Federal Open Market Committee’s (FOMC) median forecast for Fed funds rates at the end of 2017 was shifted up by 25bp, to 1.375%, which implies three quarter-point hikes in 2017 (instead of two). The upward revisions in rate projections led to a sharp market reaction. Equity markets fell and long-term rates and the dollar rose, which further tightened monetary conditions.

We estimate that, including the 25bp hike in the Fed funds rate, overall monetary conditions have tightened by around 100bp in short-term rate equivalent over the past two months (including the post-Fed meeting moves). This is the main reason why we are reluctant to be more hawkish in our forecast for the Fed funds rate next year. For the time being, we are sticking with our scenario of two 25bp hikes in 2017. We continue to expect the FOMC to raise rates twice in 2017, most probably in June and December, bringing the mid-point of the Fed funds rate target range to 1.125%.

Given the ongoing tightening in monetary conditions, the reaction of financial and currency markets to Fed behaviour, and the de-synchronisation of the Fed’s policies from those of other central banks, we continue to believe that the Fed will act very carefully. In our view, the trajectory of monetary policy will be highly data-dependent and the Fed will try to avoid any unwanted tightening of monetary conditions. However, risks are probably tilted to the upside and a lot will depend on the policies decided by the incoming Trump administration.