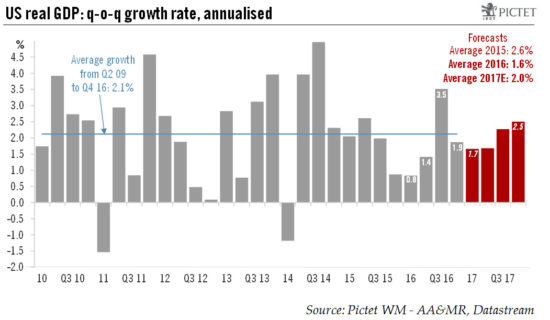

After soft GDP in first quarter, we expect a significant rebound in the current quarter. The underlying strength of the US economy remains intact.US GDP growth decelerated from 2.8% in H2 2016 to 0.7% quarter on quarter (q-o-q) annualised in Q1, slightly below consensus expectations (1.0%). However, this weak reading is mainly due to statistical anomalies (growth tends to be lower in Q1) and transitory factors that weighed on consumer spending and stockbuilding. However, fixed investment growth picked up encouragingly. More generally, with improving world growth, supportive overall financial conditions in the US, upbeat forward indicators on fixed investment and the prospect of some fiscal stimulus next year, we remain confident on prospects for US economic growth. In Q2, consumer spending growth should bounce back sharply, fixed investment growth is likely to remain strong and the pace of stockbuilding should recover. We therefore expect GDP growth to recover to 2.7% q-o-q annualised in Q2.Turning to H2, some important fundamental factors should continue to support demand. World demand is improving at last, the trade-weighted dollar has fallen back sharply over the past few months and overall financial conditions appear quite supportive.

Topics:

Bernard Lambert considers the following as important: Macroview, robust us economy, US GDP growth, US growth prospects, US wage growth

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

After soft GDP in first quarter, we expect a significant rebound in the current quarter. The underlying strength of the US economy remains intact.

US GDP growth decelerated from 2.8% in H2 2016 to 0.7% quarter on quarter (q-o-q) annualised in Q1, slightly below consensus expectations (1.0%). However, this weak reading is mainly due to statistical anomalies (growth tends to be lower in Q1) and transitory factors that weighed on consumer spending and stockbuilding. However, fixed investment growth picked up encouragingly.

More generally, with improving world growth, supportive overall financial conditions in the US, upbeat forward indicators on fixed investment and the prospect of some fiscal stimulus next year, we remain confident on prospects for US economic growth.

In Q2, consumer spending growth should bounce back sharply, fixed investment growth is likely to remain strong and the pace of stockbuilding should recover. We therefore expect GDP growth to recover to 2.7% q-o-q annualised in Q2.

Turning to H2, some important fundamental factors should continue to support demand. World demand is improving at last, the trade-weighted dollar has fallen back sharply over the past few months and overall financial conditions appear quite supportive.

Moreover, employment growth in the US will probably slow somewhat over the coming months but should remain relatively healthy, while wage increases are likely to pick up gradually. And consumer confidence has rebounded markedly. We therefore believe household spending growth should remain solid in H2 2017.

Although Congress is likely to water down Trump’s budgetary plan presented on Wednesday, we believe a stimulus package will be adopted sometime in Q4 and that it will be probably worth around 1.0% of GDP in 2018. This could raise GDP growth by 0.5-1.0% next year.

All in all, our forecasts for the US economy remain unchanged. We still believe that GDP growth will pick up from 1.6% in 2016 to 2.0% in 2017 and 2.3% in 2018.

The Employment Cost Index increased by 0.8% q-o-q, above consensus expectations. On a y-o-y basis, the ECI, generally considered the most reliable measure of wage trends in the US, moved up from 2.2% in Q4 2016 to 2.4% in Q1 2017.

Other wage statistics point to a more meaningful pick-up in US wages. Nevertheless, for the time being, wages are continuing to rise at a gentle pace. Although we expect some further acceleration over the coming quarters, the impact of wage increases on overall core inflation should remain pretty muted, at least for the coming 12 months or so.