Job metrics continue to improve in the US, but our GDP estimate for this year remains unchanged.February’s US non-farm payroll figure was strong (although partly due to temporary factors and unusually mild weather), with non-farm payrolls rising 235,000, above expectations. Other data in the February employment report were also upbeat. The US unemployment rate fell back from 4.8% to 4.7% in February, slightly below the Fed median estimate for full employment (4.8%). And the U6 measure of underemployment fell to a cyclical low of 9.2%. Wage data were in line with expectations. Y-o-y increases rebounded from 2.6% in January to 2.8% in February, moving back to the cyclical high recorded in December (2.8%).All in all, today’s employment report was encouraging. Although boosted by temporary distortions, job creation was solid and both the unemployment rate (U3) and the U6 measure of underemployment declined. And, as expected, the y-o-y pace of wage increases bounced back in February. All this reinforces the probability that the Fed will hike rates by 25 bps next week.We are not modifying our scenario for US economic growth and monetary policy in light of the latest statistics. Our forecast that US GDP will grow by 1.7% q-o-q annualised in Q1 remains unchanged, as do our projections for yearly average growth of 2.0% in 2017.

Topics:

Bernard Lambert considers the following as important: Macroview, US employment, US GDP forecast, US rate hikes, US wage growth

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Job metrics continue to improve in the US, but our GDP estimate for this year remains unchanged.

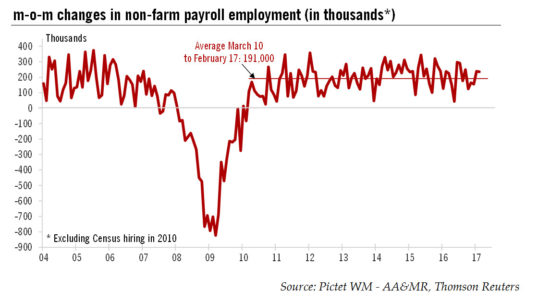

February’s US non-farm payroll figure was strong (although partly due to temporary factors and unusually mild weather), with non-farm payrolls rising 235,000, above expectations. Other data in the February employment report were also upbeat. The US unemployment rate fell back from 4.8% to 4.7% in February, slightly below the Fed median estimate for full employment (4.8%). And the U6 measure of underemployment fell to a cyclical low of 9.2%. Wage data were in line with expectations. Y-o-y increases rebounded from 2.6% in January to 2.8% in February, moving back to the cyclical high recorded in December (2.8%).

All in all, today’s employment report was encouraging. Although boosted by temporary distortions, job creation was solid and both the unemployment rate (U3) and the U6 measure of underemployment declined. And, as expected, the y-o-y pace of wage increases bounced back in February. All this reinforces the probability that the Fed will hike rates by 25 bps next week.

We are not modifying our scenario for US economic growth and monetary policy in light of the latest statistics. Our forecast that US GDP will grow by 1.7% q-o-q annualised in Q1 remains unchanged, as do our projections for yearly average growth of 2.0% in 2017. After raising rates by 25 bps next Wednesday, we expect two additional 25bp hikes to follow this year, probably in September and December.