Data released on 30 September continued to tally with our forecast of 1.5% GDP growth in the US for 2016 and a slow rise in core inflation to 1.9%. According to the Bureau of Economic Analysis (BEA), real consumer spending in the US fell 0.1% m-o-m in August, below consensus expectations. However, the figure for July was left unchanged, so that between Q2 and July-August, US personal consumption grew by 2.9% annualised.Other US data published in recent days has been mixed. Pending home sales fell to a seven-month low in August, and the advance estimate for wholesale inventories was soft. However, core capital goods orders continued to rebound, consumer confidence rose to its highest level since 2007 and, importantly for Q3 GDP, the advance estimate of August’s trade balance was surprisingly favourable.We remain sanguine on US consumer-spending growth. Although employment growth will probably slow somewhat, it should remain healthy. And the pace of wage increases is likely to pick up progressively. Moreover, consumer confidence remains upbeat and the still-high savings rate may well fall further. This should support personal consumption down the road. Our forecast that personal consumption growth will settle at around 2.7% q-o-q annualised in Q3 (after 4.3% in Q2) remains unchanged, as does our forecast that US GDP will grow 2.5% in the third quarter.

Topics:

Bernard Lambert considers the following as important: Macroview, US consumer spending, US core inflation, US growth, US inflation

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Data released on 30 September continued to tally with our forecast of 1.5% GDP growth in the US for 2016 and a slow rise in core inflation to 1.9%.

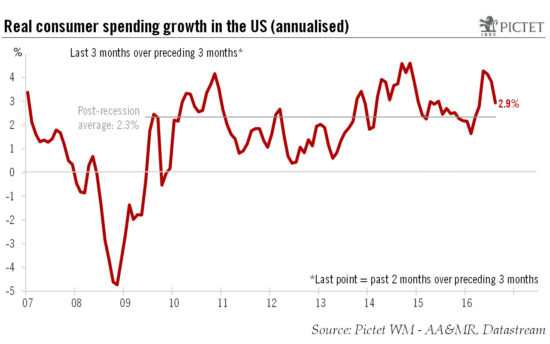

According to the Bureau of Economic Analysis (BEA), real consumer spending in the US fell 0.1% m-o-m in August, below consensus expectations. However, the figure for July was left unchanged, so that between Q2 and July-August, US personal consumption grew by 2.9% annualised.

Other US data published in recent days has been mixed. Pending home sales fell to a seven-month low in August, and the advance estimate for wholesale inventories was soft. However, core capital goods orders continued to rebound, consumer confidence rose to its highest level since 2007 and, importantly for Q3 GDP, the advance estimate of August’s trade balance was surprisingly favourable.

We remain sanguine on US consumer-spending growth. Although employment growth will probably slow somewhat, it should remain healthy. And the pace of wage increases is likely to pick up progressively. Moreover, consumer confidence remains upbeat and the still-high savings rate may well fall further. This should support personal consumption down the road. Our forecast that personal consumption growth will settle at around 2.7% q-o-q annualised in Q3 (after 4.3% in Q2) remains unchanged, as does our forecast that US GDP will grow 2.5% in the third quarter. Our projections for yearly average GDP are also unaltered (1.5% in 2016 and 2.0% in 2017).

The BEA also announced that core PCE inflation had picked up from 1.6% y-o-y in July to 1.7% in August, in line with consensus expectations.

Labour market slack has diminished markedly in the US and wage increases have started to pick up. However, wage inflation remains modest for the time being, and we think the impact of wage increases on overall core inflation should remain muted for now. In addition, the global backdrop is not conducive to more inflation, while domestic long-term inflation expectations have continued to decline.

We continue to believe that core PCE inflation in the US will only pick up modestly over the coming months. Our forecast that it will reach 1.9% y-o-y by year-end remains unchanged and our early prediction for December 2017 is 2.1%.