Macroview In spite of poor August retail report, we remain reasonably sanguine on US consumer spending growth over the near term. Today’s US retail sales report for August was surprisingly downbeat, with core retail sales recording their second monthly decline in a row. Core retail sales in the US fell by 0.1% month over month (m-o-m) in August, worse than consensus expectations. Moreover, June and July numbers were revised down by a cumulative 0.2%. The result was that between Q2 and July-August, core retail sales grew by a meagre 0.9% annualised, much lower than the quarter-over-quarter (q-o-q) rise of 6.9% seen in Q2.Nevertheless, overall personal consumption was very strong in July. Even with downward revisions and a soft reading for August, our forecast of 2.7% consumer spending growth q-o-q annualised in Q3 (following +4.4% in Q2) remains eminently achievable.Employment and household income should continue to grow at a healthy clip, US consumer confidence is relatively upbeat and the still-high saving rate may continue to fall. Employment growth will probably slow down somewhat over the coming months but should nevertheless remain relatively healthy, while wage increases are likely to pick up gradually. All these factors should support household spending in the US in the months ahead.Other US economic data published over the past few days have been mixed.

Topics:

Bernard Lambert considers the following as important: Macroview, US consumer spending, US core sales, US personal consumption, US retail spending

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

In spite of poor August retail report, we remain reasonably sanguine on US consumer spending growth over the near term.

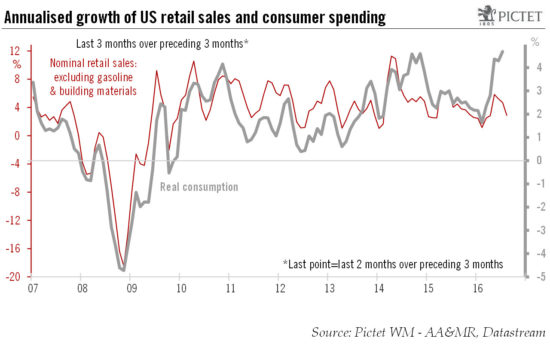

Today’s US retail sales report for August was surprisingly downbeat, with core retail sales recording their second monthly decline in a row. Core retail sales in the US fell by 0.1% month over month (m-o-m) in August, worse than consensus expectations. Moreover, June and July numbers were revised down by a cumulative 0.2%. The result was that between Q2 and July-August, core retail sales grew by a meagre 0.9% annualised, much lower than the quarter-over-quarter (q-o-q) rise of 6.9% seen in Q2.

Nevertheless, overall personal consumption was very strong in July. Even with downward revisions and a soft reading for August, our forecast of 2.7% consumer spending growth q-o-q annualised in Q3 (following +4.4% in Q2) remains eminently achievable.

Employment and household income should continue to grow at a healthy clip, US consumer confidence is relatively upbeat and the still-high saving rate may continue to fall. Employment growth will probably slow down somewhat over the coming months but should nevertheless remain relatively healthy, while wage increases are likely to pick up gradually. All these factors should support household spending in the US in the months ahead.

Other US economic data published over the past few days have been mixed. August industrial production numbers were soft, but regional manufacturing surveys for September showed some improvement. And the NFIB small businesses survey for August failed to confirm the surprisingly sharp fall in the ISM manufacturing index for the same month. Our forecast that US GDP will grow at 2.5% q-o-q annualised in Q3 remains unchanged, as do our projections for yearly average growth of 1.5% in 2016 and 2.0% in 2017.