While the Fed stood pat at its September meeting, we continue to expect one quarter-point rise in rates this year, and two more in 2017. The Federal Open Market Committee (FOMC) left interest rates unchanged at the end of its latest policy meeting on September 21. However, the Fed adopted a more hawkish tone, reintroduced in its statement a sentence saying risks in the US economy were roughly balanced, and affirmed that the case for a rate hike has strengthened. Significantly, three voting members dissented from the FOMC decision, preferring an immediate hike. Moreover, 14 out of 17 FOMC members (82%) still expect one hike or more before this year is out.In the end, the FOMC judged it appropriate to remain cautious for the moment and to wait for more evidence of progress towards the Fed’s objectives in terms of employment and inflation. This seems logical to us. Given the sensitivity of financial markets and exchange rate markets to Fed behaviour, and given growing divergence with other central banks’ policies, treading carefully makes sense. Overall, the 21 September meeting confirmed what we have repeated many times: the trajectory of monetary policy will be highly data dependent and the Fed will act very carefully to avoid any unwanted tightening of monetary conditions.

Topics:

Bernard Lambert considers the following as important: Fed median projections, Macroview, US Federal Reserve, US monetary policy, US rate hikes

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

While the Fed stood pat at its September meeting, we continue to expect one quarter-point rise in rates this year, and two more in 2017.

The Federal Open Market Committee (FOMC) left interest rates unchanged at the end of its latest policy meeting on September 21. However, the Fed adopted a more hawkish tone, reintroduced in its statement a sentence saying risks in the US economy were roughly balanced, and affirmed that the case for a rate hike has strengthened. Significantly, three voting members dissented from the FOMC decision, preferring an immediate hike. Moreover, 14 out of 17 FOMC members (82%) still expect one hike or more before this year is out.

In the end, the FOMC judged it appropriate to remain cautious for the moment and to wait for more evidence of progress towards the Fed’s objectives in terms of employment and inflation. This seems logical to us. Given the sensitivity of financial markets and exchange rate markets to Fed behaviour, and given growing divergence with other central banks’ policies, treading carefully makes sense. Overall, the 21 September meeting confirmed what we have repeated many times: the trajectory of monetary policy will be highly data dependent and the Fed will act very carefully to avoid any unwanted tightening of monetary conditions.

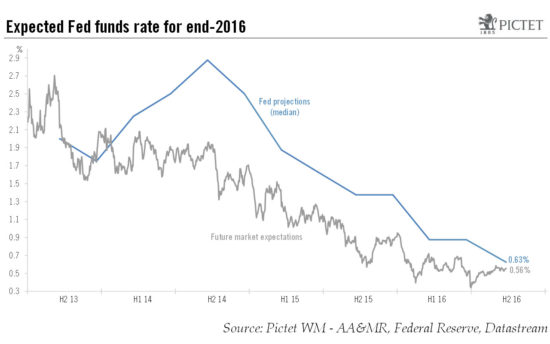

A more dovish note was struck by the announcement that FOMC members’ median projection for the Fed funds rate for end-2017 was cut by 50bp to 1.1% (implying two 25bp rate hikes in 2017 instead of the previous projection’s three). The FOMC median projections are now exactly the same as our own.

Although the median projections path for the Fed funds rate over the coming years was revised down once again, the Fed is clearly keeping a tightening bias. And in our view, it has placed the bar quite high for not hiking in December. Our scenario for US monetary policy remains unchanged. We continue to expect the FOMC to raise rates by 25 basis points in December and to follow with two additional 25bp hikes in 2017.

Somewhat surprisingly, given the hawkish tone of the meeting, the chances of a rate hike by December were not priced in any higher by futures markets following the FOMC meeting. They remain roughly stable at about 63% . This means that market expectations will have to move up if we are right and the Fed does end up hiking in December.