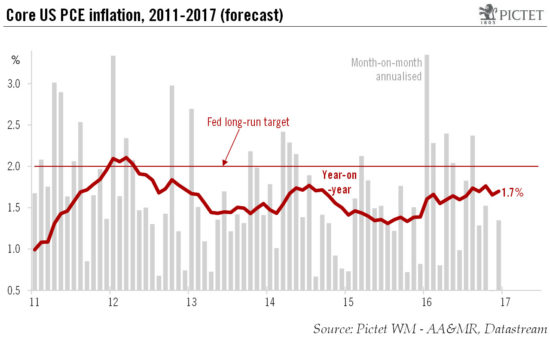

Virtually static in 2016, we continue to believe that core inflation will pick up only modestly in 2017.Core PCE inflation in the US settled at 1.7% y-o-y in December, in line with consensus and exactly the same rate as in February 2016. We continue to believe that PCE core inflation will pick up only modestly in 2017, ending the year at around 2.1%.Following a significant pick-up between October 2015 and February 2016 , y-o-y core PCE inflation stabilised at around 1.6%-1.7% for the remainder of 2016. It is worth noting that the core PCE inflation reading of 1.7% in December is actually lower than what we were expecting at the beginning of last year (1.9%), although our forecast was below consensus estimates at that time. This increases our confidence in our long-held view that core inflation will accelerate only moderately in 2017.True, wage increases have picked up, at least by some measures. However, wage inflation remains modest for the time being, and we think the impact of wage increases on overall core inflation should prove muted in 2017. The fiscal stimulus the Trump administration is widely expected to introduce may not have a positive impact on growth before 3Q 2017, and its impact on inflation may not be visible before 2018.

Topics:

Bernard Lambert considers the following as important: inflation forecast, Macroview, US core inflation, US inflation, US wage inflation

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Virtually static in 2016, we continue to believe that core inflation will pick up only modestly in 2017.

Core PCE inflation in the US settled at 1.7% y-o-y in December, in line with consensus and exactly the same rate as in February 2016. We continue to believe that PCE core inflation will pick up only modestly in 2017, ending the year at around 2.1%.

Following a significant pick-up between October 2015 and February 2016 , y-o-y core PCE inflation stabilised at around 1.6%-1.7% for the remainder of 2016. It is worth noting that the core PCE inflation reading of 1.7% in December is actually lower than what we were expecting at the beginning of last year (1.9%), although our forecast was below consensus estimates at that time. This increases our confidence in our long-held view that core inflation will accelerate only moderately in 2017.

True, wage increases have picked up, at least by some measures. However, wage inflation remains modest for the time being, and we think the impact of wage increases on overall core inflation should prove muted in 2017. The fiscal stimulus the Trump administration is widely expected to introduce may not have a positive impact on growth before 3Q 2017, and its impact on inflation may not be visible before 2018. And we believe the effects of potential trade and immigration measures undertaken by the Trump administration will have a modest effect on inflation. Moreover, the considerable appreciation of the trade-weighted dollar since the elections in November will contribute to lowering inflation over the coming few months.

We therefore remain relatively comfortable with our inflation forecasts and see no reason to alter them, at least for the time being. Our scenario that core PCE inflation will end next year at 2.1% (2.4% for total PCE inflation) remains unchanged.