Trump’s speech to Congress proved short on detail when it came to his main economic policy proposals. However, we believe a potentially significant fiscal package will eventually be approved.In his first speech to Congress yesterday, President Trump sounded more presidential but was short of specifics on many of his main policy proposals. He once again complained that US companies are facing higher barriers than their foreign counterparts, but didn’t elaborate on how specifically he intended to remedy this situation. Most notably, there was a lack of details on his tax reform package and the president did not provide any firm opinion on the controversial “border tax adjustment”.We are left with the House Republicans’ plan for a 20% border tax. This new tax plan is closer to a European-style value-added-tax (VAT) system, the main difference being that it allows firms to deduct wages. Importantly, switching to a ‘border tax adjustment’ would generate substantial additional tax revenues for the US (of around USD1,200 bn over 10 years). Without it, the projected sharp cut in the headline corporate tax rate that the Trump administration is seeking would be difficult to achieve.In his speech, Trump was more precise on his proposals for defence spending (up by bn in 2018) and on infrastructure (an extra ,000 bn over the next decade).

Topics:

Bernard Lambert considers the following as important: border tax adjustment, Macroview, Trump speech, US federal budget, US protectionism

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Trump’s speech to Congress proved short on detail when it came to his main economic policy proposals. However, we believe a potentially significant fiscal package will eventually be approved.

In his first speech to Congress yesterday, President Trump sounded more presidential but was short of specifics on many of his main policy proposals. He once again complained that US companies are facing higher barriers than their foreign counterparts, but didn’t elaborate on how specifically he intended to remedy this situation. Most notably, there was a lack of details on his tax reform package and the president did not provide any firm opinion on the controversial “border tax adjustment”.

We are left with the House Republicans’ plan for a 20% border tax. This new tax plan is closer to a European-style value-added-tax (VAT) system, the main difference being that it allows firms to deduct wages. Importantly, switching to a ‘border tax adjustment’ would generate substantial additional tax revenues for the US (of around USD1,200 bn over 10 years). Without it, the projected sharp cut in the headline corporate tax rate that the Trump administration is seeking would be difficult to achieve.

In his speech, Trump was more precise on his proposals for defence spending (up by $54 bn in 2018) and on infrastructure (an extra $1,000 bn over the next decade). Although President Trump suggested the increase in infrastructure spending should come from a mix of private and public money, the more fiscally conservative Congress is unlikely to agree.

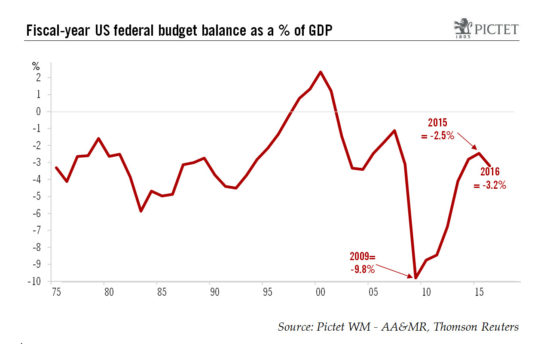

Indeed, Congress, which holds the purse strings, is highly divided on Trump stimulus plans in general. Although Congress is likely to water down Trump’s budgetary plans, we nonetheless believe a stimulus package will eventually be adopted and that it could be sizeable. Our main scenario is that it will be worth around 1.0% of GDP (0.2% in H2 2017 and 0.8% in 2018). This could raise GDP growth by 0.5-1.0% over 2017-2018. However, our hypothesis that a tax reform package would be voted by autumn now appears rather optimistic.

On trade, while there is clearly the possibility of a marked increase in protectionism, for the time being, our best guess remains that any measures adopted by the new administration will prove limited (higher tariffs only for a short period or only on specific products, renegotiation of trade treaties rather than repeal) and will have only a modest impact on growth and inflation, at least this year.