Heavy on spending cuts, but containing dubious revenue calculations, the president’s budget plan is unlikely to be adopted by Congress. But we still expect tax cuts by year’s end.President Trump’s budget request was issued yesterday. Higher defence and infrastructure spending are proposed, more than compensated for by drastic cuts in other spending. The consequence is that total outlays are reduced dramatically.On the revenue side, the budget plan was very short on details. It assumes that tax cuts will be neutral for the deficit. And it seems the positive effect of the ‘economic feedback’ was actually counted twice. Moreover, the economic assumptions are very optimistic.GDP growth is supposed to average 2.9% between 2017 and 2027. Given the deep cuts in federal spending envisaged, the tax cuts would need to be massive to push growth up to those levels. And with the economy close to full employment and with potential US growth estimated to be around 1.8% currently (and unlikely to accelerate rapidly), the Fed is certain to react aggressively to avoid overheating. In short, it is hard to imagine that the kind of growth outlined in the White House budget can be achieved, particularly with a restrictive immigration policy.

Topics:

Bernard Lambert considers the following as important: Macroview, Trump budget plans, US budget policy, US fiscal stimulus, US spending cuts

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Heavy on spending cuts, but containing dubious revenue calculations, the president’s budget plan is unlikely to be adopted by Congress. But we still expect tax cuts by year’s end.

President Trump’s budget request was issued yesterday. Higher defence and infrastructure spending are proposed, more than compensated for by drastic cuts in other spending. The consequence is that total outlays are reduced dramatically.

On the revenue side, the budget plan was very short on details. It assumes that tax cuts will be neutral for the deficit. And it seems the positive effect of the ‘economic feedback’ was actually counted twice. Moreover, the economic assumptions are very optimistic.

GDP growth is supposed to average 2.9% between 2017 and 2027. Given the deep cuts in federal spending envisaged, the tax cuts would need to be massive to push growth up to those levels. And with the economy close to full employment and with potential US growth estimated to be around 1.8% currently (and unlikely to accelerate rapidly), the Fed is certain to react aggressively to avoid overheating. In short, it is hard to imagine that the kind of growth outlined in the White House budget can be achieved, particularly with a restrictive immigration policy.

Severe spending cuts, optimistic growth assumptions and creative accounting on the revenue side allow the White House to predict a sharp reduction in the budget deficit over the coming years. But president Trump’s budget document is just a “wish list” that Congress can choose to ignore entirely. In all likelihood, most of Trump’s budget proposals are likely to be “dead on arrival”. It is Congress, which is working on its own budget ideas, that holds the purse strings.

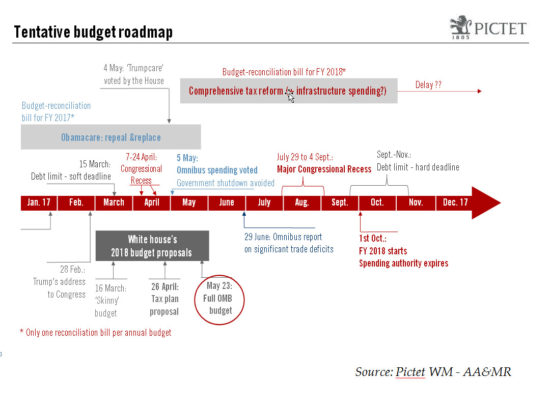

Apart from vehement opposition from Democrats to Trump’s budget blueprint, there is stark divergence among Republicans in Congress on many important themes, notably on balancing the budget, the controversial “Border Tax Adjustment” and which spending to prioritise. Nonetheless, for the time being, our main scenario remains that a stimulus package of some sort will be adopted before the year is out. Despite their divisions, the vast majority of Republicans agree on the necessity to vote through potentially quite substantial tax cuts.

Our main scenario is that the stimulus package will be worth around 1.0% of GDP. This is unlikely to have any impact in 2017, but it could raise GDP growth by around 0.5% in 2018. That’s the main reason why we expect US growth to pick up from 2.0% in 2017 to 2.3% in 2018.