Just-released figures lead us to revise our forecasts for US spending and inflation.Real consumer spending increased by just 0.1% month-on-month in May. However, Q1 and April consumption figures were revised higher. The overall result was that between Q1 and April-May, US personal consumption grew by a strong 3.2% annualised. The strong bounce back in consumption growth expected has been confirmed, so that our forecast of 2.7% growth in consumer spending for Q2 overall now looks too low. We are therefore revising it up to 3.0%.The third estimate for Q1 GDP was published this week: GDP growth was revised up from 1.2% q-o-q annualised to 1.4%, whereas consensus expectations had been for the numbers to remain unchanged. Higher consumer spending and exports were partly offset by lower

Topics:

Bernard Lambert considers the following as important: Macroview, US consumer spending, US core inflation, US growth forecast, US real GDP growth

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Just-released figures lead us to revise our forecasts for US spending and inflation.

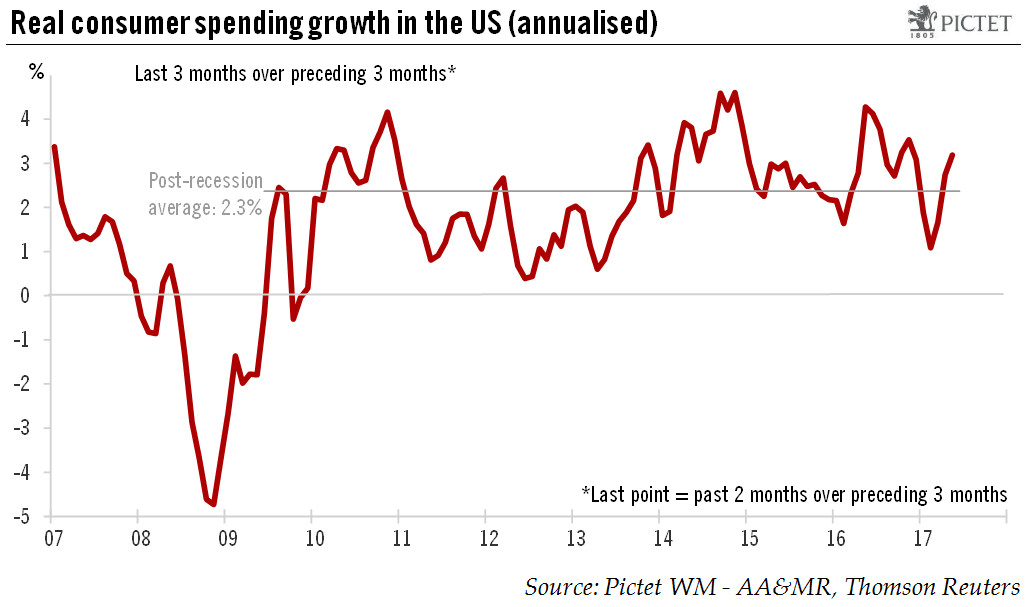

Real consumer spending increased by just 0.1% month-on-month in May. However, Q1 and April consumption figures were revised higher. The overall result was that between Q1 and April-May, US personal consumption grew by a strong 3.2% annualised. The strong bounce back in consumption growth expected has been confirmed, so that our forecast of 2.7% growth in consumer spending for Q2 overall now looks too low. We are therefore revising it up to 3.0%.

The third estimate for Q1 GDP was published this week: GDP growth was revised up from 1.2% q-o-q annualised to 1.4%, whereas consensus expectations had been for the numbers to remain unchanged. Higher consumer spending and exports were partly offset by lower estimates for other components, notably fixed investment. All in all, we remain comfortable with our existing forecast that real GDP will grow by 2.7% q-o-q annualised in Q2 and that yearly-average growth in the US will be 2.0% in 2017.

Important inflation numbers were also released today in the US. Following lower-than-expected CPI numbers for the third month in a row, the May figure for PCE (Personal Consumption Expenditure, the Fed’s inflation figure of reference) was expected to be soft. In the event, while core PCE index increased by 0.1% m-o-m in May, on a year-on-year basis, core PCE inflation dropped further, from 1.5% in April to 1.4% in May, an 18-month low.

After another soft number in May, our forecast for PCE inflation is looking too high again. In consequence, we have revised down our December forecast for core PCE from 1.9% to 1.7%, and for headline PCE from 2.2% to 1.8%.

The surprise deceleration in core PCE inflation over the past three months was relatively widely spread. However, we don’t think it is the beginning of a new trend. There is relatively little slack left in the labour market, the pace of wage increases is picking up gradually, productivity growth is subdued and the dollar has fallen back markedly over the past few months. We therefore continue to believe that core inflation will likely inch up gradually.