Financial conditions remain accommodative, perhaps setting the stage for next hike in June.In line with what almost every forecaster was expecting, the Federal Open Market Committee (FOMC) decided at its latest policy meeting to raise the Fed funds rate target range by 25bp to 0.75%-1.0%. Fed Chair Janet Yellen explained that the decision to raise rates was appropriate “in light of the economy’s solid progress toward our goals of maximum employment and price stability“. Financial markets reacted surprisingly well to the announcement, and broad financial conditions didn’t actually tighten. Indeed, stocks rose, long-term rates fell and the dollar –on a broad trade-weighted basis – depreciated by almost 1.0% on the news.As far as the economic situation is concerned, hardly surprisingly, the Fed sounded slightly more upbeat then before, notably on inflation. However, it also modified its statement to highlight that its inflation target was symmetric, which seems to have interpreted in a dovish way by the market. Overall, there were only modest changes in the wording of the statement compared to the previous one, with the Fed repeating the mantra that rate hikes should be gradual. In sum, the statement was probably less hawkish than expected. Changes in the FOMC’s economic projections were pretty minimal.

Topics:

Bernard Lambert considers the following as important: Macroview, US economic projections, US Fed hike, us financial conditions, US monetary policy

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Financial conditions remain accommodative, perhaps setting the stage for next hike in June.

In line with what almost every forecaster was expecting, the Federal Open Market Committee (FOMC) decided at its latest policy meeting to raise the Fed funds rate target range by 25bp to 0.75%-1.0%. Fed Chair Janet Yellen explained that the decision to raise rates was appropriate “in light of the economy’s solid progress toward our goals of maximum employment and price stability“. Financial markets reacted surprisingly well to the announcement, and broad financial conditions didn’t actually tighten. Indeed, stocks rose, long-term rates fell and the dollar –on a broad trade-weighted basis – depreciated by almost 1.0% on the news.

As far as the economic situation is concerned, hardly surprisingly, the Fed sounded slightly more upbeat then before, notably on inflation. However, it also modified its statement to highlight that its inflation target was symmetric, which seems to have interpreted in a dovish way by the market. Overall, there were only modest changes in the wording of the statement compared to the previous one, with the Fed repeating the mantra that rate hikes should be gradual. In sum, the statement was probably less hawkish than expected. Changes in the FOMC’s economic projections were pretty minimal. The forecast for unemployment remained unchanged, with the exception of the estimate for the neutral unemployment rate. Yellen also said it was “too early to say” how the Trump administration’s policies might affect the economic outlook.

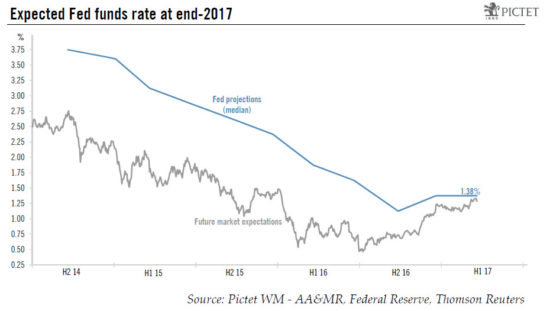

The FOMC statement and projections contained some signals that were also considered dovish. Markets feared that the FOMC might well revise its (in)famous ‘dot plot’ chart upwards. But in the event, the FOMC’s median forecast for the Fed funds rates at the end of 2017 remained unchanged at 1.375% (which implies three 25bp hikes in total in 2017). All things considered, we now believe that a hike in June is more likely than not. Our scenario of two more 25bp hikes before the year is out remains valid but we now expect the moves to come in June and September instead of September and December. And risks are probably tilted towards a total of four hikes over the year. A lot will depend on the policies decided by the Trump administration and Congress.