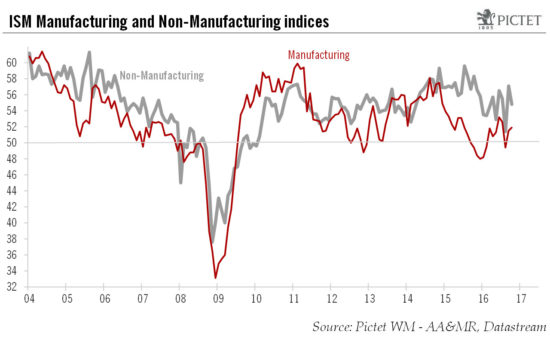

Other data have been more mixed and our forecast for U.S. growth remains unchanged for Q4.The ISM Manufacturing index increased modestly in October, to 51.9 from 51.5 in September, slightly above consensus expectations (51.7). However, following a sharp increase to 57.1 in September, the Non-manufacturing index fell back to 54.8 in October, below consensus expectations (56.0).The rebound in the ISM manufacturing index over the past two months confirmed that the declines in the dollar’s trade-weighted value and the rebound in oil prices recorded in H1 have been giving some support to manufacturing activity in the US. However, the improvement remains modest so far. As for the ISM Non-manufacturing index, having reached its highest level in 11 months in September, the reading for October still suggests that activity in US non-manufacturing remains pitched at reasonably high levels.Taken together, the two indices point to US GDP growth of 2.4% in October following average growth of 2.3% in Q3 and 2.5% in Q2. However, while they might be timely and useful indicators of the strength of business activity, ISM surveys are not very reliable at forecasting short-term GDP growth.Other data published recently have been mixed. Auto sales increased by more than expected in October.

Topics:

Bernard Lambert considers the following as important: Macroview, US GDP forecast, US ISM surveys, US manufacturing, US non-manufacturing

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Other data have been more mixed and our forecast for U.S. growth remains unchanged for Q4.

The ISM Manufacturing index increased modestly in October, to 51.9 from 51.5 in September, slightly above consensus expectations (51.7). However, following a sharp increase to 57.1 in September, the Non-manufacturing index fell back to 54.8 in October, below consensus expectations (56.0).

The rebound in the ISM manufacturing index over the past two months confirmed that the declines in the dollar’s trade-weighted value and the rebound in oil prices recorded in H1 have been giving some support to manufacturing activity in the US. However, the improvement remains modest so far. As for the ISM Non-manufacturing index, having reached its highest level in 11 months in September, the reading for October still suggests that activity in US non-manufacturing remains pitched at reasonably high levels.

Taken together, the two indices point to US GDP growth of 2.4% in October following average growth of 2.3% in Q3 and 2.5% in Q2. However, while they might be timely and useful indicators of the strength of business activity, ISM surveys are not very reliable at forecasting short-term GDP growth.

Other data published recently have been mixed. Auto sales increased by more than expected in October. However, although data for July and August were revised up, figures for construction spending were once again disappointing in September. Residential construction spending rebounded m-o-m in September but both private non-residential construction and public construction spending fell.

Our scenario that US GDP will grow at a 1.5% quarter on quarter annualised pace in Q4 remains unchanged, as do our projections for yearly average growth rates of 1.5% in 2016 and 2.0% in 2017.