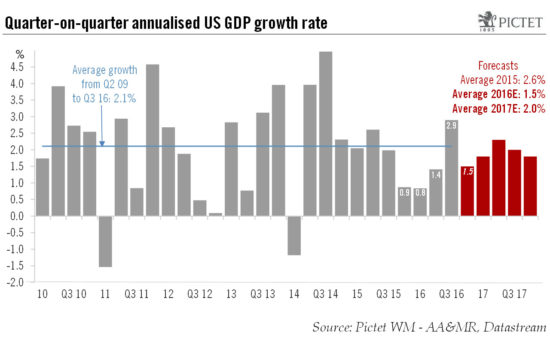

3Q GDP growth was flattered by a temporary surge in soybean exports, while consumer spending was disappointing. However, our 2016 and 2017 growth forecasts remain unchanged.On the back of a temporary surge in exports, real US GDP grew by a strong 2.9% in Q3, above consensus expectations. Our yearly average forecasts that US GDP will grow by 1.5% in 2016 and 2.0% in 2017 remain unchanged. The robust rate of expansion in Q3 needs to put in proper context. First, it is partly linked to a temporary surge in soybean exports. And second, it followed three consecutive quarters of very meagre expansion. Growth actually inched up only marginally from 1.3% in Q2 to 1.5% in Q3 on a year-on-year basis, still well below the average 2.1% pace recorded since the end of the last recession in Q2 2009.It is also worth noting that consumer spending growth was somewhat disappointing, with growth in final domestic demand actually decelerating from 2.4% in Q2 to 1.4% in Q3. And the strong growth in exports (+10.0%) was mainly linked to a surge in soybean exports that will likely prove temporary. Given the surge in soybean exports will likely go into reverse in the short term, we are cutting our growth forecasts for Q4 2016 from 2.0% q-o-q annualised to 1.5%.

Topics:

Bernard Lambert considers the following as important: Macroview, US GDP, US growth forecast, US household consumption

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

3Q GDP growth was flattered by a temporary surge in soybean exports, while consumer spending was disappointing. However, our 2016 and 2017 growth forecasts remain unchanged.

On the back of a temporary surge in exports, real US GDP grew by a strong 2.9% in Q3, above consensus expectations. Our yearly average forecasts that US GDP will grow by 1.5% in 2016 and 2.0% in 2017 remain unchanged. The robust rate of expansion in Q3 needs to put in proper context. First, it is partly linked to a temporary surge in soybean exports. And second, it followed three consecutive quarters of very meagre expansion. Growth actually inched up only marginally from 1.3% in Q2 to 1.5% in Q3 on a year-on-year basis, still well below the average 2.1% pace recorded since the end of the last recession in Q2 2009.

It is also worth noting that consumer spending growth was somewhat disappointing, with growth in final domestic demand actually decelerating from 2.4% in Q2 to 1.4% in Q3. And the strong growth in exports (+10.0%) was mainly linked to a surge in soybean exports that will likely prove temporary. Given the surge in soybean exports will likely go into reverse in the short term, we are cutting our growth forecasts for Q4 2016 from 2.0% q-o-q annualised to 1.5%.

But while exports should fall back in Q4, and while some monthly indicators, notably on the consumption side, actually showed some loss of momentum toward the end of the quarter, fundamentals for consumer spending and the housing sector are positive, and investment in the oil sector should recover. Employment growth will probably slow down somewhat over the coming months but should remain relatively healthy, while wage increases are likely to continue to pick up gradually. The contribution of stock-building to GDP growth is likely to remain positive over the coming quarters.

In addition, while financial conditions have tightened slightly of late on the back of higher long-term rates and a stronger dollar, they remain much more accommodative than at the beginning of the year. If we take into account the usual time lags, supportive financial conditions should broadly remain in place in Q4 and H1 2017.We therefore remain reasonably sanguine on US growth.