The latest non-farm payroll report is unlikely to make the Fed deviate from plans for policy normalisation.All in all, today’s employment report was healthy. In the end, job creation was actually quite robust overall in Q2, ‘aggregate weekly payrolls’ rose strongly q-o-q, and if unemployment rebounded a little in June, it was only because of higher participation, not a lack of employment growth. However, once again, wage data brought some disappointment, with average hourly earnings increasing by less than expected in June, although we continue to expect wage increases in the US to gradually pick up over the coming quarters.We are not modifying our scenario for US economic growth and monetary policy in light of the latest statistics. Our forecast for US GDP growth of 2.7% q-o-q annualised

Topics:

Bernard Lambert considers the following as important: Macroview, US employment report, US nonfarm payrolls, US participation rate, US wage growth

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

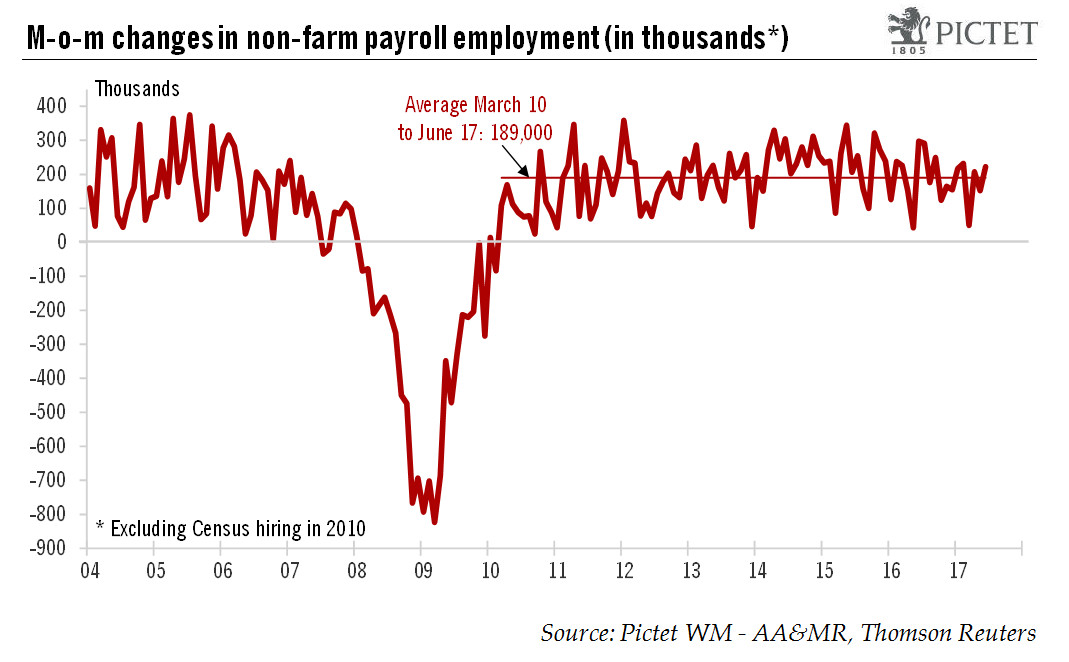

The latest non-farm payroll report is unlikely to make the Fed deviate from plans for policy normalisation.

All in all, today’s employment report was healthy. In the end, job creation was actually quite robust overall in Q2, ‘aggregate weekly payrolls’ rose strongly q-o-q, and if unemployment rebounded a little in June, it was only because of higher participation, not a lack of employment growth. However, once again, wage data brought some disappointment, with average hourly earnings increasing by less than expected in June, although we continue to expect wage increases in the US to gradually pick up over the coming quarters.

We are not modifying our scenario for US economic growth and monetary policy in light of the latest statistics. Our forecast for US GDP growth of 2.7% q-o-q annualised in Q2 remains unchanged, as do our projections for yearly average growth of 2.0% in 2017.

We view today’s healthy report as unlikely to modify the Fed’s analysis of economic prospects. We continue to forecast that it will announce the beginning of its balance sheet reduction programme in September and hike rates again in December.

In detail, non-farm payroll employment rose by a strong 222,000 month-on-month (m-o-m) in June, above consensus expectations. Moreover, figures for April and May were revised up by a cumulative 47,000. The US unemployment rate rose marginally to 4.4% after rounding, but remained below the Fed’s median estimate for full employment (4.6%). However, wage data were somewhat disappointing for the third month in a row. The y-o-y increase was revised down from 2.5% to 2.4% for May, and inched up only to 2.5% June.