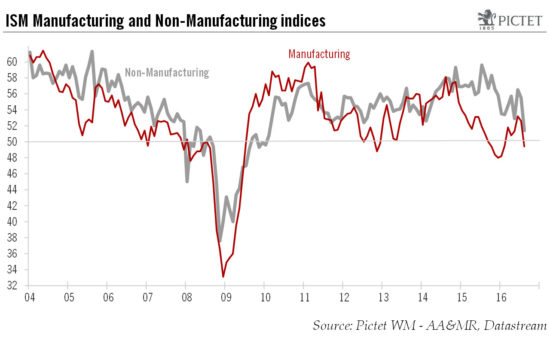

Macroview The ISM manufacturing and nonmanufacturing surveys for August declined sharply. But these surveys are not necessarily a good predictor of economic growth The ISM Manufacturing index in the US fell heavily in August. The 49.4 reading was well below consensus expectations (52.0) and its lowest level since January 2016. The Non-Manufacturing index painted a similar picture, recording its worst monthly fall since the recession of 2008-2009. It dropped from 55.5 in July to 51.4 in August, well below consensus expectations (55.0). Taken together, the two indices point to US GDP growth of 1.1% in August and 1.9% so far in Q3.But while these results are disheartening, the ISM surveys are not very reliable at forecasting short-term GDP growth and they need to be seen in context. For example, ISM indices had been pointing to 2.5% GDP growth in Q2, whereas growth turned out to be only 1.1%. And the sharp monthly fall in the August ISM manufacturing index number follows surprisingly robust numbers for June and July. The fall registered in August simply brought it back in line with trend. Moreover, while the Markit Manufacturing PMI (the other main survey on manufacturing activity) also dropped in August, it remains well above its ISM counterpart. So the overall picture in the manufacturing sector is probably less disheartening than the headline ISM figure suggests.

Topics:

Bernard Lambert considers the following as important: Macroview, US business surveys, US ISM surveys, US manufacturing data, US non-manufacturing

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The ISM manufacturing and nonmanufacturing surveys for August declined sharply. But these surveys are not necessarily a good predictor of economic growth

The ISM Manufacturing index in the US fell heavily in August. The 49.4 reading was well below consensus expectations (52.0) and its lowest level since January 2016. The Non-Manufacturing index painted a similar picture, recording its worst monthly fall since the recession of 2008-2009. It dropped from 55.5 in July to 51.4 in August, well below consensus expectations (55.0). Taken together, the two indices point to US GDP growth of 1.1% in August and 1.9% so far in Q3.

But while these results are disheartening, the ISM surveys are not very reliable at forecasting short-term GDP growth and they need to be seen in context. For example, ISM indices had been pointing to 2.5% GDP growth in Q2, whereas growth turned out to be only 1.1%. And the sharp monthly fall in the August ISM manufacturing index number follows surprisingly robust numbers for June and July. The fall registered in August simply brought it back in line with trend. Moreover, while the Markit Manufacturing PMI (the other main survey on manufacturing activity) also dropped in August, it remains well above its ISM counterpart. So the overall picture in the manufacturing sector is probably less disheartening than the headline ISM figure suggests. Nor should one forget that the manufacturing sector accounts for only some 12% of the US economy.

At the same time, the sharp drop in the ISM Non-Manufacturing index in August, while not necessarily signaling a new trend, is clearly a concern. The ISM number is now more aligned with the comparable Markit reading for non-manufacturing activity.

Taken together, the marked deterioration in both ISM surveys reinforces our view that the Fed will wait until December before hiking rates. However, we don’t want to overreact. Our forecast that US GDP will grow by 2.5% q-o-q annualised in Q3 remains unchanged, as do our projections for yearly average growth rates of 1.5% in 2016 and 2.0% in 2017.