It’s a broken a record, the macro stylus stuck unable to move on, just skipping and repeating the same spot on the vinyl. Since Xi Jinping’s lockdowns broke it, as it’s said, when Xi is satisfied there’s zero COVID he’ll release the restrictions and that will fix everything. The economy will go right back to good, like flipping a switch. Where have we heard that before? Everywhere, actually, but especially in China. Whether early last year, last August, and now again over the past few months, focus has been (intentionally) maintained on overly aggressive pandemic policies as the catchall for every bad number and vibe. . Just last week, the country’s National Bureau of Statistics (NBS) reported a substantial decline for Industrial Profits, typically a particularly

Topics:

Jeffrey P. Snider considers the following as important: $CNY, 5.) Alhambra Investments, China, currencies, economy, Featured, Federal Reserve/Monetary Policy, industrial profits, Markets, newsletter, PBOC, Xi Jinping

This could be interesting, too:

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Ryan McMaken writes A Free-Market Guide to Trump’s Immigration Crackdown

Wanjiru Njoya writes Post-Election Prospects for Ending DEI

Swiss Customs writes Octobre 2024 : la chimie-pharma détermine le record à l’export

| It’s a broken a record, the macro stylus stuck unable to move on, just skipping and repeating the same spot on the vinyl. Since Xi Jinping’s lockdowns broke it, as it’s said, when Xi is satisfied there’s zero COVID he’ll release the restrictions and that will fix everything. The economy will go right back to good, like flipping a switch.

Where have we heard that before? Everywhere, actually, but especially in China. Whether early last year, last August, and now again over the past few months, focus has been (intentionally) maintained on overly aggressive pandemic policies as the catchall for every bad number and vibe. |

|

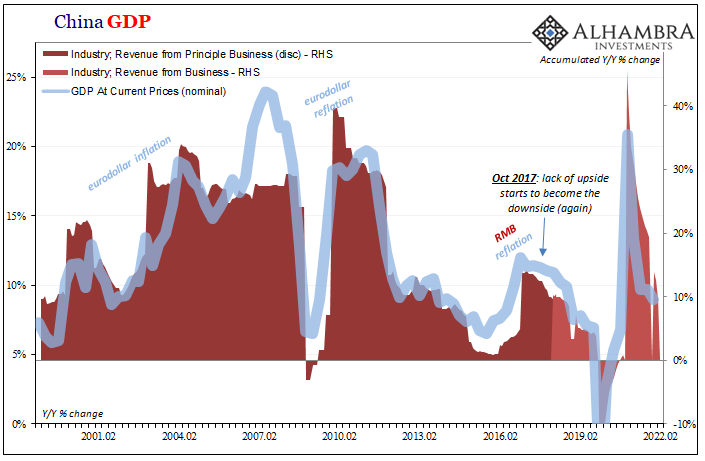

| Just last week, the country’s National Bureau of Statistics (NBS) reported a substantial decline for Industrial Profits, typically a particularly ominous macro signal. Despite all attempts to move away from the configuration, as you can plainly see (below) China’s entire economy remains – at root – an industrial/export-driven machine. Industry does well, predicated upon global demand, the Chinese as a whole do well.

Industry revenues in April 2022? Just 1.5% y/y. Total profits? A harmful -8.5%. |

|

Officials at the NBS, however, quite purposefully draw our focus to the lockdown aspect of these plainly undesirable industrial. Don’t fret, just give it a few months:

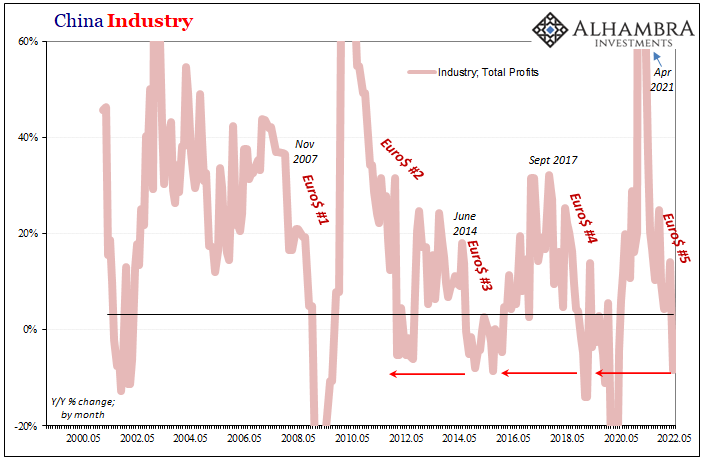

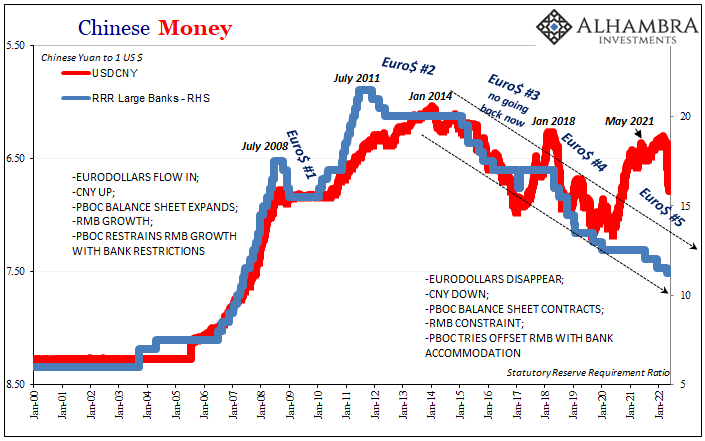

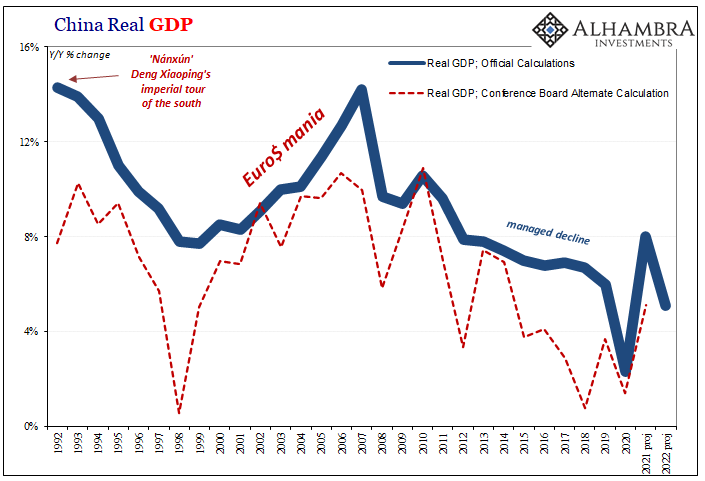

However, you would only assume that once the quarantines are lifted the economy goes back to doing well. And we are all repeatedly invited to make such an assumption. But was it actually doing well before any of the lockdowns were implemented? That, not the lockdowns, is the thing. By every single measure, every account the NBS spits out, China has been on a more than yearlong slide. Industrial profits like revenues didn’t just start falling off with the Shanghai closures. Instead, they really began to fall down right when Euro$ #5 showed up. |

|

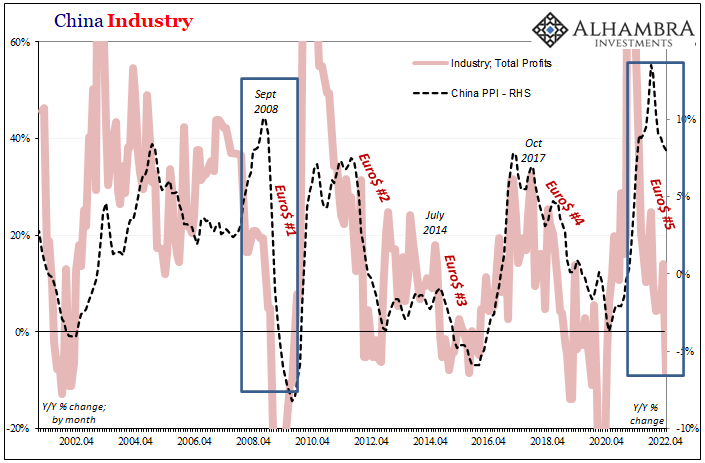

| Even producer prices in China appear to be reaching a reckoning of the prolonged demand weakening; in a way that’s reminiscent of the summer of 2008 (I’m not claiming the Great “Recession” and GFC1 are being repeated in 2022, only pointing out that Chinese industry and price pressures haven’t historically diverged but when they do they converge on industrial demand rather than “inflation”).

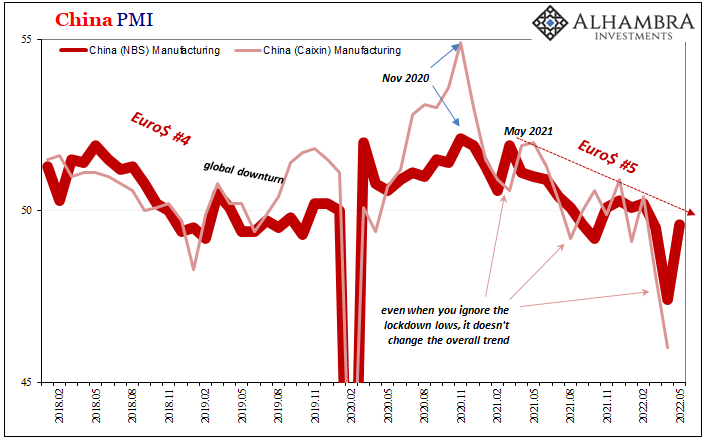

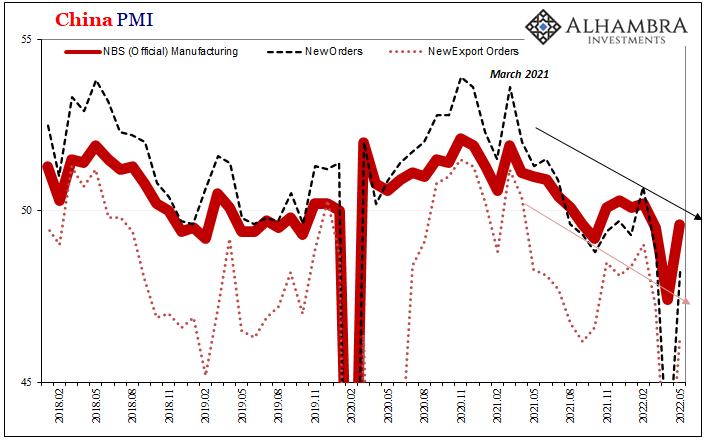

Thus, if you focus only on the lows presented by the one-off months when Xi’s regime is most restrictive, you miss the larger, otherwise unmistakable (and unmistakably worse than 2018-19) inclination – which, again, I believe is the true point. And it is one that gets replicated series after series. Whereas industrial profits and revenues were yet to begin shaking off their Shanghai in the April figures, the NBS is now turning the calendar toward May data when Xi’s mood apparently improved. Over the weekend, the official PMI figures showed that, yep, April was bad when China was “fighting the coronavirus” then May got better as the pandemic situation purportedly recovered. |

|

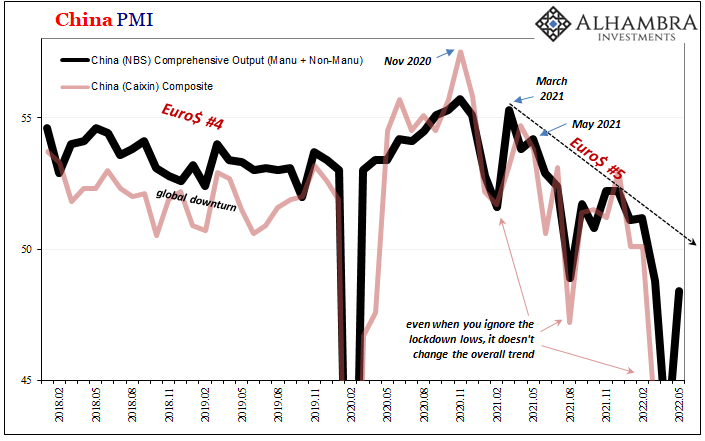

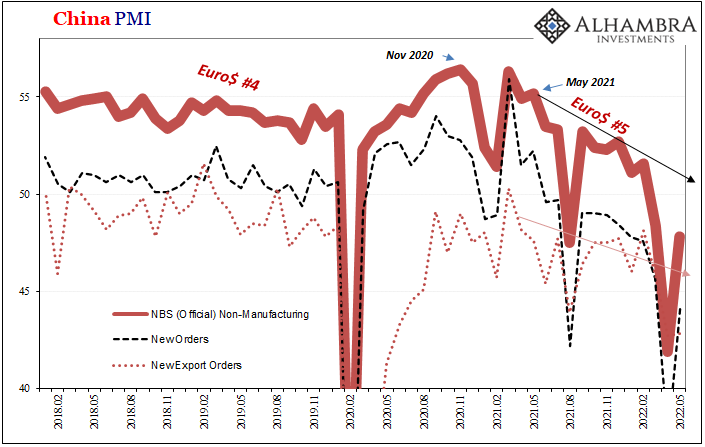

| According to the NBS, its General PMI (comprehensive output) rose sharply to 48.4 from its April awful of 42.7. The non-manufacturing rebounded from 41.9 in April to 47.8 for May; manufacturing 47.4 to 49.6.If that’s all you see, an April to May improvement, you might indeed extrapolate growing positives further into June and beyond. Maybe even full, complete, and world-giving recovery.

Yet, April to May isn’t the priority to consider; rather, it’s all the months leading up to April which advise therefore caution about what trend to follow mostly likely will follow. The pre-lockdown baseline remains as clear as ever, and that is the global problem. |

|

| While it may seem impressive, the General PMI’s almost six-point rise, for example, at 48.4 it’s still less than March’s 48.8 and nowhere close to the ~53 or 54 level which in 2019 was already too-low being consistent with a worldwide downturn into recession.

Ignore every one of those prior extreme downside, single-month lockdown lows. Put them totally out of your mind, follow instead from way back to the earliest parts of last year and then post-May 2021. Zero-COVID didn’t make that line, the months when that pursuit was driven to insanity merely struck new and temporary lows underneath it. |

|

| Every instance when quarantines were imposed, it had been widely claimed China’s economy would bounce right back. It never once did; the slide continued and continues to this month.

Nobody is asking why the bounce-back doesn’t happen, and mostly because everyone on both sides of the Pacific, apparently, insist on deriving their views and expectations of and for the global economy from various CPIs; the globe can’t be working its way decidedly into this kind of weak-demand recession, it is, we’re told, being blistered with inflation from one corner to the next. Ironically, though, not according to China’s CPI. The latter also consistent with all the other NBS data which says lockdowns aren’t the issue and never really have been. Weak and weakening demand independent of the pandemic, that’s what’s been in all the data since last year. Not a recent month of authoritarianism, more than a year of Euro$ #5 and all that goes with it. The politics of COVID aren’t driving China’s economy to lows, they are, once properly assessed, exposing the political (over)reactions to China’s irresistible wrong way condition. |

Tags: $CNY,China,currencies,economy,Featured,Federal Reserve/Monetary Policy,industrial profits,Markets,newsletter,PBOC,Xi Jinping