Ben Bernanke once admitted how the job of the post-truth “central banker” is to try to convince the market to do your work for you. What he didn’t say was that this was the only prayer officials had for any success. Because if the market ever decided that talk wasn’t enough, only real money in hand would do, everyone’d be screwed. Yes, 2008. Also everything after. The Chinese have followed closely this style having realized what took Bernanke too long. That is, the...

Read More »Follow China’s True Line

It’s a broken a record, the macro stylus stuck unable to move on, just skipping and repeating the same spot on the vinyl. Since Xi Jinping’s lockdowns broke it, as it’s said, when Xi is satisfied there’s zero COVID he’ll release the restrictions and that will fix everything. The economy will go right back to good, like flipping a switch. Where have we heard that before? Everywhere, actually, but especially in China. Whether early last year, last August, and now again...

Read More »A Sour End To The 2010’s Doesn’t Have To Spoil The Entire 2020’s

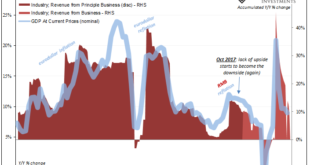

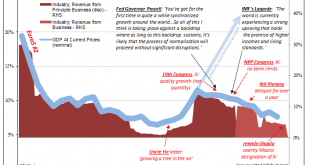

It has been perhaps the most astonishing divergence in the first two decades of 21st century history. In late 2017, Western economic officials (mostly central bankers) were taking their victory laps. They took great pains to tell the world it was due to their profound wisdom, deep courage, and, most of all, determined patience, that they had been able to see their policies through to the light of day (no thanks to voters around the world). This set up the third...

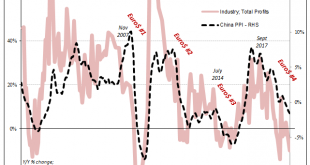

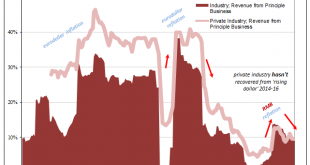

Read More »Nothing Good From A Chinese Industrial Recession

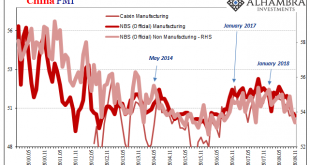

October 2017 continues to show up as the most crucial month across a wide range of global economic data. In the mainstream telling, it should have been a very good thing, a hugely positive inflection. That was the time of true inflation hysteria around the globe, though it was always presented as a rationally-determined base case rather than the unsupported madness it really was. That was the month the real recovery was supposed to have started. Instead, we can...

Read More »Fear Or Reflation Gold?

Gold is on fire, but why is it on fire? When the precious metals’ price falls, Stage 2, we have a pretty good idea what that means (collateral). But when it goes the other way, reflation or fear of deflation? Stage 1 or Stage 3? If it is Stage 1 reflation based on something like the Fed’s turnaround, then we would expect to find US$ markets trading in exactly the same way. Like 2017, when gold was last rising, there...

Read More »China’s Global Slump Draws Closer

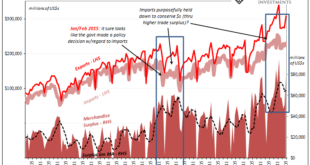

By the time things got really bad, China’s economy had already been slowing for a long time. The currency spun out of control in August 2015, and then by November the Chinese central bank was in desperation mode. The PBOC had begun to peg SHIBOR because despite so much monetary “stimulus” in rate cuts and a lower RRR banks were hoarding RMB liquidity. Late 2015 was not a fun time in China. The idea of economic...

Read More »China’s Industrial Dollar

In December 2006, just weeks before the outbreak of “unforeseen” crisis, then-Federal Reserve Chairman Ben Bernanke discussed the breathtaking advance of China’s economy. He was in Beijing for a monetary conference, and the unofficial theme of his speech, as I read it, was “you can do better.” While economic gains were substantial, he said, they were uneven. To keep China going down the same path of rapid growth,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org