Overview: The 0.5% decline in US March producer prices pushed on the door opened by the softer-than-expected CPI on Wednesday. The Fed funds futures market sees the year end rate to a 4.33%, while still pricing in a nearly 70% chance of a hike on May 3 to 5.25%. The dollar tumbled to new lows for the year against the euro, sterling, and Swiss franc. The Dollar Index made a new low for the year today, a few hundredths of an index point below the low set in early...

Read More »Dramatic Swing in Sentiment Extends the Greenback’s Rally

Overview: A series of strong US high-frequency data points after a poor finish to last year has spurred a dramatic shift in market expectations. And talk among a couple of (non-voting) FOMC members of a 50 bp hike has provided added fodder. The greenback is extending its recovery today against all the major currencies, with the Australian and New Zealand dollars hit the hardest. Emerging market currencies have also been knocked back. This is part of a larger risk...

Read More »US CPI Featured and Why the Fed may Still Hike by 50 bp

The most important economic report in the week ahead is the US December Consumer Price Index on January 12. To be sure, the Federal Reserve targets an alternative measure, the deflator of personal consumption expenditures. However, in this cycle, when households, businesses, investors, and policymakers are particularly sensitive to inflation, CPI, which is reported a couple of weeks before the PCE deflator, has stolen the thunder. In explaining the surprise...

Read More »USD Stretched Ahead of Employment Report, while Yuan Jumps on Hopes of New Property Initiatives

Overview: The US dollar extended yesterday's gains as the market adjusts positions ahead of the jobs data. Yesterday and today's price action looks to have strengthened the near-term technical outlook for the greenback. However, the intraday momentum indicators are stretched. This warns of the risk of a counter-intuitive move after the data, barring a significant surprise. Meanwhile, one of the Fed's leading hawkish voices, St. Louis Fed President Bullard seemed to...

Read More »The Yen and Yuan Continue to Weaken

Overview: While the US dollar appears to be consolidating its recent gains, the Japanese yen and Chinese yuan remain under pressure. Officials seem more concerned about the pace of the move than the level it has reached. New and large fiscal initiatives that the new UK government has floated has failed to change sentiment toward sterling, which is the second weakest major currency today after the Japanese yen. The yen’s weakness did not prevent new losses in Japanese...

Read More »Turn Around Tuesday Began Yesterday, Likely Ends before Wednesday

Overview: Corrective pressures were evident yesterday and they extended today in Asia and Europe but seem to be running their course now. Market participants should view these developments as countertrend and be wary of waning risk appetites in North America today. Most Asia Pacific equities rallied earlier today, save China and Hong Kong. Europe’s Stoxx 600 has retraced most of yesterday’s losses and US futures are trading higher. Benchmark bond yields are softer...

Read More »Dollar Longs Pared as Jackson Hole Gathering is set to Start

Overview: It seems that many market participants had the same thing in mind, cut dollar longs before the Jackson Hole gathering. The Antipodeans lead the majors move, encouraged perhaps by China’s new economic measures, with around a 1% gain. The euro and sterling are up about 0.35% and are the laggards. Emerging market currencies are higher as well, with the notable exception of India and Turkey, which are nursing small losses. Equities are having a good day. All...

Read More »Wait A Sec, That’s Not Really An *RMB* Liquidity Pool…

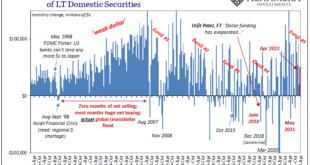

Ben Bernanke once admitted how the job of the post-truth “central banker” is to try to convince the market to do your work for you. What he didn’t say was that this was the only prayer officials had for any success. Because if the market ever decided that talk wasn’t enough, only real money in hand would do, everyone’d be screwed. Yes, 2008. Also everything after. The Chinese have followed closely this style having realized what took Bernanke too long. That is, the...

Read More »Angry April TIC Zeroed In On China’s CNY and Japan’s JPY

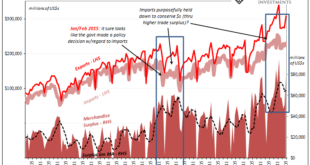

If the March gasoline/oil spike hit a weak global economy really hard and caused what more and more looks like a recessionary shock, a(n un)healthy part of it was the acceleration of Euro$ #5 concurrently rippling through the global reserve system. This much was apparent right from the start, with financial markets gone haywire three months ago (mid-March seasonal bottleneck), and then more of the same into April right to now. The updated TIC data for the month of...

Read More »Follow China’s True Line

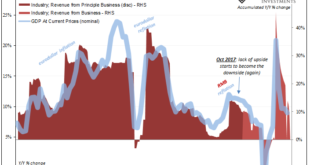

It’s a broken a record, the macro stylus stuck unable to move on, just skipping and repeating the same spot on the vinyl. Since Xi Jinping’s lockdowns broke it, as it’s said, when Xi is satisfied there’s zero COVID he’ll release the restrictions and that will fix everything. The economy will go right back to good, like flipping a switch. Where have we heard that before? Everywhere, actually, but especially in China. Whether early last year, last August, and now again...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org