Overview: The US dollar has extended the losses scored late yesterday when Federal Reserve Governor Waller indicated he was still leaning toward a December rate cut. The odds of a rate cut rose to around 76% from about 66% at the end of last week. The odds are slightly lower today, around 72%. A solid jobs report on Friday and another uptick in CPI may change some minds. The only G10 currency that is weaker today is the Japanese yen, and it is off about 0.25%....

Read More »Fed Day: Skip = Hawkish Pause, but Market Says Finito

Overview: The year-end effective Fed funds rate implied in the futures market is about 5.11%. The rate has been averaging 5.08% since the Fed hiked rates last month The Fed may go to pains to explain that the steady that to be announced later today is just a pause to get a better read on the economy, the market favors this to be the end of the tightening cycle. The dollar is trading softer against nearly all the G10 currencies. Emerging market currencies are more...

Read More »PBOC Surprise Rate Cut and a Strong UK Labor Market Report Ahead of US CPI

Overview: A surprise cut in China's seven-day repo and a stronger than expected UK employment report are session's highlights ahead of the US CPI. The base effect alone suggests a sharp fall in the year-over-year rate, while the median forecast in Bloomberg's survey has been shaved to a 0.1% month-over-month gain. The dollar is under pressure and is weaker against nearly all the G10 currencies. It is mixed against the emerging market currencies. The dollar gapped...

Read More »The Dollar Consolidates after Powell Sapped its Mojo

Overview: Federal Reserve Chair Powell's offered a stronger case for a pause in the monetary tightening before the weekend and this sapped the dollar's mojo. The greenback is mostly consolidating through the European morning in quiet turnover. The JP Morgan Emerging Market Currency Index is trying to snap a four-day decline. The South African rand is recovering from its recent slide and is up nearly 1%. The South Korea won is benefitting from China's decision to...

Read More »Fragile Calm to End the Volatile Week even with the Quadruple Expirations

Overview: The support for First Republic Bank shown by a consortium of US banks by shifting $30 bln of deposits is helping break the financial anxiety that has gripped the market for more than a week. The liquidity provisions for Credit Suisse by the Swiss National Bank also are contributing to improved sentiment. The Fed's balance sheet expanded sharply last week as the bridge banks were extended credit to help the unwind of SVB and Signature Bank. Discount window...

Read More »Dollar Slumps, Yuan Rallies by Most this Year amid Intervention Talk

Overview: The US dollar is having one of toughest days of the year. It has been sold across the board and taken out key levels like parity in the euro, $1.15 in sterling, and CAD1.36. The Chinese yuan surged over 1%. Chinese officials promised healthy bond and stock markets. There is some talk that the PBOC may have intervened directly in the forex market. Large bourses in the Asia Pacific region rallied and the CSI 300 rose by 0.8%, its first gain of the week. After...

Read More »Week Ahead: Focus Shifts away from the US after Robust Jobs Data and Stronger than Expected Inflation

The latest US employment and inflation figures are passed. The market is confident of a 75 bp rate hike next month. While a 50 bp in December is still the odds-on favorite, the market has a slight chance (~15%) of a 100 bp move instead after the robust jobs report and stronger-than-expected September CPI. The implied yield of the December Fed funds futures has ground higher for 12 consecutive sessions to about 4.23%. After two straight quarters of contraction, the...

Read More »The Week Ahead: Dollar Bulls Still in Charge

The poor preliminary PMI readings, the ongoing European energy crisis, and the recognized commitment of most major central banks to rein in prices through tighter financial conditions are risking a broad recession. These considerations are weighing on sentiment and shaping the investment climate. Most high-frequency data due in the days ahead will not change this, even if they pose some headline risk. What we have seen among some central bankers applies to market...

Read More »Wait A Sec, That’s Not Really An *RMB* Liquidity Pool…

Ben Bernanke once admitted how the job of the post-truth “central banker” is to try to convince the market to do your work for you. What he didn’t say was that this was the only prayer officials had for any success. Because if the market ever decided that talk wasn’t enough, only real money in hand would do, everyone’d be screwed. Yes, 2008. Also everything after. The Chinese have followed closely this style having realized what took Bernanke too long. That is, the...

Read More »Follow China’s True Line

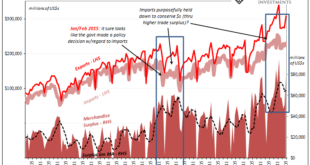

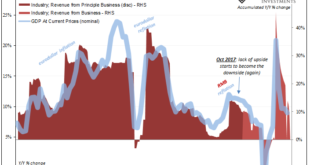

It’s a broken a record, the macro stylus stuck unable to move on, just skipping and repeating the same spot on the vinyl. Since Xi Jinping’s lockdowns broke it, as it’s said, when Xi is satisfied there’s zero COVID he’ll release the restrictions and that will fix everything. The economy will go right back to good, like flipping a switch. Where have we heard that before? Everywhere, actually, but especially in China. Whether early last year, last August, and now again...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org