We regularly publish the SNB asset structure by currency, rating & duration and the investment strategy. They shall be a template for the tactical asset allocation along these dimensions for other conservative asset managers – CHF holdings certainly excluded because the SNB nearly exclusively buys foreign assets. The SNB balance sheet looks as follows: In this post we will concentrate on the assets side, investment strategy and composition of “FX reserves”.See more on liabilities here, and on the history of the balance sheet and Owner’s Equity here. Assets Currency allocation (excluding investments and liabilities from foreign exchange swaps) Foreign Currency Investments CHF Bond Investments Q1/2015 Q4/2014 Q3/2014 Q2/2014 Q1/2014 Q1/2015 Amount in CHF 532 bln. 510 bln. 471 bln. 457 bln. 447 bln. 4 bln. CHF - - - - - 100% USD 32% 29% 29% 27% 27% - EUR 42% 46% 45% 46% 48% - GBP 7% 6% 7% 7% 7% - JPY 8% 8% 9% 9% 8% - CAD 4% 4% 4% 4% 4% - Other (1) 7% 7% 6% 7% 6% - Investment categories Investments with banks 0% 0% 0% 0% 0% - Government bonds (2) 71% 73% 73% 73% 76% 43% Other bonds (3) 11% 12% 11% 11% 8% 57% Equities 18% 15% 16% 16% 16% - Breakdown of fixed income assets (4) AAA-rated 61% 63% 63% 65% 70% 74% AA-rated 24% 22% 29% 27% 24% 25% A-rated 10% 10% 3% 3% 2% 1% Other 5% 5% 5% 5% 4% 0% Investment duration (years) 4.1 4.0 4.0 3.8 3.3 7.

Topics:

George Dorgan considers the following as important: asset allocation, composition, decomposition, Duration, equities, Featured SNB, Forex reserves, FX reserves, Government Bonds, interim results, Italian, Rating, Reserves, SNB, Swiss National Bank

This could be interesting, too:

investrends.ch writes SNB erhöht Mindestreserve-Erfordernisse der Banken

investrends.ch writes SNB-Vize: Devisenkäufe waren nötig für Preisstabilität

investrends.ch writes Inflation sinkt über Erwarten und gibt SNB Spielraum

Marc Chandler writes Waller Pushes on Open Door: Push for Patience Lifts the Dollar, Complicating Japanese Efforts

We regularly publish the SNB asset structure by currency, rating & duration and the investment strategy. They shall be a template for the tactical asset allocation along these dimensions for other conservative asset managers – CHF holdings certainly excluded because the SNB nearly exclusively buys foreign assets.

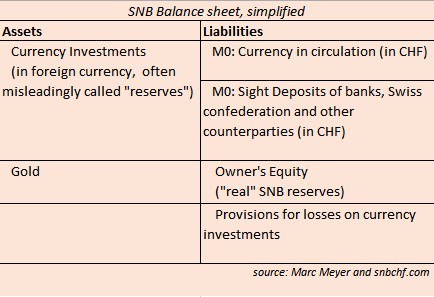

The SNB balance sheet looks as follows:

In this post we will concentrate on the assets side, investment strategy and composition of “FX reserves”.See more on liabilities here, and on the history of the balance sheet and Owner’s Equity here.

Assets Currency allocation (excluding investments and liabilities from foreign exchange swaps) Foreign Currency Investments CHF Bond Investments Q1/2015 Q4/2014 Q3/2014 Q2/2014 Q1/2014 Q1/2015 Amount in CHF 532 bln. 510 bln. 471 bln. 457 bln. 447 bln. 4 bln. CHF - - - - - 100% USD 32% 29% 29% 27% 27% - EUR 42% 46% 45% 46% 48% - GBP 7% 6% 7% 7% 7% - JPY 8% 8% 9% 9% 8% - CAD 4% 4% 4% 4% 4% - Other (1) 7% 7% 6% 7% 6% - Investment categories Investments with banks 0% 0% 0% 0% 0% - Government bonds (2) 71% 73% 73% 73% 76% 43% Other bonds (3) 11% 12% 11% 11% 8% 57% Equities 18% 15% 16% 16% 16% - Breakdown of fixed income assets (4) AAA-rated 61% 63% 63% 65% 70% 74% AA-rated 24% 22% 29% 27% 24% 25% A-rated 10% 10% 3% 3% 2% 1% Other 5% 5% 5% 5% 4% 0% Investment duration (years) 4.1 4.0 4.0 3.8 3.3 7.7(1) Mainly AUD, DKK, KRW, SEK and SGD plus small holdings in additional currencies in the equity portfolios.(2) Government bonds in their own currencies, deposits with central banks and BIS; in the case of CHF investments, also bonds issued by Swiss cantons and municipalities.(3) Government bonds in foreign currency, covered bonds, bonds issued by foreign local authorities, supranational organisations, corporate bonds, etc.(4) Average rating, calculated from the ratings of the three major credit rating agencies.

Equities are managed on a purely passive basis, whereby broad market indices of advanced economies are replicated. Exchange rate and interest rate risks are managed using derivative instruments such as interest rate swaps, interest rate futures, forward foreign exchange transactions and foreign exchange options. In addition, futures on equity indices are used to manage the equity investments.

Source: This page at the SNB shows exactly how the currency reserves are invested.

The investment structure at the year-end is also published in the Annual Report under ‘Asset management’.

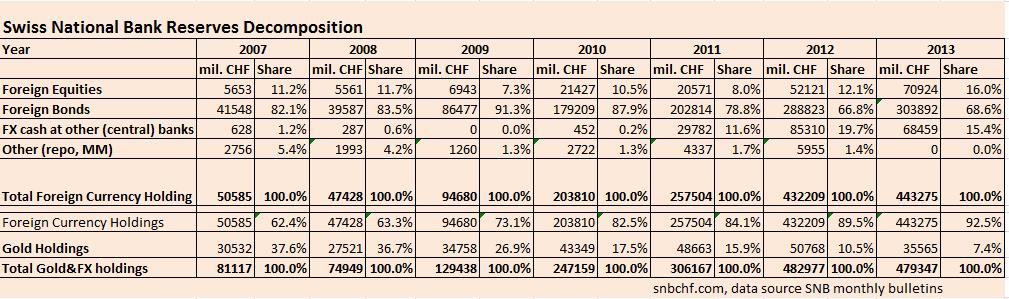

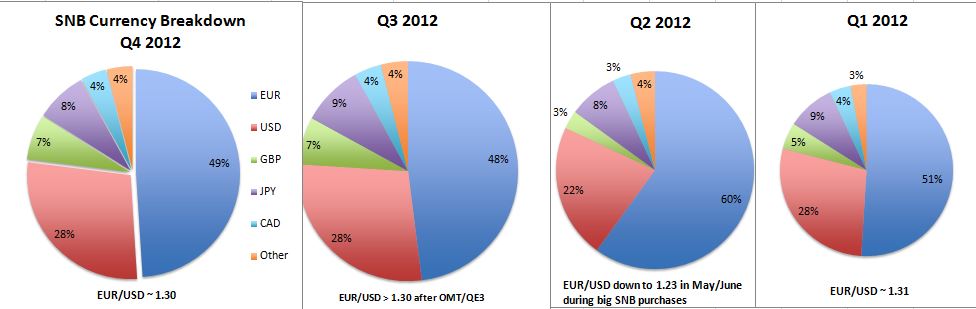

Be aware that in the above statistics 17% cash is misleadingly included in the 77% government bonds share (see the footnote 2).In 2012 there were heavy flucations. The SNB bought euros where they were cheap against the dollar, at around $1.25. In August/September 2011, however, they bought USD when the euro was over $1.40.

Breakdown by major positions

Breakdown by major positions

The following gives a rough estimate of major SNB positions (see the European ratings e.g. here), in comparison to all FX reserve positions (of which gold and the smaller IMF, SDR or repos positions are excluded).

German and other AAA EUR government bonds make up around 22% of the FX reserves = 48% * 60% * 76%Explanation: EUR share 48%, Government bonds 60%, German bonds remain the only major euro-denominated AAA bonds, AAA 76%Other AAA are: Dutch, Austrian, Finnish and Luxemburg bonds, all of them smaller countries. US treasuries are around 16% of the FX reserves = 27% * 60% * 100%Explanation: USD share 27%, Government bonds 60%, only U.S. issues USD gov. bonds French (and Belgium) government bonds make up around 5.2% of the FX reserves = 48% * 60% * 18%Explanation: 48% EUR, Government bonds 60%, AA share 18%, France (and Belgium) are only AA in Europe. Japanese JGB are around 5.4% = 9% * 60% * 100%Explanation: JPY share 9%, government bonds 60%, only Japan issues gov. bonds in JPY UK government bonds are around 4.2% of the FX reserves = 7% * 60% * 100%Explanation: GBP share 7%, government bonds 60%, only UK issues gov. bonds in GDP Canadian government bonds are around 2.4% of the FX reserves = 4% * 60% * 100%Explanation: CAD share 4%, government bonds 60%, only Canada issues gov. bonds in GDP SNB Investment Strategy 2007-2013 Historic data:For comparison Q1/2014

(source SNB here Internet Snapshot) Foreign currency investments CHF bond investments Currency allocation, excluding investments and liabilities from foreign exchange swaps Q2/2014 Q1/ Investment categories Investments with banks Government bonds (2) Other bonds (3) Breakdown of fixed income assets (4) Investment duration (years)Find here the information about

SNB Reserves Composition in Q2/2013,here the one for Q1/2013 and 2012.

See the historical composition of SNB reserves until 2012 in this post.