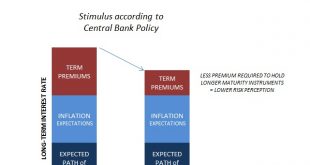

According to orthodox theory, if interest rates are falling because of term premiums then that equates to stimulus. Term premiums are what economists have invented so as to undertake Fisherian decomposition of interest rates (so that they can try to understand the bond market; as you might guess it doesn’t work any better). It is, they claim, the additional premium a bond investor demands so as to hold a security that...

Read More »Swiss National Bank: Composition of Reserves and Investment Strategy

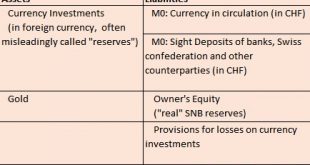

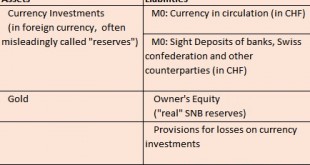

The Q1/2016 update on the SNB investment strategy and its assets. The Swiss National Bank is a passive conservative investor. As opposed to other investors, the exposure in currencies is as important as the strategic asset allocation according asset classes (bonds, equities, cash, real estate). The importance of currencies is one reason why the SNB is often called a hedge fund, the second the volatility of gains and losses.The SNB balance sheet looks as follows: In this post we will...

Read More »Swiss National Bank: Composition of Reserves and Investment Strategy

We regularly publish the SNB asset structure by currency, rating & duration and the investment strategy. They shall be a template for the tactical asset allocation along these dimensions for other conservative asset managers – CHF holdings certainly excluded because the SNB nearly exclusively buys foreign assets. The SNB balance sheet looks as follows: In this post we will concentrate on the assets side, investment strategy and composition of “FX reserves”.See more on liabilities...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org