There’s an old Wall Street maxim that the cure for high commodity prices is high commodity prices. As prices rise two things will generally limit the scope of the increase. Demand will wane as consumers just use less or find substitutes. Supply will also increase as the companies that extract these raw materials open new mines, grow more crops or drill new wells. The combination of those two will act to bring prices back down until the process reverses. As prices...

Read More »Weekly View – Biden time for markets

Donald Trump’s poll numbers were looking increasingly unhealthy at the time of writing, but at least the cocktail of drugs administered to the coronavirus-stricken President appears to have worked. This is encouraging news in the fight against the virus and a considerable achievement for Regeneron, whose founders increased their stake in the company after a French pharma group pulled back earlier this year. At this point, markets are increasingly taking on board...

Read More »House View, September 2020

Macroeconomy A surge in new covid-19 cases in a number of countries has interrupted progress towards normality, yet the effects of the virus are becoming more manageable and positive world H2 growth is achievable. Prospects for the US economy hinge on the ability of Washington to agree a new fiscal support package. While we have raised out 2020 GDP projection for the US we remain prudent. We expect the Fed to provide more stimulus via increased asset purchases,...

Read More »House View, September 2019

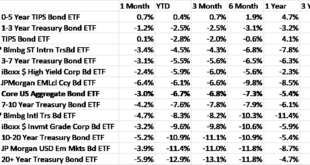

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset allocationWe remain underweight global equities, but continued stimulus and an economic backdrop that is not catastrophic mean this is nuanced by neutral positions in some regions. We favour stocks of companies that have pricing power as well as those showing healthy dividend growth and low leverage.We are neutral US Treasuries as a way to protect portfolios, but underweight negative-yielding...

Read More »House View, June 2019

Pictet Wealth Management's latest positioning across asset classes and investment themesAsset allocationWe have turned tactically underweight on global equites, including US equities, given elevated valuations, mixed economic data and rising trade tensions. We remain neutral on euro area equities, where valuations are generally more reasonable than in the US. We have also moved from an overweight to neutral stance on Asian emerging-market equities.At the same time as we remain focused on...

Read More »Avenues worth exploring in strategic asset allocation

The prospect of diminishing returns for classic, and previously highly effective, 60/40 portfolios (60% equities, 40% bonds) is leading to changes in strategic asset allocation. Efforts to improve prospects include identifying macroeconomic regimes to guide investments and refining how diversification is understood. Interest in endowment-style investing is also growing as private assets are incorporated into strategic...

Read More »Avenues worth exploring in strategic asset allocation

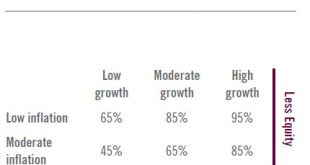

The prospect of diminishing returns for classic, and previously highly effective, 60/40 portfolios (60% equities, 40% bonds) is leading to changes in strategic asset allocation. Efforts to improve prospects include identifying macroeconomic regimes to guide investments and refining how diversification is understood. Interest in endowment-style investing is also growing as private assets are incorporated into strategic asset allocation to boost portfolio returns.Using macroeconomic regimes...

Read More »House View, May 2019

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationThere were no changes to our asset allocation in April. While we are encouraged by better-than-expected Q1 earnings and some improvement in earnings expectations, we remain neutral on global equities as we await new catalysts to justify current valuations. At the same time, we have a positive view of Chinese and Indian equities.We remain underweight government bonds given low yields,...

Read More »House View, April 2019

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationAlthough we expect the economic picture to brighten and the decline in earnings expectations to end, we have a prudent stance on global equities, as expressed in our decision to book some profits on global equities and to invest in put options on large-cap European and small-cap US equities.At the same time, our willingness to take on reasonable risk means that the reduction in equities...

Read More »Taking account of regime shifts

Understanding what economic regime we are in and for how long before we transition to a different one is vital for any strategic asset allocation.Predicting the returns for different asset classes is the Holy Grail of asset allocation. The problem is that risk premiums and returns are instable over time. According to our analysis, over the long term (our data stretches back 115 years) there is a 90 percent probability of achieving an annual average return of 8 percent with a 60/40 portfolio....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org