You can listen to the audio version of this article here. Last week the cryptocurrency exchange FTX, which was recently valued at $32 billion, imploded. While the tragedy continues to play out, let’s summarize what has happened so far: FTX is a cryptocurrency exchange, co-founded by Sam “SBF” Bankman-Fried. FTX enables customers to make leveraged bets (as high as 20 to 1) on cryptocurrencies. More often than not, it takes loans to make loans. FTX would make these...

Read More »Weekly Market Pulse: What Now?

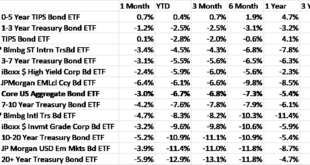

The yield curve inverted last week. Well, the part everyone watches, the 10 year/2 year Treasury yield spread, inverted, closing the week a solid 7 basis points in the negative. The difference between the 10 year and 2 year Treasury yields is not the yield curve though. The 10/2 spread is one point on the Treasury yield curve which is positively sloped from 1 month to 3 years, negatively sloped from 3 years to 10 years and positively sloped again from 10 out to 30...

Read More »Weekly Market Pulse: The Cure For High Prices

There’s an old Wall Street maxim that the cure for high commodity prices is high commodity prices. As prices rise two things will generally limit the scope of the increase. Demand will wane as consumers just use less or find substitutes. Supply will also increase as the companies that extract these raw materials open new mines, grow more crops or drill new wells. The combination of those two will act to bring prices back down until the process reverses. As prices...

Read More »Swiss National Bank: Composition of Reserves and Investment Strategy

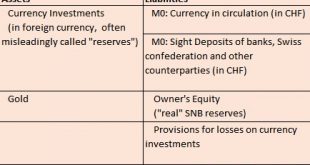

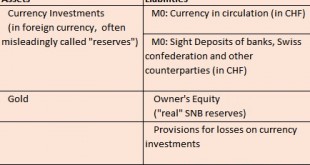

The Q1/2016 update on the SNB investment strategy and its assets. The Swiss National Bank is a passive conservative investor. As opposed to other investors, the exposure in currencies is as important as the strategic asset allocation according asset classes (bonds, equities, cash, real estate). The importance of currencies is one reason why the SNB is often called a hedge fund, the second the volatility of gains and losses.The SNB balance sheet looks as follows: In this post we will...

Read More »Swiss National Bank: Composition of Reserves and Investment Strategy

We regularly publish the SNB asset structure by currency, rating & duration and the investment strategy. They shall be a template for the tactical asset allocation along these dimensions for other conservative asset managers – CHF holdings certainly excluded because the SNB nearly exclusively buys foreign assets. The SNB balance sheet looks as follows: In this post we will concentrate on the assets side, investment strategy and composition of “FX reserves”.See more on liabilities...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org