Overview: The sharp losses in global equities are dominating today's market developments. Yesterday's 2.1% loss of the S&P 500 and 3.25% drop in the Nasdaq were the largest since carry-trade unwind climaxed on August 5. They have fallen more today and are poised to gap lower at the opening. Asia Pacific shares tumbled, led by Taiwan's 4.5% tumble and the Nikkei's 4.25% loss. It delivered Indian stocks its first loss in nearly three weeks. Europe's Stoxx 600 is...

Read More »Here are three things you can learn from the Fed

Anyone who has decided to buy gold, or follows the gold price will be aware of how powerful the US Federal Reserve is. This year the Federal Reserve will turn 110 years old, only in recent years is dollar hegemony appearing to falter. Below we look at the central bank’s origins and three lessons we can learn from the history of the world’s most powerful bank, in order to help our investment decisions in 2023. Is the FED’s institutional history about to repeat...

Read More »New Recession Worry Stalls Dollar Express but Doesn’t Derail It

Overview: A simply dreadful flash US PMI stopped the dollar’s four-day rally in its tracks. It followed news that the eurozone, Japan, and Australia’s composite PMIs are below the 50 boom/bust level. However, the dollar recovered, even if not fully as the market seemed unconvinced that the data could change Fed Chair Powell’s message at Jackson Hole on Friday. A consolidative tone is evident today. Asia Pacific equities were mixed. China and Hong Kong fell more than...

Read More »Yep, There’s A New ‘V’ In Town And The Locals…Don’t Seem To Much Care For It

They should be drooling over the prospects of a clearing path toward normality. The pain and disaster of 2020’s economic hole receding into a more pleasant 2021 which would have been in position to conceivably pay it all back before any long run damage. Getting back to just even with February instead is becoming a distant probability, the kind of non-transitory shortfall with which we’ve grown far too accustomed. Therefore, “they” now salivate (reported to be...

Read More »FX Daily, September 23: Trying to Find Solid Ground

Swiss Franc The Euro has risen by 0.04% to 1.0769 EUR/CHF and USD/CHF, September 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A more stable tone is evident in the capital markets after the S&P 500, and NASDAQ rose more than one percent yesterday. Japan returned from a two-day holiday, and local shares slipped fractionally, while China, Hong Kong, South Korea, and Australian shares rallied. India and...

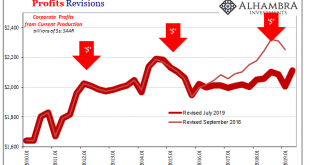

Read More »GDP Profits Hold The Answers To All Questions

Revisions to second quarter GDP were exceedingly small. The BEA reduced the estimate by a little less than $800 million out of nearly $20 trillion (seasonally-adjusted annual rate). The growth rate therefore declined from 2.03502% (continuously compounded annual rate) to 2.01824%. The release also gave us the first look at second quarter corporate profits. Like the headline GDP revisions, there wasn’t really much to them. At least not when viewed in isolation....

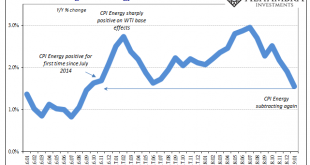

Read More »Inflation Falls Again, Dot-com-like

US inflation in January 2019 was, according to the CPI, the lowest in years. At just 1.55% year-over-year, the index hadn’t suggested this level since September 2016 right at the outset of what would become Reflation #3. Having hyped expectations over that interim, US policymakers now have to face the repercussions of unwinding the hysteria. CPI Changes On Energy 2016-2019 - Click to enlarge Live by oil, now die by...

Read More »FX Weekly Preview: DOTS in the Week Ahead: Divergence, Oil, Trade and Stocks

The Federal Reserve’s confidence in the economy and its need to continue to gradually increase interest rates stands in sharp contrast to most of the other major central banks. The European Central Bank will finish its asset purchases at the end of the year, but it is in no position to begin to normalize interest rates. Indeed, the risk is that it may feel compelled to off another Targeted Long-Term Repo, which would,...

Read More »Great Graphic: What is Happening to Global Equities?

The decline in the global equity market is the most serious since the February and March spill. In this Great Graphic, the white line is the S&P 500. With the setback, it is up a little more than 8% for the year. It managed to recover fully from the sell-off earlier in the year. The fuchsia line is the MSCI World Index of developed countries. It is up 1.25% year-to-date, and it never managed to take out the high set...

Read More »Central Bank Investment Strategies

A survey of central banks and sovereign wealth funds by Invesco sheds light on their investment plans. The traditional separation of markets and the state may be helpful for ideological arguments, but the real situation is more complicated. Central banks and their investment vehicles (sovereign wealth funds) are market participants. In some activities, such as custodian, central banks compete with the private sector....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org